Pershing Square: Bill Ackman’s 7 Stock Market-Beating Portfolio

Pershing Square Capital is a New York-based hedge fund founded in 2004 and still managed by legendary investor Bill Ackman.

Pershing Square is unique, as it has been structured as a closed-end fund whose shares are publicly traded, but is still managed like a hedge fund. According to the company’s latest 13F report, Pershing Square has around $10.6 billion worth of public equity holdings.

Investors following the company’s 13F filings over the last 3 years (from mid-February 2018 through mid-February 2021) would have generated annualized total returns of 28%. For comparison, the S&P 500 ETF (SPY) generated annualized total returns of 12.5%.

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

Keep reading this article to learn more about Pershing Square.

Table Of Contents

- Introduction & 13F Spreadsheet Download

- Pershing Square’s Legendary Manager Bill Ackman

- Current Portfolio Holdings

- Final Thoughts

Pershing Square’s Legendary Manager Bill Ackman

Since the fund’s inception, Pershing Square has been primarily managed by Bill Ackman, who initially funded the company with $54 million from his personal funds.

The billionaire hedge fund manager has gained legendary status in the investing community, having executed many successful and creative investment plays.

One such bet which dominated headlines recently involved him turning $27 million into $2.6 billion. Ackman used credit protection on investment-grade and high-yield bond indexes in his controversial bet that the coronavirus would tank the market.

The trade eventually paid off, at a time when most portfolios were recording losses. The uniquely structured position was so successful that Wall Street journalists described Ackman’s bet as the single best trade of all time.

Mr. Ackman has several other noteworthy achievements throughout his career. In 2011 Pershing Square acquired a 14.2% stake in Canadian Pacific Railway Limited (CP). Ackman eventually won a fierce battle with the existing board to install a new CEO and overhaul the company’s business strategy. Over the next 3 years, CP shares quadrupled. This successful investment netted the activist hedge fund a total of $2.6 billion in profit.

Finally, while Ackman’s coronavirus generated a sizeable return, it’s certainly not Pershing Square’s first. In 2009, Ackman said that he realized a 13-fold return in General Growth Properties, which was on the brink of bankruptcy amid the Great Financial Crisis. By accomplishing a 7-year extension of the company’s $27.3 billion in debt, the mall owner was able to survive, and eventually, buyback Pershing Square’s stake. Ackman’s risky bet is now the second-best in his investing career, turning $60 million into $1.6 billion, exceeding his initial expectations.

Current Portfolio Holdings

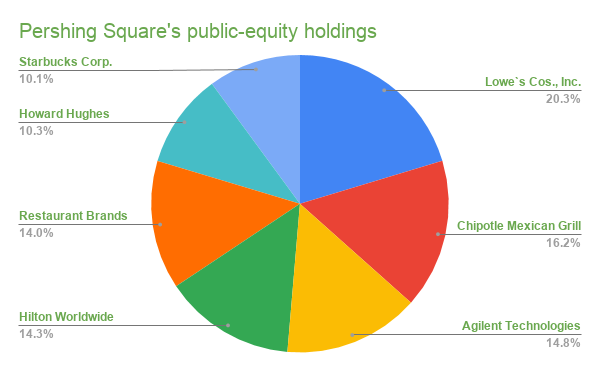

Unlike many hedge funds, which will heavily diversify their portfolio holdings by investing in numerous equities, Pershing Square’s philosophy has always involved betting on a few high conviction ideas. All $10.6 billion of its public-equity holdings are currently invested in only 7 stocks.

Pershing Square’s current holdings are identical to those in its previous 13F filing. The fund only sold tiny parts of its stakes, which amounted to less than 1% of its position.

Pershing Square holds the following equities:

Source: Company filings, author

Lowe’s (LOW): Currently occupying around ¼ of the fund’s public-equities portfolio, Lowe’s is Pershing Square’s largest position. Ackman has been building the position since 2018, in hopes that Lowes’s market share in the home improvement space will grow against Home Depot (HD). The position was trimmed slightly, by less than 1% as of Pershing Square’s latest f13 filing. Mr. Ackman has paid an average estimated price of around $95 while building the position. Shares are currently trading above $160, making Lowes a winning bet over the past couple of years.

