Pinduoduo Could Pull Back When Lockup Expires

The 180-day lockup period for Pinduoduo Inc. (PDD) ends on January 22, 2019. When the lock up ends, the company’s pre-IPO shareholders and company insiders will be able to sell large blocks of currently-restricted shares in the secondary market for the first time. With just 14.5% of shares outstanding trading pursuant to the IPO, the potential for an increase in volume in the secondary market following the lockup expiration is significant. Any significant sales of currently-restricted shares could cause a sharp, short-term downturn in share price.

(Click on image to enlarge)

Trading in PDD has been a veritable roller coaster during this six-month period. Shares closed on the first day of trading at $26.70, which is an increase of 40.5% from its IPO price of $19. The stock has bounced around significantly. Currently, shares trade in the $24 to $26 range.

Business Overview: Provider of eCommerce Platform in China

Pinduoduo operates its eCommerce platform in China as well as a mobile platform that markets a wide array of merchandise for sale.

In its SEC filings, Pinduoduo notes that its platform model is an innovation over other platforms, which offers consumers a fun, interactive shopping experience while providing value-for-money merchandise. The difference is the leverage of social networks for customer engagement and acquisition.

Pinduoduo created its “team purchase” model, which enables consumers to make team purchases through social networks like QQ and Weixin. The platform encourages consumers to share their experiences on these social networks or create teams by inviting friends and families to join a group. This serves to increase low-cost organic traffic and a growing user base. In 2017, Pinduoduo had 245 million active consumers, and for the first six months of 2018, the platform had 344 million active consumers.

This has attracted over 1.7 million active merchants to the platform. Pinduoduo markets their platform as a virtual bazaar that enables users to shop and interact with each other. The embedded social networks spur higher engagement. For the second quarter of 2018, average monthly active users on the mobile app reached 195 million.

The company was formerly known as Walnut Street Group Holding Limited. In July 2018, it changed its name to Pinduoduo Inc. Pinduoduo Inc. was founded in 2015, has approximately 1,160 employees, and is headquartered Shanghai, the People's Republic of China.

Company information sourced from the firm's S-1/A and company website.

Financial Highlights

Pinduoduo reported the following third-quarter results for the period ending September 30, 2018:

- Total revenue was RMB3,372.4 million (US$491.0 million), for an increase of 697 percent versus the same quarter of 2017.

- Total cost of revenue was RMB774.7 million (US$112.8 million), for an increase of 315 percent versus the same quarter of 2017

- Operating expenses were RMB3,867.2 million (US$563.1 million), versus RMB470.6 million for the same period of 2017.

- Operating loss was RMB1,269.5 million (US$184.8 million), in contrast to an operating loss of RMB234.4 million for the same period of 2017.

- Non-GAAP operating loss was RMB790.0 million (US$115.0 million), in contrast to RMB230.9 million in the same period of 2017.

Financial highlights sourced from company website.

Management Team

Zheng Huang founded Pinduoduo, and he serves as CEO and Chairman of the Board of Directors. He also founded Xinyoudi Studio and Ouku.com. His previous experience includes positions at Google as a project manager and software engineer. He was a member of the team that established Google China. Mr. Huang earned a bachelor’s degree from Zhejiang University and a master’s degree in computer science from the University of Wisconsin, Madison.

Lei Chen has served as CTO since 2016 and as a director since February 2017. His previous experience includes senior positions at Xinyoudi Studio and internships at IBM, Yahoo, and Google. He earned a bachelor’s degree from Tsinghua University and a doctoral degree in computer science from the University of Wisconsin, Madison.

Company bios sourced from PDD website.

Competition: Alibaba, Tencent, and Baidu

Pinduoduo faces intense competition in the eCommerce industry in China. The largest platforms are Alibaba (BABA), Tencent (OTCPK:TCEHY), Baidu (BIDU), JD.com (JD), VipShop (VIPS), NetEase (NTES), and 58.com (WUBA), among others. They also face competition from traditional sectors such as brick-and-mortar retailers.

