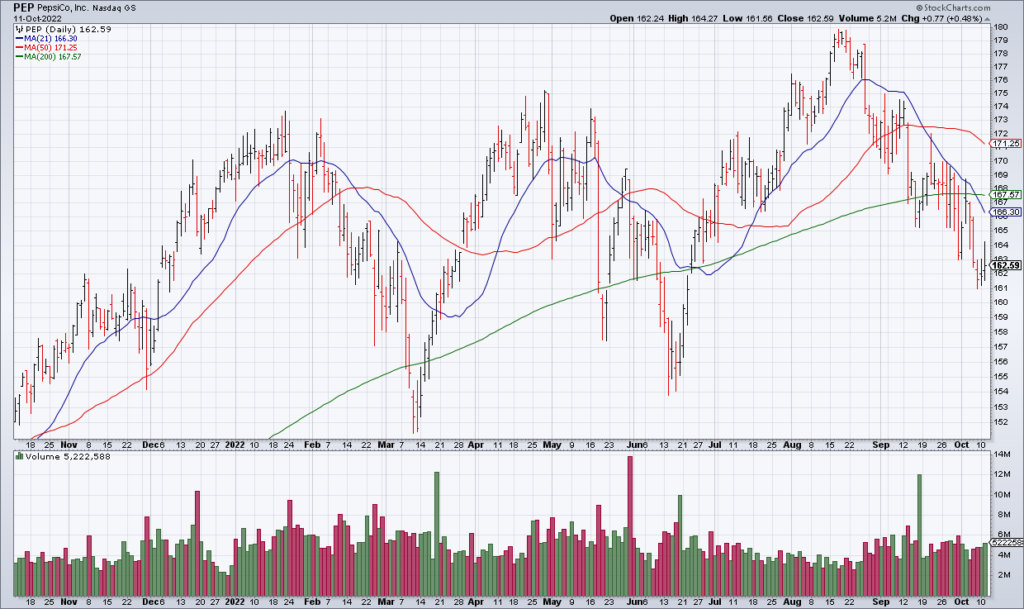

PEP: Consumer Staples Are The Way To Go

(Click on image to enlarge)

Pepsi (PEP) just reported solid 3Q22 earnings for the quarter that ended September 3. Organic Revenue at the $225 billion food and beverage behemoth increased 16% compared to a year ago. Importantly this was due to pricing power as volume actually decreased by 1.5% in Convenient Foods and increased only 3% in Beverages. Gross Margin was steady at 53.4%. PEP also marginally raised full-year Organic Revenue and Core Constant Currency EPS guidance. Shares are currently +3% in the premarket. While PEP shares are not cheap at 24x current year guidance at least you can take comfort in the fact that its business will hold up far better than more cyclical and discretionary companies during the tough times ahead.

More By This Author:

Another 75 Point Hike?!Use The Bounce To Clean Up Your Portfolio

MU: Demand Has Collapsed