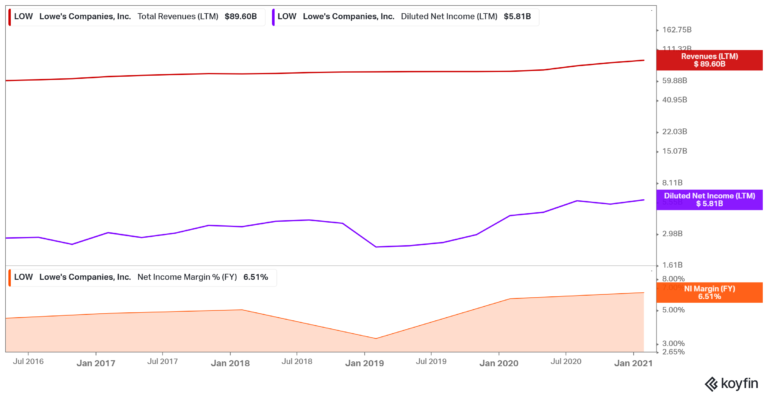

The company has proven resilient, posting growing revenues during the past year, as consumers focus on home-improvement amid the stay-at-home economy. Over the past four quarters, the company has generated nearly $90 billion in sales, the highest in its history. Additionally, Lowe’s net income margins remained robust, at around 6.5%, despite most companies seeing increased costs as a result of the pandemic. The company’s margins have never been very juicy due to being a retailer, but at such sales volumes, Lowe’s managed to net $5.81 billion in profits during this period, also the highest in its history.

