PepsiCo Vs. Coca-Cola: What's The Stronger Near-Term Buy?

Image Source: Pixabay

When thinking of competitors, Coca-Cola (KO - Free Report) and PepsiCo (PEP - Free Report) undoubtedly come to mind. Both have established themselves over decades of successful operations while also sporting shareholder-friendly natures.

These defensive-natured stocks are great for balancing a risk profile, as they can generate consistent sales across many economic environments.

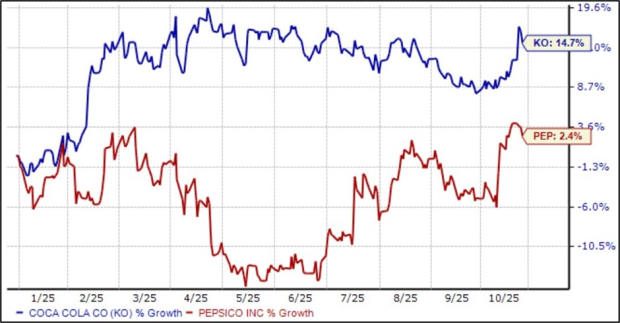

Still, there has been a big performance disparity between the duo in 2025, with KO shares widely outperforming. This is illustrated in the chart below.

Image Source: Zacks Investment Research

Despite the performance disparity, both companies recently reported better-than-expected quarterly results, with each seeing post-earnings gains.

It raises a valid question – which one looks better positioned to continue their momentum?

PepsiCo Earnings

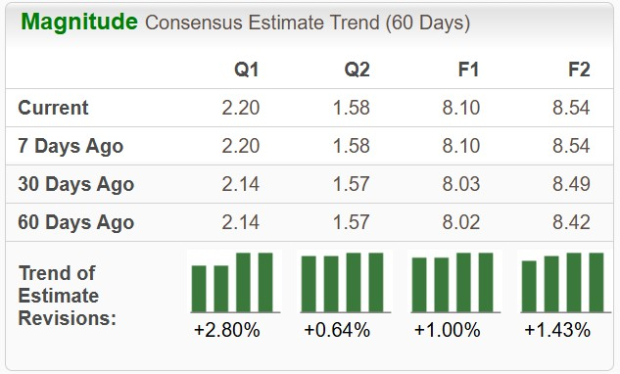

Favorable results in PEP’s release lead analysts to raise their EPS expectations across the board, making it a favorable Zacks Rank #2 (Buy). The company posted a double-beat concerning our consensus headline expectations, with sales growing 2.7% year-over-year alongside a -0.8% decline in adjusted EPS.

Image Source: Zacks Investment Research

Importantly, PEP affirmed its previous FY25 guidance, clearing a massive hurdle. The company enjoyed improved momentum across its North America Beverages, with international momentum also remaining firm. Rising EPS revisions post-earnings can be partly attributed to a stronger USD EPS outlook on improved foreign exchange rates.

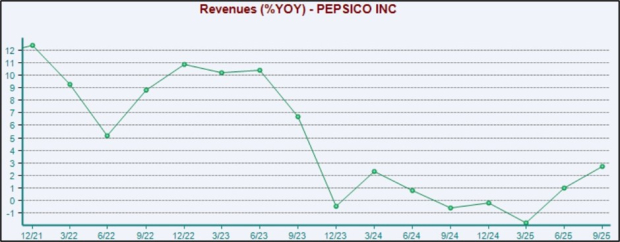

The +2.7% year-over-year sales growth rate is the strongest we’ve seen from the titan since the September 2023 period. Weakening growth rates were largely to blame for shares’ less-than-ideal performance over the last year and a half.

Please note that the chart below tracks YoY sales growth rates, not actual sales figures.

Image Source: Zacks Investment Research

Coca-Cola Earnings

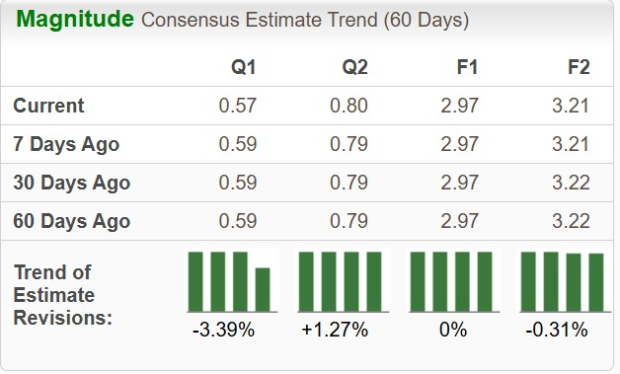

Coca-Cola posted mixed results concerning our headline expectations, exceeding the Zacks Consensus EPS estimate by 5% but falling short of sales expectations by a marginal 0.1%. Unlike PEP, analysts haven’t increased their EPS expectations post-earnings, with KO remaining a Zacks Rank #3 (Hold).

Downward revisions for its next period hit the tape following the release, though.

Image Source: Zacks Investment Research

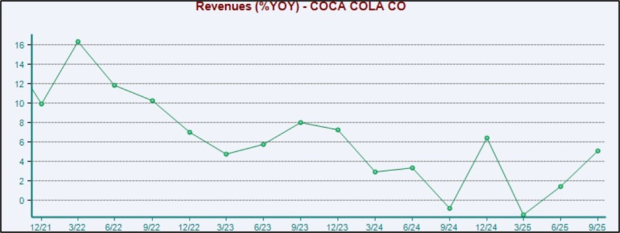

KO posted stronger top and bottom line growth relative to PEP, with sales up 5.1% year-over-year alongside a 6.5% climb in adjusted EPS. Coca-Cola has been facing the same weakening sales growth rates, as shown below, but the +5.1% print does reflect a notable turnaround relative to the last two periods.

Please note that the chart below tracks YoY sales growth rates, not actual sales figures.

Image Source: Zacks Investment Research

Sales growth was aided by a 6% increase in price/mix, with the company largely successful in passing its costs on to consumers through higher prices without hampering demand.

Which Looks Better Positioned?

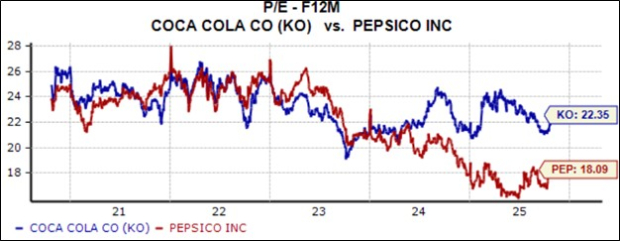

From a valuation perspective, PEP shares currently trade at an 18.1X forward 12-month earnings multiple, well below the five-year median of 23.1X. KO shares are noticeably more expensive, trading at a 22.4X forward 12-month earnings multiple, not too far off the 23.1X five-year median.

Image Source: Zacks Investment Research

Concerning near-term performance, PepsiCo's much-improved EPS outlook also gives it the edge over Coca-Cola shares, with its favorable Zacks Rank #2 (Buy) rating doing some heavy lifting.

Both companies have largely been able to produce solid results in the face of a challenging environment, but the momentum within PEP appears clearer at present, underpinned by a more attractive valuation picture and a bullishly shifting EPS outlook.

More By This Author:

Insider Buys: 3 CEOs Buying SharesThis 3 Stocks Portfolio Provides Monthly Income

Can Tesla Shares Charge Higher Post-Earnings?