Pfizer: How A 15% Decline Is A Gift To Income Investors

Pfizer (PFE) stock has declined 15% from its 52-week closing high, of $37.31 per share. The positive aspect of this is that it gives income investors a better buying opportunity.

Because of its share price dip, Pfizer’s dividend yield has elevated to nearly 4% (it’s currently at 3.8%). This is a notable event. Pfizer’s dividend yield has rarely reached 4% over the past five years.

And, Pfizer has the ability to raise its dividend each year…The company is highly profitable and is likely to increase earnings-per-share going forward.

In fact, Pfizer has raised its dividend payments for 7 consecutive years. The company will be a Dividend Achiever in 3 years if it continues its current trend. Dividend Achievers are a group of 273 stocks with 10+ consecutive years of dividend increases. You can see a full list of the Dividend Achievers here.

The average dividend yield in the S&P 500 hovers around 2%. In a low interest rate climate, Pfizer’s ~4% dividend yield is high appealing to income investors.

Business Overview

Pfizer is a pharmaceutical giant. The company operates in two core segments, which are Innovative Products and Established Products. The two segments are nearly equal in size.

The Innovative Products business consists of the Global Innovative Pharmaceutical and the Global Vaccines, Oncology, and Consumer Healthcare businesses.

Global Innovative Pharmaceuticals focuses on therapeutic areas like inflammation, immunology, cardiovascular, neuroscience, pain, and rare diseases. The major brands in this area include Xeljanz, Eliquis, Lyrica, Enbrel, and Viagra.

The Established Products segment is comprised of legacy brands that have lost or will soon lose market exclusivity. It also includes branded generics, generic sterile injectable products, biosimilars, and infusion systems.

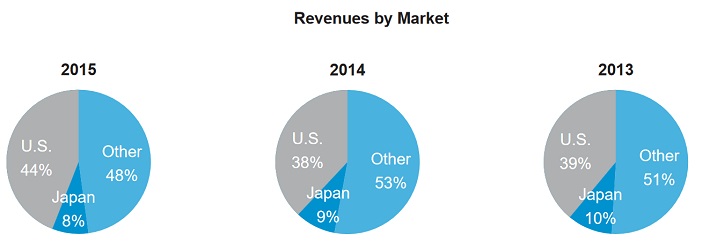

Pfizer is a global company. Approximately 56% of the company’s sales come from outside the U.S.

Source: 2015 Annual Report, page 21

Pfizer is fairly diversified geographically. It operates in 12 countries that generate at least $500 million of annual sales for the company.

Business conditions have been challenging for Pfizer for many years. Its biggest challenge has been the loss of patent protection on its flagship cholesterol drug, Lipitor.

Lipitor was once a $10 billion product for Pfizer in terms of annual sales. But the proliferation of generic competition has had a devastating effect on the company. Last year, Lipitor sales fell another 10% to just $1.86 billion.

This is a perfect example of what can happen to a pharmaceutical company if its most important drug loses patent protection. The flood of competition into a highly profitable therapeutic area is swift and severe. Similar fears have made shares of fellow high yield pharmaceutical stock AbbVie (ABBV) a bargain as well.

However, the good news for shareholders is that Pfizer has rebuilt itself with new products. It has invested aggressively in research and development. Last year, Pfizer spent $7.7 billion on R&D.

It has also conducted large acquisitions. In the past year, Pfizer has spent more than $40 billion on M&A.

These will be its growth catalysts in the post-Lipitor era.

Growth Prospects

One way Pfizer is coping with the loss of Lipitor exclusivity is through acquisitions. Rather than develop drugs internally, which is a time-consuming and costly process, Pfizer can simply buy growth. It can do this because of its financial strength.

Last year, Pfizer acquired Hospira for $17 billion. Then, Pfizer announced the $14 billion acquisition of Medivation.

The Medivation takeover significantly enhances Pfizer’s position in oncology drugs. Medivation has a large product portfolio.

Source: Investor Presentation, page 7

Oncology is an attractive area to expand into. Pfizer’s oncology drug sales rose 60% over the first three quarters of 2016.

These deals will continue to boost Pfizer’s revenue. Total revenue rose 8% last quarter, and adjusted earnings-per-share increased 2% year over year.

Source: Third Quarter Results, page 8

And, Pfizer will realize significant cost synergies. Medivation fits in well with Pfizer’s existing infrastructure. Pfizer will be able to cut duplicated costs across the business model.

This is why Pfizer expects the acquisition will add to earnings-per-share growth in the first year after closing.

Lastly, Pfizer will boost future earnings-per-share growth with share repurchases. Since the company is highly profitable, it can afford to invest in R&D, acquisitions, pay a dividend, and repurchase its own stock simultaneously.

In 2016, Pfizer announced an $11 billion share repurchase authorization. This represents approximately 5.7% of Pfizer’s current market capitalization. So, all things being equal, Pfizer could generate nearly 6% earnings-per-share growth just from share buybacks.

Dividend Analysis

Pfizer’s dividend looks secure. The company has a current annualized dividend of $1.20 per share. Meanwhile, the company has an optimistic forecast for the full year.

Source: Third Quarter Results, page 10

At the midpoint of its forecast, Pfizer expects to earn $2.40 per share in its 2016 forecast. This is in terms of adjusted earnings-per-share, which excludes various one-time costs including acquisition-related costs, discontinued operations, or restructuring charges.

This means that even though Pfizer has a ~4% dividend yield, the company is only set to distribute half of its earnings-per-share this year.

A 50% payout ratio is a very comfortable level, especially for a company as strong as Pfizer. Pfizer has a very solid business model. Consumers typically need to purchase their medications, even when the economy goes into recession.

This helps Pfizer maintain its profitability and shareholder dividends, even during difficult economic periods.

And, moving forward Pfizer should have little trouble increasing its dividend. It has provided high dividend growth rates in recent years. For example, in 2016 Pfizer increased its dividend by 7%.

Pfizer consistently raises its dividend in the high-single digit range on a percentage basis. The combination of a 4% dividend yield and 6%-8% annual dividend growth is highly attractive for income investors

Final Thoughts

Pfizer stock has declined significantly from its 52-week high. The market appears concerned about slowing global economic growth and heightened geopolitical uncertainty. In addition, the prospect of tightening regulatory scrutiny over drug pricing has eroded investor sentiment this year.

However, Pfizer is a high yield blue-chip dividend stock with good long-term prospects. It should continue to generate rising sales and earnings-per-share through its multi-faceted growth strategy.

In turn, Pfizer should continue to reward shareholders with significant cash returns. Income investors should view Pfizer’s declining share price and its 4% dividend yield as a potential buying opportunity.

Disclosure:

more

Thanks for sharing