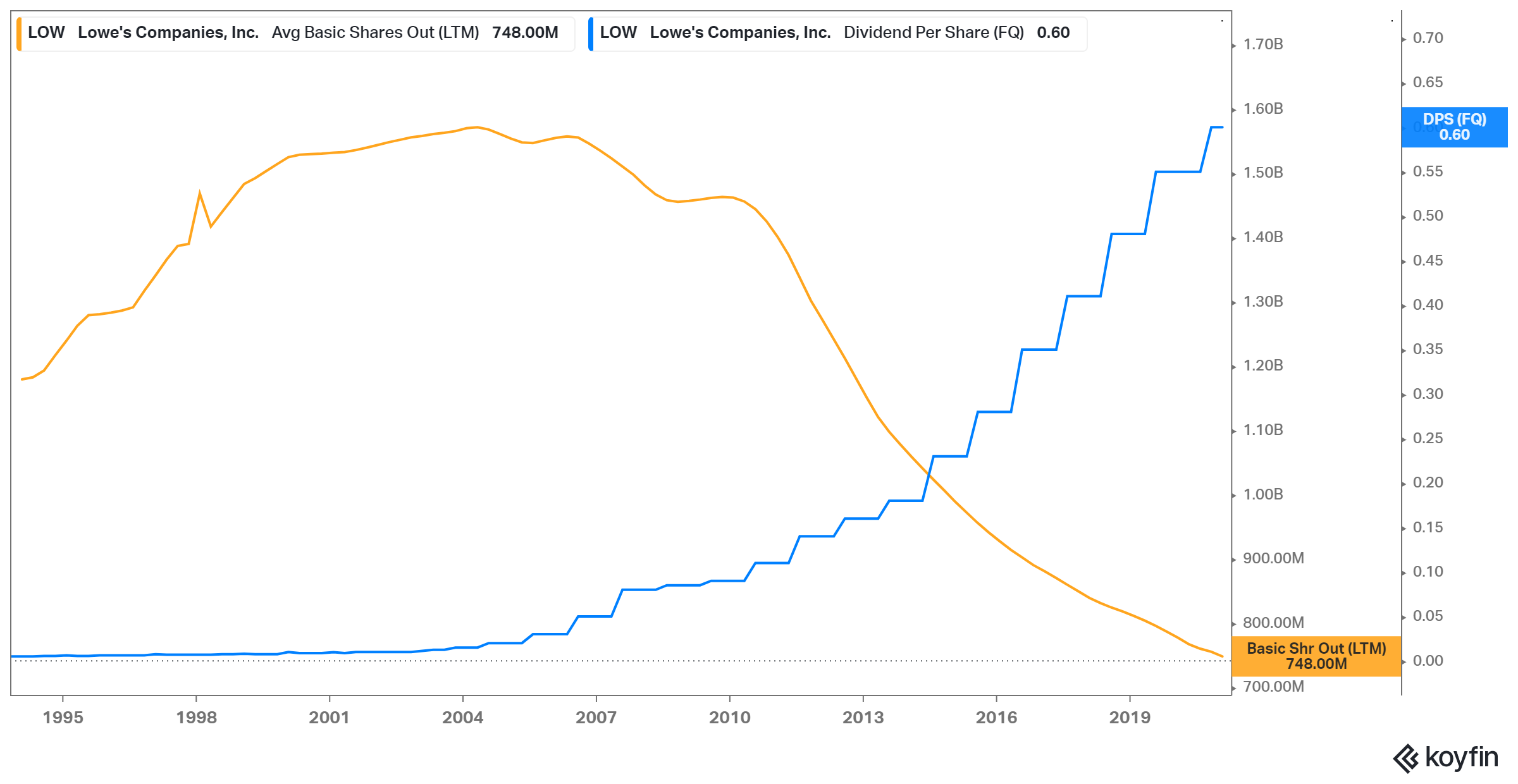

It’s worth noting that Lowe’s is a Dividend King, counting 57 years of consecutive annual dividend increases. Despite the company’s mature profile, Lowe’s keeps on returning capital to its shareholders very aggressively. Its latest dividend increase was of a satisfactory 9%, while the company has been repurchasing its stock very rapidly, retiring more than half of its outstanding shares over the past 15 years. As a result, Pershing Square’s stake is likely to keep expanding even if the fund does not grow its position further, as continued buybacks gradually result in Pershing owning a larger percentage of the company over time.

