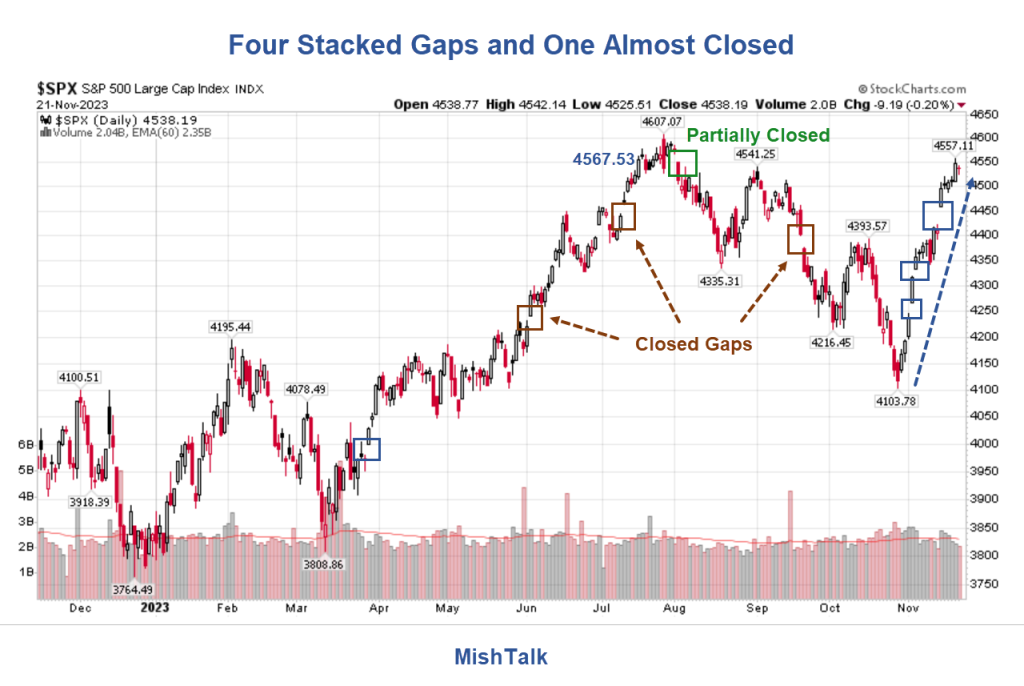

Powerful Stock Market Rally Leaves Four Stacked Gaps But They Will Close

The S&P 500 is on the verge of closing the last open gap down on August 1. Now there are four gaps up that beg to be filled.

SPX S&P 500 chart courtesy of StockCharts.Com, annotations by Mish.

Gaps are Like Magnets

I have commented on this before but it’s worth repeating. Gaps are like magnets and nearly all of them close sooner or later, typically sooner.

A down gap occurs when the market opens lower than the lowest point of the previous day and stays lower. An upward gap occurs when the market opens higher than the high of the previous day and stays there.

At the end of October, there were two open gaps higher and one lower. The gaps higher are now closed or partially closed.

Anyone who shorted the S&P 500 breakdown in August and held, just lost all their gains back. That gap did not completely close yet, but it partially filled with another 10 points to go.

The powerful rally that started at the end of October left three stacked gaps and there is still one more from March. The unfinished business is now all to the downside, assuming the remaining 10 points fill or the gap gods are satisfied with a partial fill.

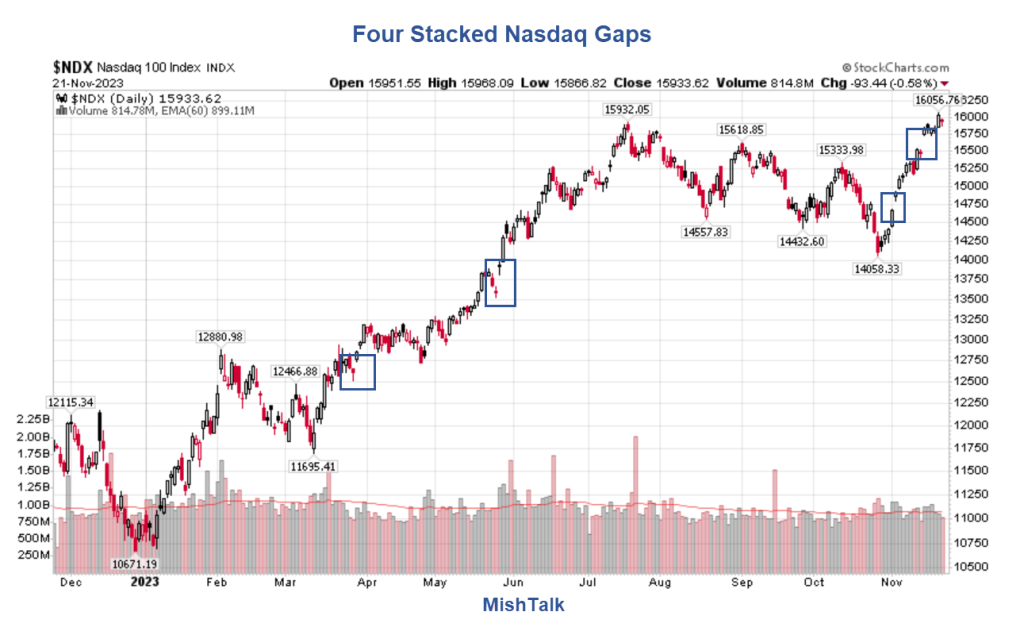

Four Stacked Nasdaq Gaps

NDX Nasdaq 100 chart courtesy of StockCharts.Com, annotations by Mish.

The Nasdaq is in the same setup. There are four stacked gaps lower. I expect all of these gaps will close next year.

If you are thinking about joining this rally now, I suspect it is nearly over. Even if there is still more to come, buying over four stacked gaps is begging for trouble.

More By This Author:

Existing Home Sales Sink 4.1 Percent, Down 19 Of The Last 21 MonthsArgentina’s New President Wants to Adopt the U.S. Dollar, How Would That Work?

Question Of The Day: Why Does The Fed Value Its Gold At $35 Per Ounce?

Disclaimer: The content on Mish's Global Economic Trend Analysis site is provided as general information only and should not be taken as investment advice. All site content, including ...

more