PG Should Continue Rally To Complete The Cycle From March 2020

Since the crash of March 2020, all stocks have tried to recover what they lost and PG was no exception. PG did not only recover from the loss, but it also reached historic highs. We tried to build an impulse from wave II with the first target of $154.00, but market movements of last months have shown the impulse from wave II ended at 147.23 as wave III and PG appear to have entered in an ending diagonal structure from March 2020 low.

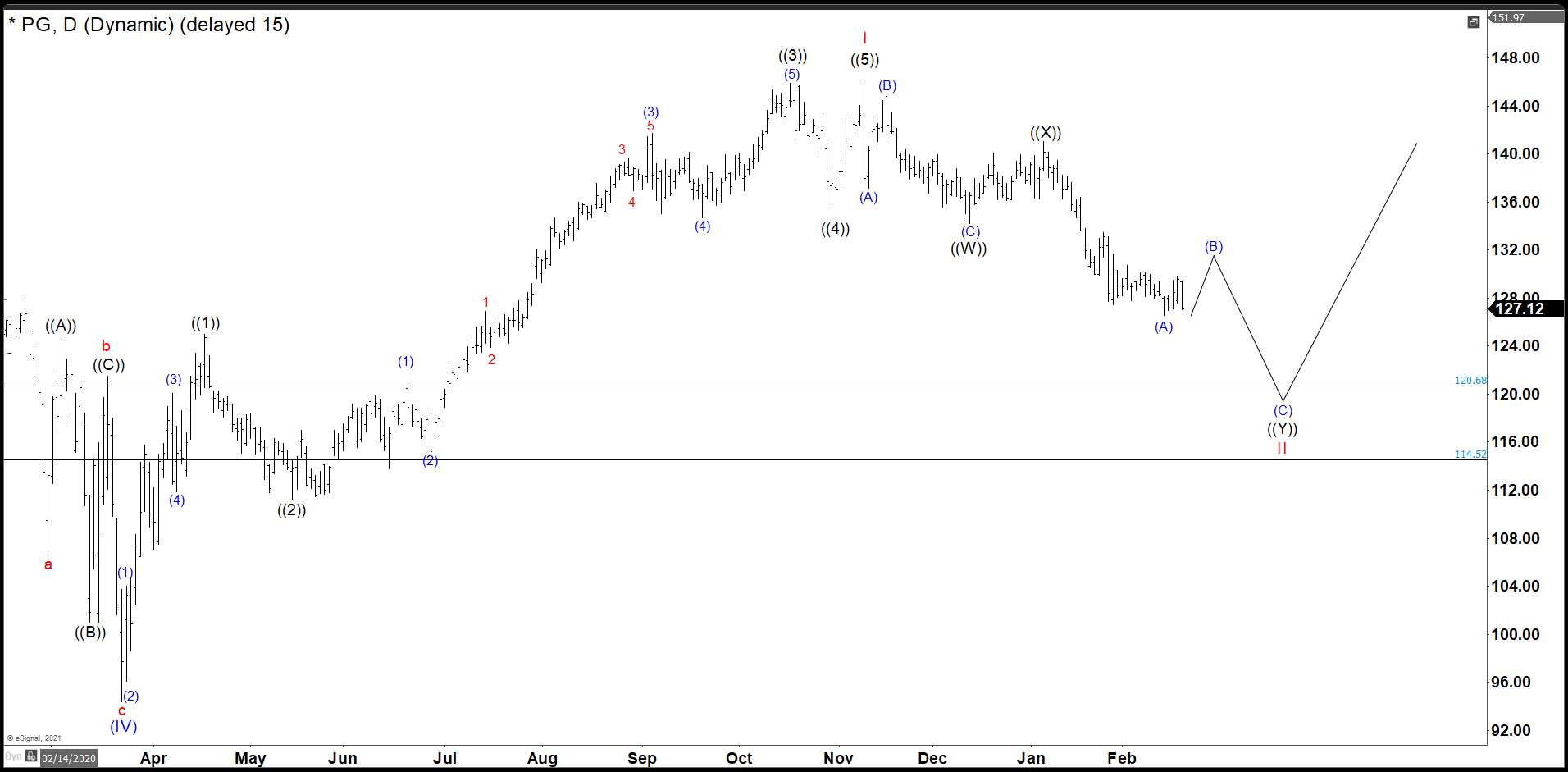

PG February Daily Chart

(Click on image to enlarge)

As we see in the daily chart, PG built an impulse ((1)), ((2)), ((3)), ((4)), and ((5)) that we call in the red and it ended at 146.92. Then, we saw the stock with an incomplete bearish sequence and we called 2 swings more down (B) and (C) in blue to finish wave ((Y)) forming a double correction as wave II.