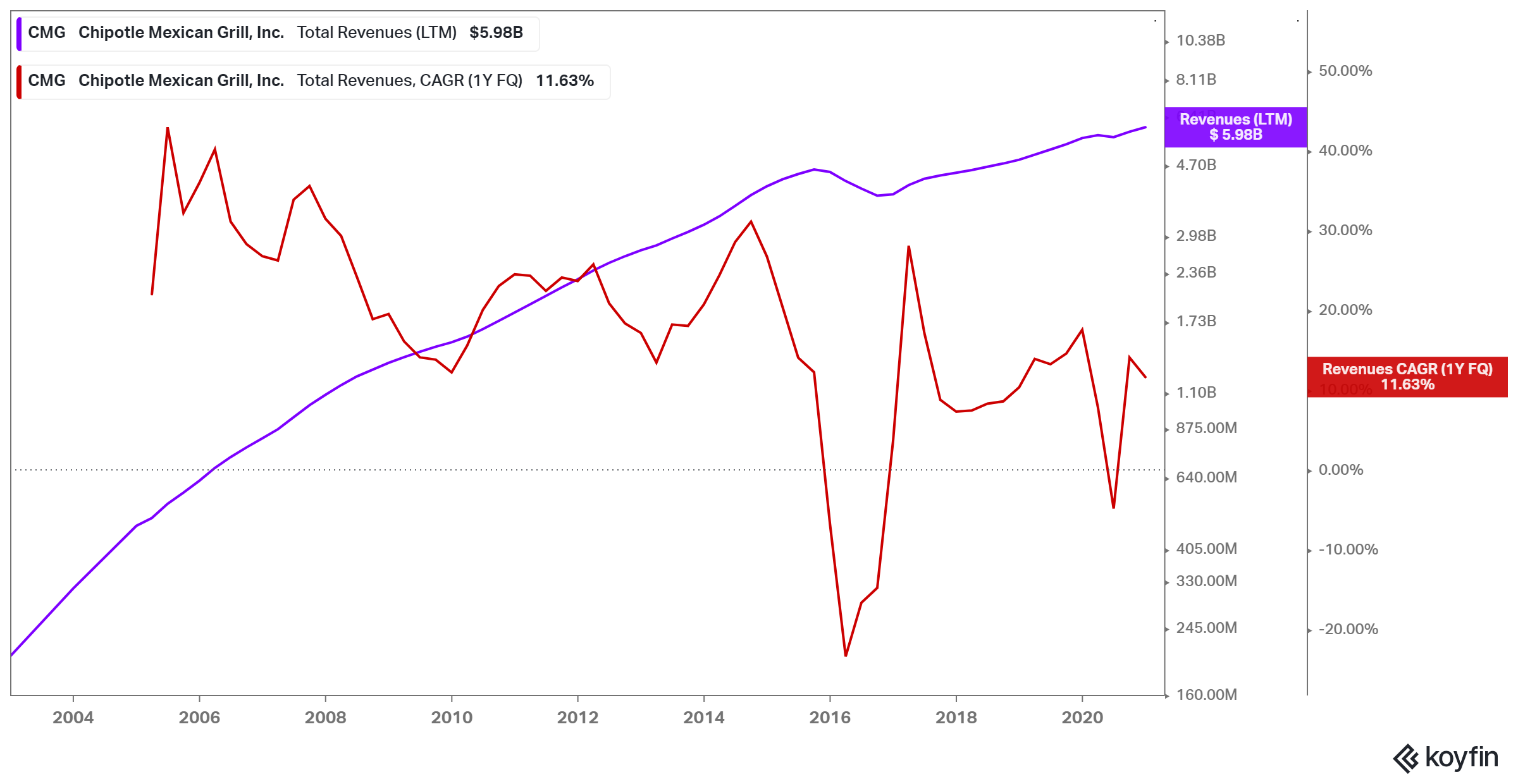

Chipotle Mexican Grill (CMG): At around 16% of Pershing Square’s equity holdings is Chipotle. Ackman has been buying shares since 2016, betting heavily on the fast-food chain. Shares have more than tripled since, with Pershing Square still holding around 4.1% of the company’s total shares. With an average estimated purchasing price of around $386, Chipotle has been one of Pershing Square’s most successful picks, currently trading at $1335/share. No changes were made to this position as of Pershing’s latest 13F filing.

The company has been in an extended growth phase, with revenues moving higher over the past year. While the pandemic adversely affected the restaurant industry, fast-food chains and cloud-kitchen businesses benefited greatly amid growth in delivery orders. Chipotle’s growth slightly decelerated over the past few quarters, though it is still at a double-digit rate.

