Pessimism Growing

“Davidson” submits:

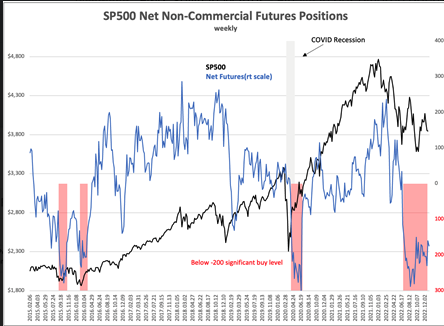

One of the lessons of history is that market lows have always been identified by extreme levels of pessimism. The use of margin(borrowed funds) and futures to enhance returns is a reflection of investor optimism/pessimism. Optimism often proceeds market tops but it is pessimism that is more useful in identifying market lows, especially extreme pessimism. The Year-over-Year change in margin use reflects the rapid development of pessimism of past significant buying opportunities. Not surprising should be the correlation with the Net Non-commercial Futures Positions.

The current environment is as pessimistic as any of past periods which proved later to have been significant opportunities to add capital to equity markets.

More By This Author:

The Drain Of The SPR Continues

“Administration Desperate...”

Inflation Is Not Oil’s Fault

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more