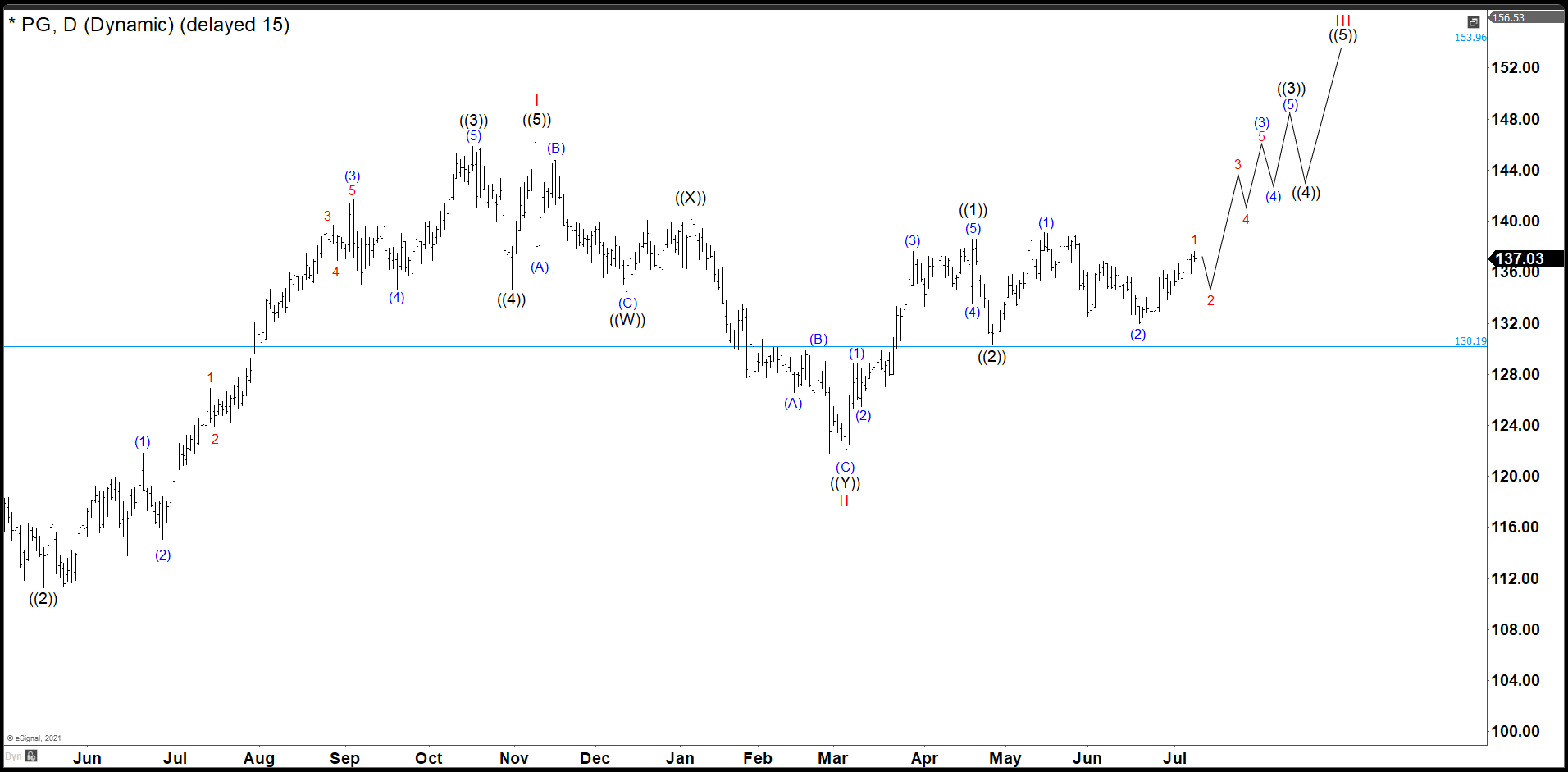

PG July Daily Chart

(Click on image to enlarge)

The market dropped and wave II bounced from 121.54 dollars missing our ideal level for a few cents at 120.68.