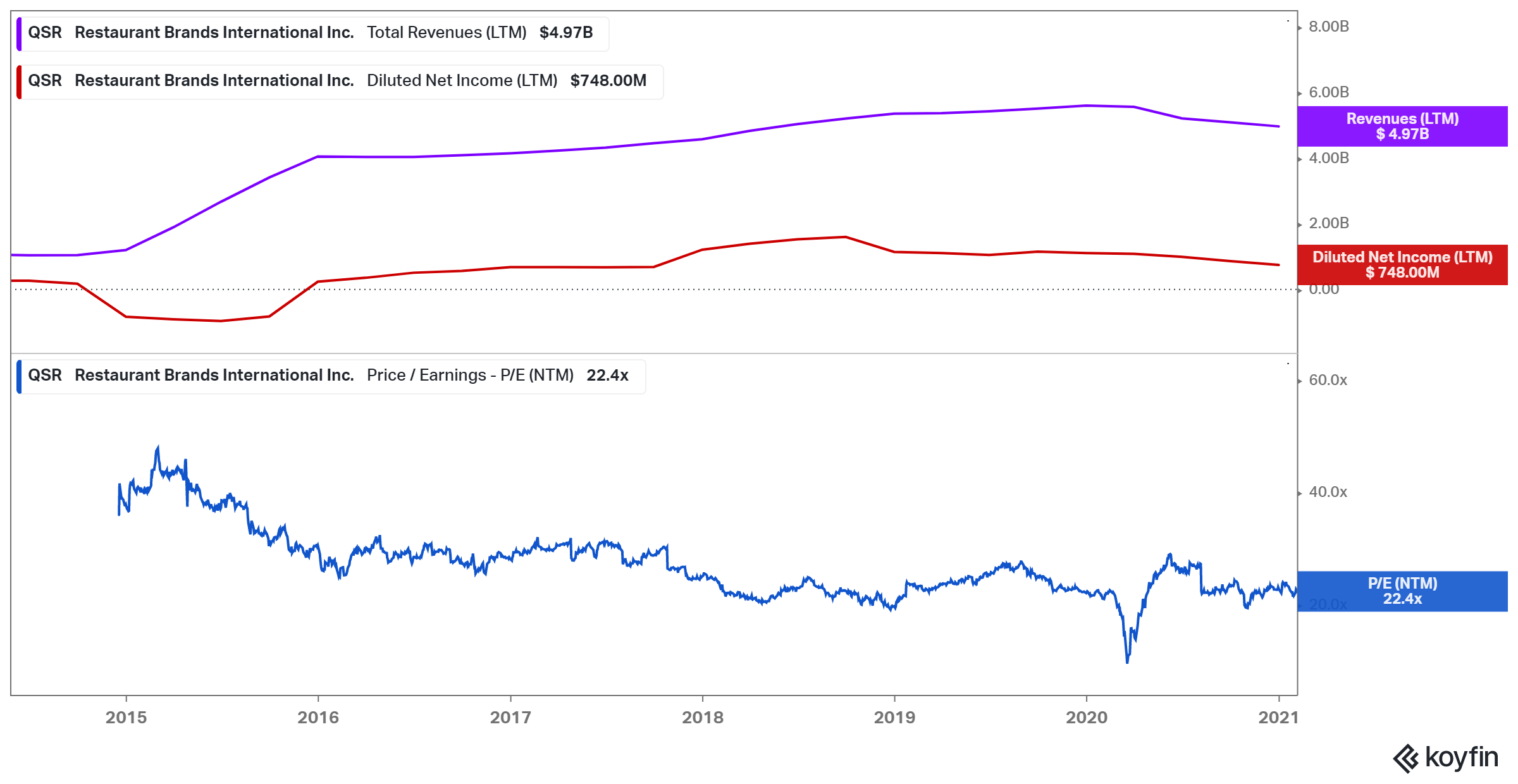

Restaurant Brands International (QSR): Also occupying around 15% of the fund’s holding is Restaurant Brands. Ackman had raised Pershing’s stake by a substantial 66% over the previous few months, now holding around 8.2% of the company’s shares. After shares lost more than half of their value during March’s coronavirus selloff, Ackman’s investment has been rather successful, with the stock regaining most of its value from its pre-COVID-19 levels. Shares have gained additionally since last quarter, with no changes made to Pershing Square’s position.

While QSR’s top & bottom line declined during this past year amid disruption in operations, the company has remained profitable, currently trading at a forward P/E of ~22.

