Philip Morris International: Is It A Buy?

Image Source: Pixabay

As part of an ongoing series, we will take a closer look at one of the stocks from our stock screeners and briefly review why it’s a ‘buy’ based on key fundamentals. One of the cheapest stocks on our screens is Philip Morris International Inc.

Philip Morris International Inc. (PM)

Created from the international operations of Altria in 2008, Philip Morris International sells cigarettes and reduced-risk products, including heatsticks, vapes, and oral nicotine offerings primarily outside of the US.

With the 2022 acquisition of Swedish Match, a leading manufacturer of traditional oral tobacco products and nicotine pouches primarily in the US and Scandinavia, Philip Morris International has not only diversified away from smokeable products, but it also gained a toehold into the US to sell its iQOS heatsticks.

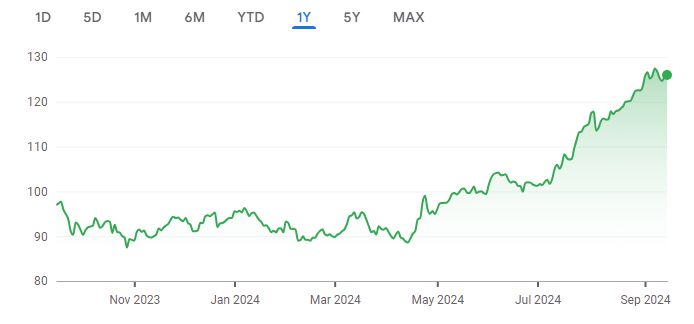

Provided below is a quick look at the share price history. It shows that over the past 12 months, the price has moved up approximately 29.92%. Here’s is a brief review on why the company is undervalued and could be considered a buy. Numbers below are as of Sept. 26, 2024.

Source: Google Finance

Key Stats

- Market cap: $195.85 billion

- Enterprise value: $241.92 billion

Operating Earnings

- Operating earnings: $13.65 billion

Acquirer’s Multiple

- Acquirer’s multiple: 17.70

Free Cash Flow (TTM)

- Free Cash Flow: $10.12 billion

FCF/MC Yield Percentage

- FCF/MC yield percentage: 5.17

Shareholder Yield Percentage

- Shareholder yield percentage: 4.10

Other Indicators

- Piotroski F score: 6.00

- Dividend yield percentage: 4.10

- ROA (five-year average percentage): 21

More By This Author:

The Home Depot, Inc. Valuation: Is The Stock Undervalued?Adobe Inc. Valuation: Is The Stock Undervalued?

Comcast Corporation: Is It A Buy?

Disclosure: None.