PPG Industries: A Paint And Coatings Giant To Turn To If Markets Get Volatile

Image Source: Unsplash

By far the most important thing you can do in a steep market decline is to not panic sell. I believe the single biggest mistake most investors make is selling when the market crashes. Meanwhile, I like PPG Industries Inc. (PPG), the largest paints and coatings company in the world, notes Ben Reynolds, editor of Sure Dividend.

Recessions (and market declines) are an inevitable part of the economic cycle. Economic cycles are characterized by periods of expansion followed by contraction. And while the timing of the next recession is uncertain, it is not a question of if, but when.

There have been 14 US recessions since the Great Depression of the early 1930s. Over the last 100 years, the average recession has lasted about 10 months, while expansions have averaged about 47 months.

While recessions aren’t the norm, they aren’t particularly uncommon. It makes sense to prepare yourself and your portfolio for a recession before one occurs. When the market is in free-fall, it’s much more difficult to psychologically position yourself to make sound decisions.

As for PPG Industries, the company has just two competitors, Sherwin-Williams Co. (SHW) and Dutch paint company Akzo Nobel (AKZOF), which are of comparative size. PPG Industries was founded in the late 1800s and has become a global company, with operations in more than 70 countries around the world. The company has a market capitalization of $29 billion and generates annual revenue in excess of $18 billion.

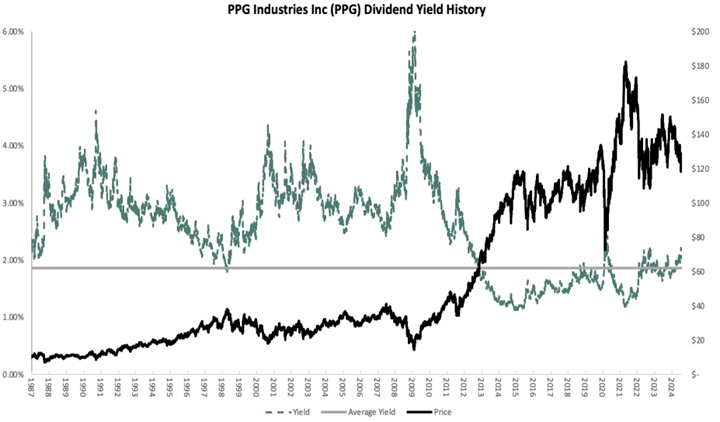

On July 18, PPG Industries raised its quarterly dividend 4.6% to $0.68, extending the company’s dividend growth streak to 53 consecutive years. PPG Industries also reported second-quarter results for the period ending June 30. Revenue fell 1.6% to $4.79 billion, while adjusted earnings per share of $2.50 compared favorably to $2.25 in the prior year.

Second-quarter organic growth was unchanged compared to the prior year. Performance Coatings revenue of $3.048 billion was flat from the prior year, while Industrial Coatings fell 5% to $1.746 billion. PPG Industries expects adjusted earnings per share to be in a range of $8.15 to $8.30 for the year, down from $8.34 to $8.59 previously.

Shares of the company have recently traded with a price-to-earnings ratio of 15.7. Our target multiple is 19 times earnings, which is below the stock’s long-term average P/E of 22.3. Reaching our target valuation by 2029 would add 3.9% to annual returns over this period.

In total, we project that PPG Industries will provide a total annual return of 13.8% through 2029. This stems from earnings growth of 8%, the starting dividend yield of 2.1%, and a tailwind from multiple expansion.

My recommended action would be to consider buying shares of PPG Industries.

About the Author

Ben Reynolds is the CEO and founder of Sure Dividend. Sure Dividend helps individual investors build high-quality growth stock portfolios for rising passive income over the long run. Sure Dividend analyzes 600+ income securities to find the best dividend growth stocks for the long run. His work has appeared on Forbes, MSN Money, The Street, and other leading financial sites.

More By This Author:

September is Historically the Market's Worst Month. Will Things Be Different in '24?From Luxury Cars To Powerful Engines, Rolls-Royce Does It All

Sow Good: An Under-The-Radar Food Play Poised For A Resurgence

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more