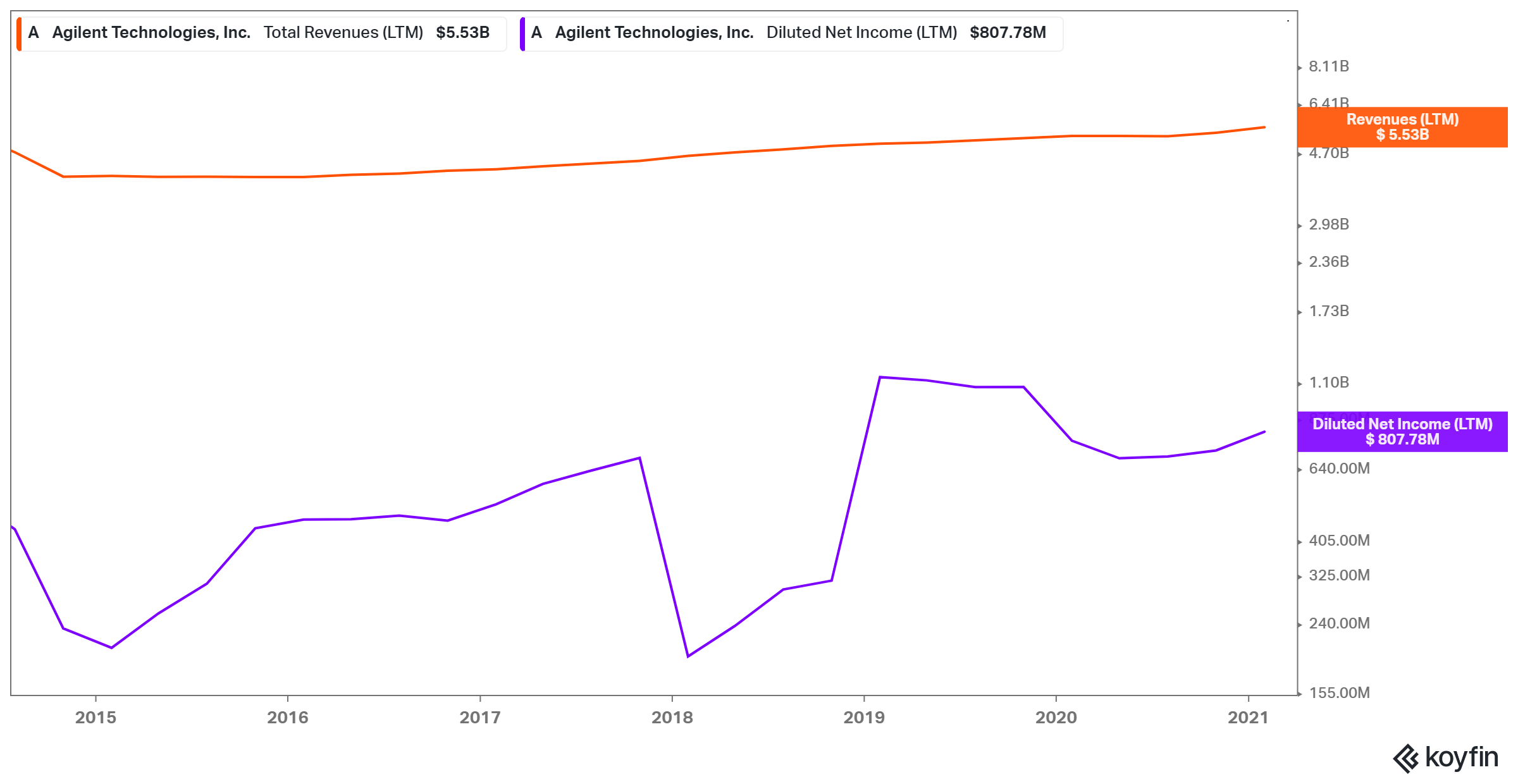

Agilent Technologies (A): Occupying just under 15% of Pershing Square’s total holdings, is Agilent Technologies. Mr. Ackman has been consistently increasing his exposure to the company, currently owning around 4% of the outstanding shares. As he explained in his annual letter to shareholders, Mr. Ackman expects “the net impact of the virus on Agilent’s long-term intrinsic value to be minimal.” During its latest earnings report, the company reported revenues of $1.55 billion, 14% growth YoY. Overall, revenues and net income remained quite steady during the past year, causing shares to currently trade near all-time high levels. Still, investors should be wary of the stock’s expanded valuation, which may face a possible correction moving forward.

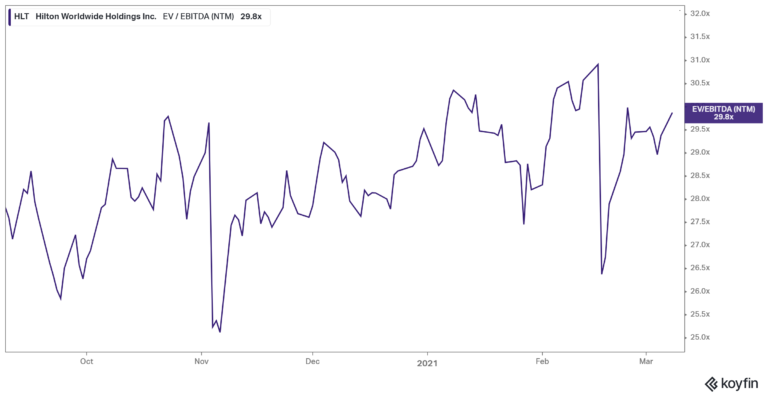

Hilton Worldwide Holdings (HLT): Pershing Square’s strategy of holding large chunks of major corporations is also reflected in HLT, in which Mr. Ackman has bought up a 5% stake. Mr. Ackman has commented that while the pandemic may have adversely impacted the hotel industry, it should also cause independent hotels to seek affiliation with global brands like Hilton, which will contribute to its long-term growth prospects. The company further benefits from a capital-light economic model and a strong balance sheet. The position was trimmed by less than 1% during the quarter. Shares are currently trading at all-time high levels, despite the inial catastrophe-like concerns during the initial COVID-19 outbreak, proving Mr. Ackman’s conviction right.

Shares are currently trading ~30 times their forward EV/EBITDA, however, which is definitely an expanded valuation, subject to a potential correction as well.

