Profit-Efficient Top Stocks To Buy Now

Image Source: Pixabay

The bulls have held their ground in June after the furious rally off the stock market’s April lows.

It’s difficult to know what, if anything, will shake the Nasdaq and the S&P 500 out of their recent holding patterns until the start of the second quarter earnings season in the middle of July.

Thankfully, the bullish backdrop appears to remain intact as long as trade war progress continues, inflation remains in check, and corporate earnings grow.

The last several months also highlight why investors must stay constantly exposed to the market and continue buying stocks even if broader sentiment turns bearish.

A good starting point for investors looking to buy stocks in June is to find companies that boast improving earnings outlooks to help earn a Zacks Rank #1 (Strong Buy) that are also efficiently generating profits.

Return on Equity 101

Return on Equity or ROE helps investors understand if a firm’s executives are creating assets with investors’ cash or burning it. ROE shows a company’s ability to turn assets into profits. Put another way, this vital metric measures the profits made for each dollar of shareholder equity.

ROE is calculated as net income / shareholder's equity. For example: if $0.10 of assets are created for each $1 of shareholder equity that would equal a ROE of 10%.

Overall, Return on Equity is a great item to use regardless of what type of investor you are since it provides insight into management’s ability to create value and keep costs under control. Plus, if ROE slips, it can alert us to potential problems.

With all that said, let’s take a look at this screen’s parameters and see the companies proving they can return value to shareholders instead of churning through their cash…

• Zacks Rank equal to 1

The Zacks Rank looks at upward earnings estimate revisions, among other metrics, in order to find companies that are projected to see their earnings get stronger. In fact, beginning with a Zacks Rank #1 can be a great starting point because it boasts an average annual return of over 25% per year during the last 30 years.

• Price greater than or equal to 5

Today we ruled out any stocks that are trading for less than $5 a share because they can be more volatile and speculative.

• Price/Sales Ratio less than or equal to 1

On top of that, we are looking for a low price to sales ratio. Today we went with 1 or below as this range is usually thought to provide better value since investors pay less for each unit of sales.

• % (Broker) Rating Strong Buy equal to 100 (%)

In this screen, we decided to go with companies that brokers are fully on board with since ratings are typically skewed strongly toward ‘buy’ and ‘strong buy.’

• ROE greater than or equal to 10%

Lastly, but most importantly for today’s screen, we got rid of any companies with Return on Equity of less than 10 because the median ROE value for all of the stocks in the Zacks Universe is under 10.

Here is one of the seven stocks that made it through today’s screen…

Buy This Market-Beating, Dividend Stock for Value and Profit Efficiency

Marubeni (MARUY - Free Report) is a Japanese trading and investment conglomerate. MARUY, which trades OTC in the U.S., imports, exports, and trades a wide range of products, including food, chemicals, energy, metals, and machinery, across global markets.

The company also invests in various industries, including real estate, power generation, and infrastructure projects. Additionally, Marubeni provides services such as finance, logistics, and resource development, operating through a vast network in nearly 70 countries.

Image Source: Zacks Investment Research

MARUY stock has ripped 250% higher in the past 10 years, blowing away the Zacks Conglomerates sector’s sideways movement and the S&P 500’s 200% climb.

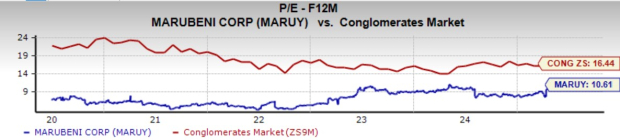

The stock recently hit all-time highs, and it’s attempting to break meaningfully above a trading range it’s been stuck in for several years. Despite its outperformance and charge to record highs, Marubeni trades at a 35% discount to its sector and 11% below its highs at 10.6X forward earnings.

Image Source: Zacks Investment Research

Marubeni’s ROE of 13.5% crushes its highly-ranked industry’s 3.13% average. On top of that, its 2.71% dividend yield is a great bonus for a stock that has easily beaten the benchmark over the last decade.

More By This Author:

OPFI: Top-Ranked Stock To Buy In June2 Under-The-Radar Tech Stocks To Buy Before Earnings: NU, WIX

Is Netflix a Must-Buy Tech Stock Down 10% from Its Highs?

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more