Pick Up These Three High-Yield Stocks While They’re Still On Sale

The spread of Coronavirus across the globe as led to a decimation of stock prices in the travel and vacation related stocks. With stock prices down so far, it is tempting to possibly pick up shares of an airline, cruise ship, or hotel stock. I caution against jumping in now and have an alternative idea.

The airlines, cruise line, and hotel stock prices will continue to decline as long as the number of virus cases continues to grow, and cancellation of travel and events continues.

After the fear has bottomed, there may be a small recovery in stock prices, but the first quarter and possibly second-quarter earnings results for these companies will be terrible. Again, we do not have a time frame on when the Coronavirus crisis will abate. It could be weeks. It could be months.

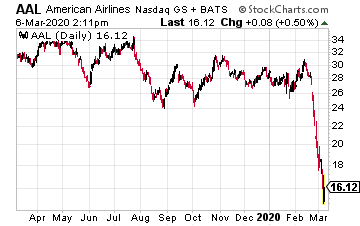

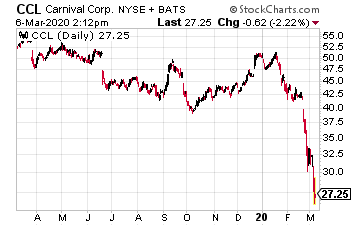

My point is don’t try to time the bottom for companies like American Airlines Group (AAL) or Carnival Corporation (CCL). For these companies, the bad news future remains open-ended.

If you do want to go fishing for good to great values in the travel, vacation, and hospitality sectors, consider the lodging real estate investment trusts (REITs). This REIT sector owns hotels that are run by third party operators. Lodging REITs are different from most of the REIT world in that the landlords participate in the financial results alongside the operators. Because of the assumed business risk, the hotel REITs will be more conservative with their dividend payouts.

The lodging REIT share prices have dropped with the rest of the market and the corporate hotel stocks. The good news is that the REIT’s pay steady dividends and high yields. You can buy the REITs now, and if the stock prices continue to decline, you will at least earn a steady dividend income. Right now, after the last two weeks of market decline, the yields are exceptional. Here are three lodging REITs to consider.

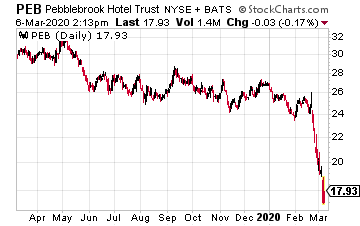

Pebblebrook Hotel Trust (PEB) owns 56 hotels. The portfolio focus is on experiential, lifestyle, urban hotels, and resorts. Pebblebrook is a growth-focused company.

The REIT has a broad operator base, with over 20 different companies running its hotels. These are names like Marriott, Kimpton, Accor, and Hyatt. For 2019, PEB generated FFO of $2.63 per share.

That cash flow provides excellent coverage of the $1.52 annual dividend.

A business slowdown due to the virus outbreak should not put the dividend at risk.

PEB shares currently yield 7.9%.

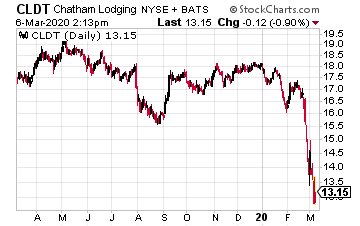

Chatham Lodging Trust (CLDT) owns 40 premium-branded upscale extended-stay and select-service hotels. Brand names include Residence Inn, Hilton Garden Inn, and Homewood Suites.

2019 AFFO came in at $1.85 per share. The annual dividend is $1.32 per share. Chatham pays monthly dividends at $0.11 per share rate.

That dividend has been in effect since March 2016.

At that time, it increased from a dime per share per month. Steady goes the dividend at CLDT.

The current yield is 9.6%.

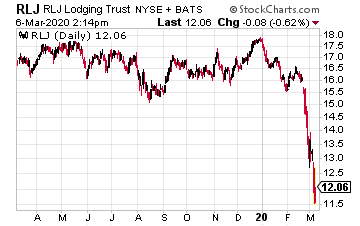

RLJ Lodging Trust (RLJ) owns premium-branded, focused-service, and compact full-service hotels. The portfolio currently consists of 103 hotels in 23 states.

RLJ has expertise in acquiring independent hotels, refurbishing the hotels, and rebranding them to names such as Marriott, Hilton, and IHG.

Company management provides 2020 FFO guidance of $1.62 to $1.77 per share.

The dividend rate is $1.32 per share, paid at $0.33 quarterly.

RLJ shares currently yield 10.0%.

Disclaimer: The information contained in this article is neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Investors Alley Corp. and its ...

more