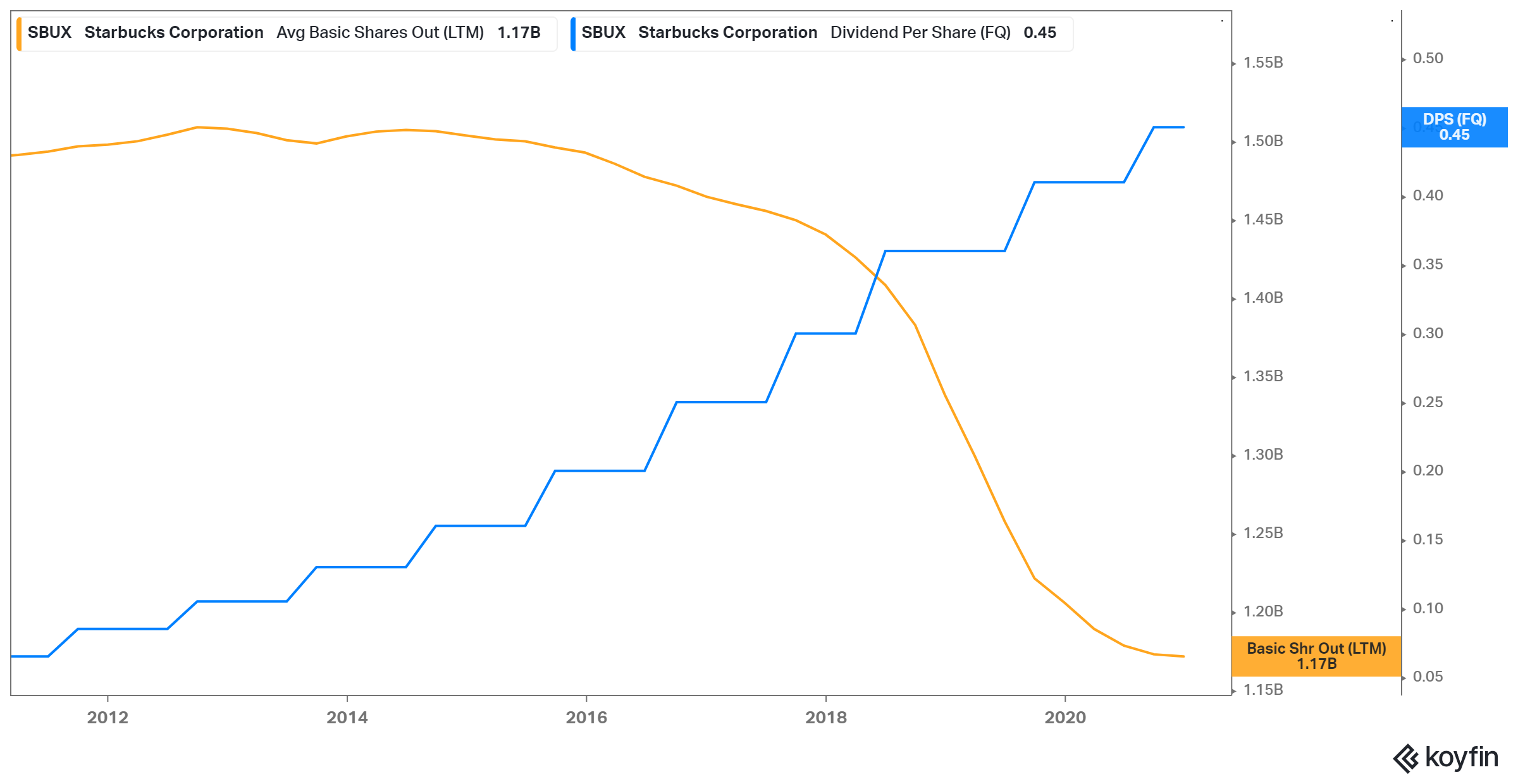

Starbucks Corporation (SBUX): Holding nearly 1% of its total shares and occupying around 10% of Pershing Square’s holdings is Starbucks. The stock marks another success story of Mr. Ackman’s market timing skills. Pershing Square sold its entire Starbucks stake near the stock’s all-time high levels in January, as it had exceeded Pershing Square’s intrinsic value estimates. Ackman repurchased the stock just before shares rebounded amid COVID-19’s massive selloff, scoring a winning swing trade. Starbucks has been one of the most successful of Pershing Square’s short-term trades of this past year. The position was held steady since Pershing Square’s last f13 filing.

Despite the challenges and temporary closing of some of its locations, Starbucks raised its dividend once again this year, by an above-average rate of 9.8%. The company now counts 10 years of consecutive annual dividend increases. Management also took this past year’s opportunity to repurchase more shares of Starbucks when the stock was trading at quite a cheap valuation during the first half of the year.

