Previewing Q3 Earnings Season

Image Source: Unsplash

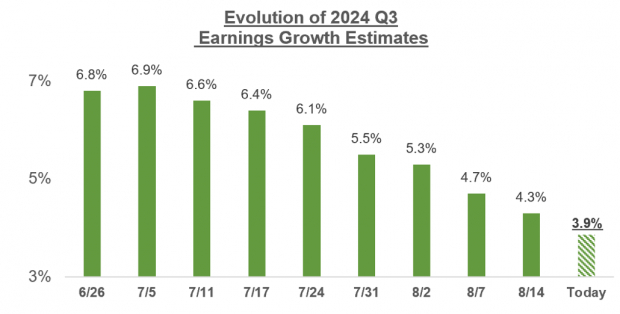

- Estimates for 2024 Q3 have come down, with the magnitude of estimate cuts significantly bigger than what we had seen in the comparable periods of the first two quarters of the year. This negative shift in the revisions trend reverses the prior favorable development on this front that had been in recent quarters.

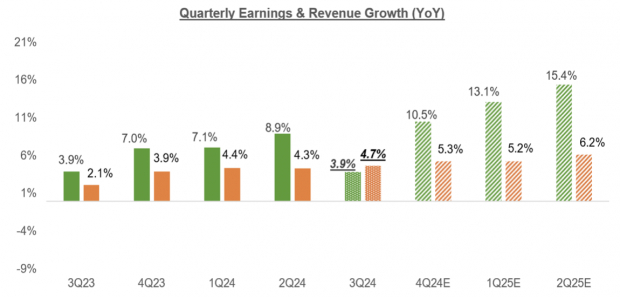

- Total S&P 500 earnings are currently expected to be up +3.9% from the same period last year on +4.7% higher revenues. Estimates have steadily come down since the start of the period, with the current +3.9% growth pace down from +6.9% at the start of July.

- Not only is the negative revisions trend more pronounced relative to other recent periods, but it is also more widespread. Since the start of Q3, estimates have declined for 14 of the 16 Zacks sectors, with the biggest declines for the Transportation, Aerospace, Energy, Basic Materials, Construction, Medical and Consumer Discretionary sectors. On the positive side, estimates have modestly increased for the Tech and Finance sectors over that period.

- Q3 earnings are expected to be above the year-earlier level for 8 of the 16 Zacks sectors, with Aerospace (up +30.5%) and Tech (+10.9%) as the only sectors with double-digit year-over-year gains.

- On the negative side, Q3 earnings are expected to be below the year-earlier level for 7 sectors, with Energy (down -14.3%) and Conglomerates (-15.5%) as the biggest year-over-year decliners.

- For the Technology sector, Q3 is expected to be the 5th quarter in a row of double-digit earnings growth (up +10.9%). Excluding the Tech sector’s contribution, Q3 earnings for the rest of the index would be up only +1.1%.

- Q3 earnings for the Magnificent 7 companies are expected to be up +17% from the same period last year on +13.5% higher revenues. This would follow the +35.2% earnings growth on +14.7% higher revenues in Q2. Excluding the Mag 7, Q3 earnings growth for the rest of the index would be +3.6% (vs. +3.9% otherwise).

- Q3 earnings for the Energy sector are expected to be down -14.3% from the same period last year on -1.6% lower revenues, which follows the sector’s flat earnings growth in the preceding quarter.

- Net margins in Q3 are expected to be modestly below the year-earlier level, with the Energy sector as the major reason for the decline. Excluding the Energy sector, net margins for the rest of the index would be essentially flat.

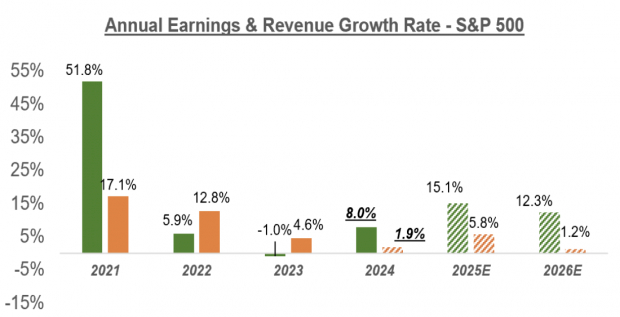

- Looking at the calendar year picture, total S&P 500 earnings are expected to grow by +8.0% this year and +15.1% next year. Excluding the Energy sector, full-year 2024 earnings are expected to be up +9.6%, followed by +14.9% in 2025.

- The implied ‘EPS’ for the S&P 500 index, calculated using the current 2024 P/E of 23.6X and index close, as of September 4th, is $233.43. Using the same methodology, the index ‘EPS’ works out to $268.62 in 2025 (P/E of 20.6X). The multiples have been calculated using the index’s total market cap and aggregate bottom-up earnings for each year.

We noted earlier how the revisions trend has been notably negative ahead of the start of the Q3 earnings season. You can see this in the chart below that shows the evolution of Q3 earnings growth expectations since the start of the period:

Image Source: Zacks Investment Research

This is a bigger decline to estimates relative to the comparable periods for the two preceding quarters. The negative revisions trend is widespread and not concentrated in one or two sectors, with estimates for 14 of the 16 Zacks sectors getting cut over this period. The Tech and Finance sectors are the only ones enjoying positive estimate revisions over this period.

The negative revisions trend has been most pronounced for the Transportation and Energy sectors. We know that Energy sector estimates come under pressure when oil prices decline, with a softening oil price backdrop typically serving as a catalyst for positive estimate revisions trend for the Transportation sector since fuel expenses are such a major expense item in the transportation business. But the weakening revisions trend for the Transportation sector shows that operators in the space are faced with softening demand trends as well.

We can see this in the revisions trend for air carriers like United Airlines (UAL - Free Report) and American Airlines (AAL - Free Report) and railroad operators like Union Pacific (UNP - Free Report) .

The quarterly earnings growth pace is expected to improve from next quarter onwards. You can see this in the chart below that shows the overall earnings picture on a quarterly basis.

Image Source: Zacks Investment Research

The chart below shows the overall earnings picture on an annual basis.

Image Source: Zacks Investment Research

Please note that this year’s +8.0% earnings growth on only +1.9% top-line gains reflects revenue weakness in the Finance sector. Excluding the Finance sector, the earnings growth pace changes to +7.5%, and the revenue growth rate improves to +4.3%. In other words, about half of this year’s earnings growth comes from revenue growth, with margin gains accounting for the rest.

More By This Author:

Looking Ahead To The Q3 Earnings Season

Q2 Earnings Reflect Positivity, But Q3 Estimates Decrease

A Closer Look At Retail And Nvidia Earnings