Early Market Performance

The underwriters for Pinduoduo priced its IPO at $19, at the high end of its expected price range of $17 to $19 per share. The stock has had several peaks and valleys in the last six months. It closed on its first day of trading at $26.70 for an increase of 40.5%. It began to decline to reach $17.22 on August 24, rose to a high of $29.96 on September 13, and dropped again to reach $17.22 on November 12. Currently, the stock trades in the $24 to $26 range.

Conclusion: Short PDD Ahead of IPO Lockup Expiration

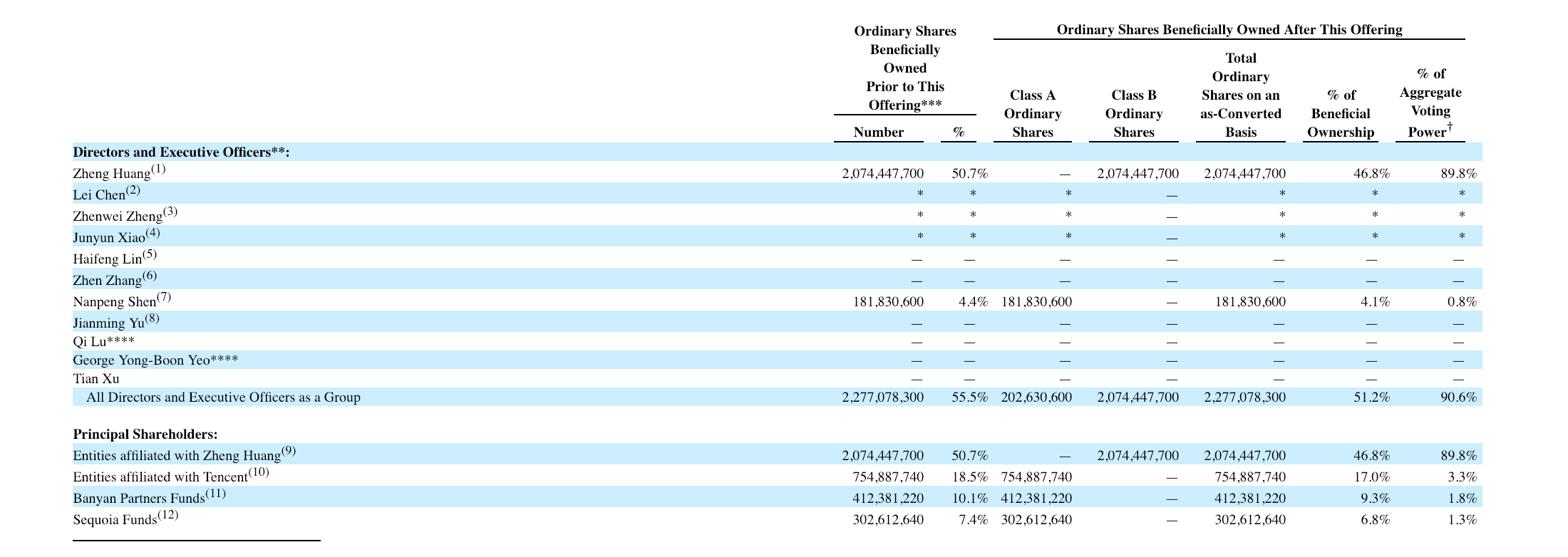

When PDD's IPO lockup expires on January 22nd, pre-IPO shareholders and company insiders will be able to sell currently-restricted shares of the company for the first time. This group of pre-IPO shareholders and company insiders includes several directors and numerous corporate entities.

(Click on image to enlarge)

Any significant sales of currently restricted stock could flood the secondary market and cause a sharp, short-term downturn in share price.

Aggressive, risk-tolerant investors should consider shorting shares of PDD ahead of the January 22nd lockup expiration. Interested investors should cover short positions either late on January 22nd or during the January 23rd trading session.

Disclosure: I am/we are short PDD.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any ...

more