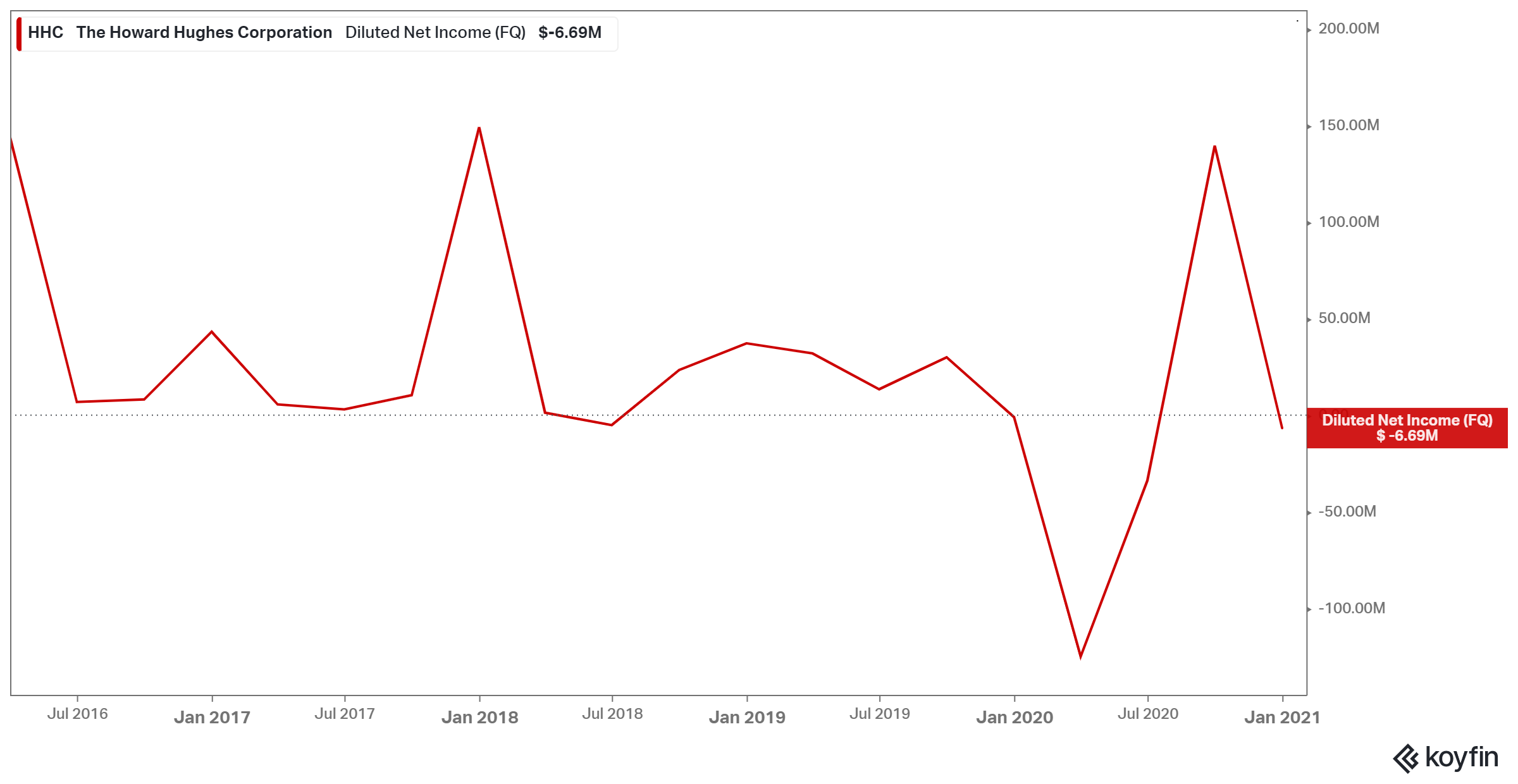

Howard Hughes Corporation (HHC): Finally, Howard Hughes is weighted at 7.3% of Pershing’s portfolio. Mr. Ackman increased his position by 158% by 2019’s year-end, with the position staying unchanged as of Pershing Square’s latest F13 filing. The previous quarter’s trim is likely attributed to the company’s exposure to its Houston, Woodlands, and Bridgeland areas, which have been heavily impacted due to the decline in oil prices. However, Pershing Square is still holding nearly 20% of HHC’s shares, significantly backing the Dallas-based property manager.

While Mr. Ackman’s picks usually turn into very successful investment ideas, it’s worth mentioning the Howard Hughes has been struggling as of late, unable to post consistent profits.

Final Thoughts

Pershing Square is an unusual hedge fund, which the public has the opportunity to buy into due to its public market listing. Run by renowned investor Bill Ackman, the company has massively outperformed the market over the past few years, through its uniquely structured plays, and high conviction ideas. While management’s annual fee of 1.3% (previously 1.5%) in NAV and 16% incentive fee may be quite rich, the company’s long-term performance has been well worth it.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more