PEP K: Boring Is Beautiful

While it’s always nice to hit home runs, I prefer to hit singles in the current environment. Pepsi (PEP) and Kellogg (K) are not sexy stocks but boring is beautiful as far as I’m concerned. Both reported excellent quarters this morning and I can sleep at night with these stocks in my portfolio.

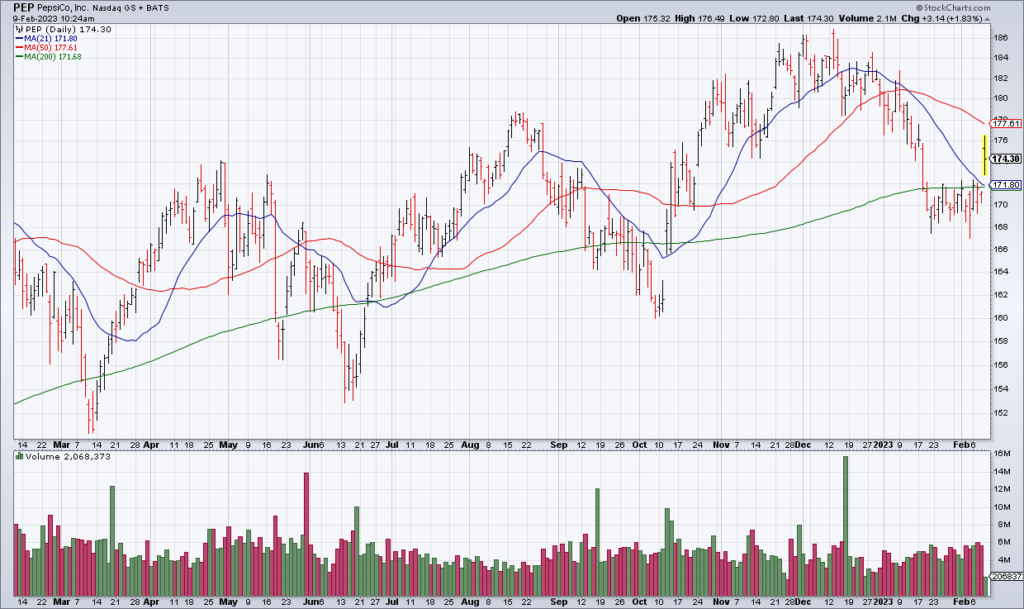

(Click on image to enlarge)

"We don't see signs of consumer weakness in our business," says $PEP CFO Hugh Johnston. "In a world where consumers have money but are also nervous, they won't buy cars, they won't buy personal technology, but they'll treat themselves to our products." pic.twitter.com/qnxwoQCvsI

— Squawk Box (@SquawkCNBC) February 9, 2023

Let’s start with PEP. Organic revenue was +14.6% compared to a year ago resulting in a 10% increase in core constant currency EPS. For the full year, the numbers were +14.4% and +11%, respectively. PEP guided 2023 organic revenue to +6% and core constant currency EPS to +8%. Steady as she goes. PEP also pays an almost 3% dividend. While it’s a little expensive at 24x 2023 EPS guidance, at least I can be confident that the stuff PEP sells isn’t going out of style anytime soon (see the CNBC interview with PEP CFO Hugh Johnson this morning).

The same kind of analysis applies to K. Organic net sales were +16.2% resulting in a +16.9% increase in constant currency adjusted EPS for 4Q22. The numbers for the full year were +11.5% and +5.3%, respectively. K guided 2023 organic net sales growth to 5-7% and adjusted operating income growth to 7-9%. Nothing sexy but it’s reliable. K is cheaper than PEP at 16x 2023 EPS guidance and pays a 3.5% dividend.

If I can get 4-7% annual share price appreciation plus the 3% dividends from PEP and K, I’ll be happy. Depending on your risk tolerance, you can weight your portfolio appropriately with these kinds of safe stocks.

More By This Author:

Why I’m Betting UBER Is Crushing LYFT

UBER Is Crushing It, But The Stock Is Short-Term Overbought

CMG Shares Are Too Hot To Handle