PG September Daily Chart

(Click on image to enlarge)

P&G rallied, and it completed wave ((1)) at 138.63 dollars. Also, we have seen a pullback that bounced at 130.19 dollars, Fibonacci 50% retracement, ending for us the wave ((2)). Wave (1) of ((3)) ends at 139.18 and wave (2) of ((3)) made a double correction to complete at 131.93. Wave (3) of ((3)) ended at 145.97 and wave (4) of ((3)) pullback completed at 141.47. At this moment, we were calling one more high to 147.19 – 149.97 area to complete wave the whole wave ((3)). The stock hit the area at 147.23, but the pullback as wave ((4)) were to dip to consider a wave ((4)) and we rebuilt the count from wave II ending the impulse at 147.23 as wave III.

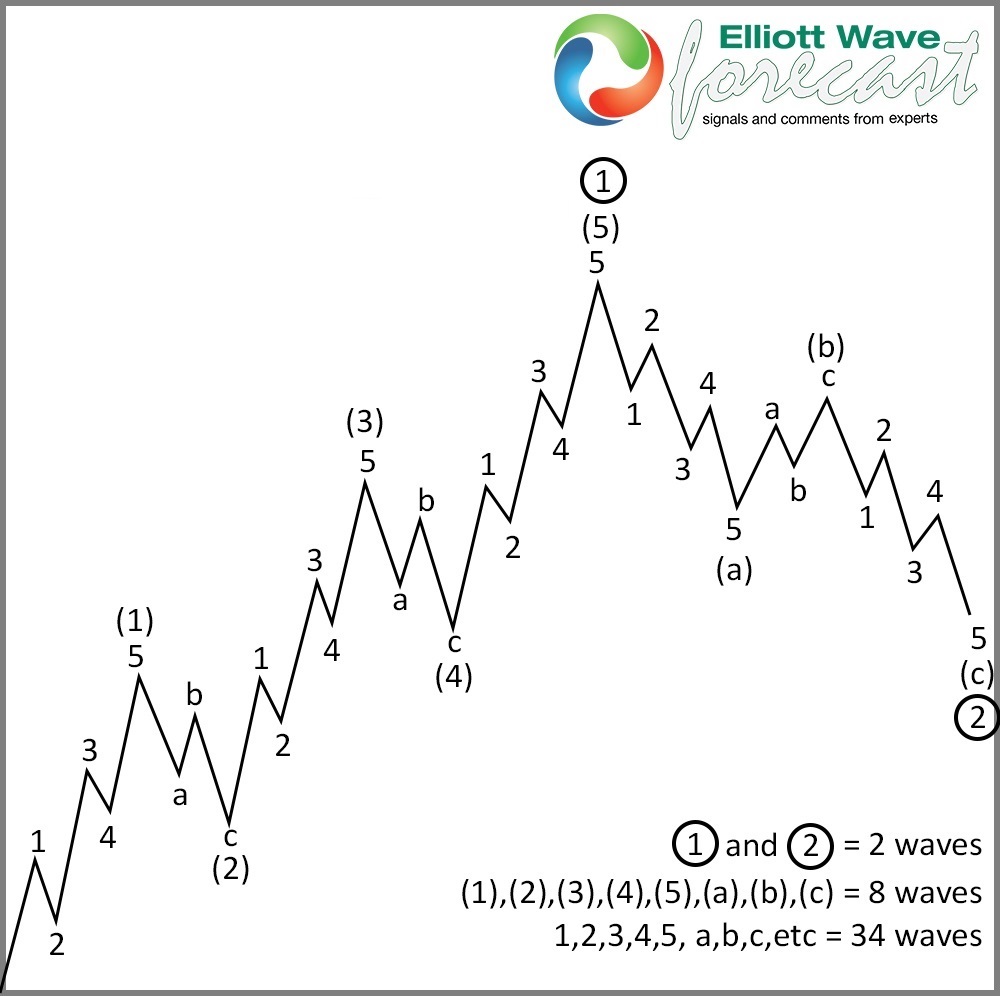

Elliott Wave Theory Motive Wave Structure

PG Daily Chart

(Click on image to enlarge)

At last, wave III was finished. Wave ((1)) of III ended at 139.18, wave ((2)) ended at 131.93. Wave ((3)) completed at 145.98 with an ending diagonal as wave (5). Wave ((4)) correction finished at 141.47 and the last push to 147.23 as we know. Then we have a deep pullback as a double correction completed wave IV at 137.60 and that is why it is better to consider that the structure from March low is an ending diagonal.

Actually, wave V already ended with 2 swings. Wave ((1)) at 144.87 and wave ((2)) at 138.80. Wave ((3)) almost should be done; therefore, we are near a pullback as wave ((4)) before the rally to complete wave fifth. This rally could end in 149.56 – 153.26 at first view and we could expect a nice correction from those levels.

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more