Peak "Black Candlesticks" Again Offer Cause For Concern

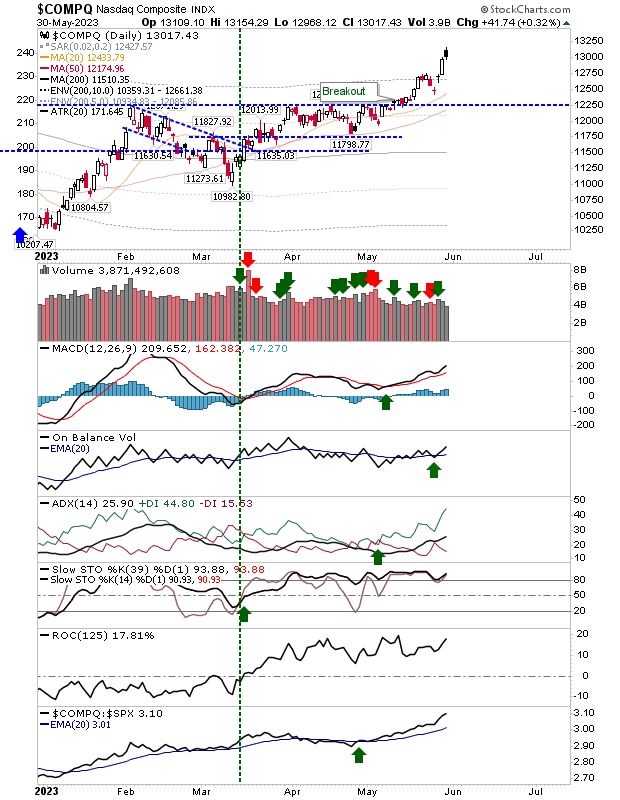

With junior traders likely to be still holding the reigns after the long weekend it was worrisome to see 'black' candlesticks pop into the charts of the Nasdaq and S&P. If there is a bullish caveat, it's that the significance of these candlesticks is reduced in the absence of a prior rally. The Nasdaq is perhaps the most vulnerable in this regard, but only because it has extended itself beyond its breakout point. However, I would expect this index to come back toward the 12,250 level over the coming days and weeks.

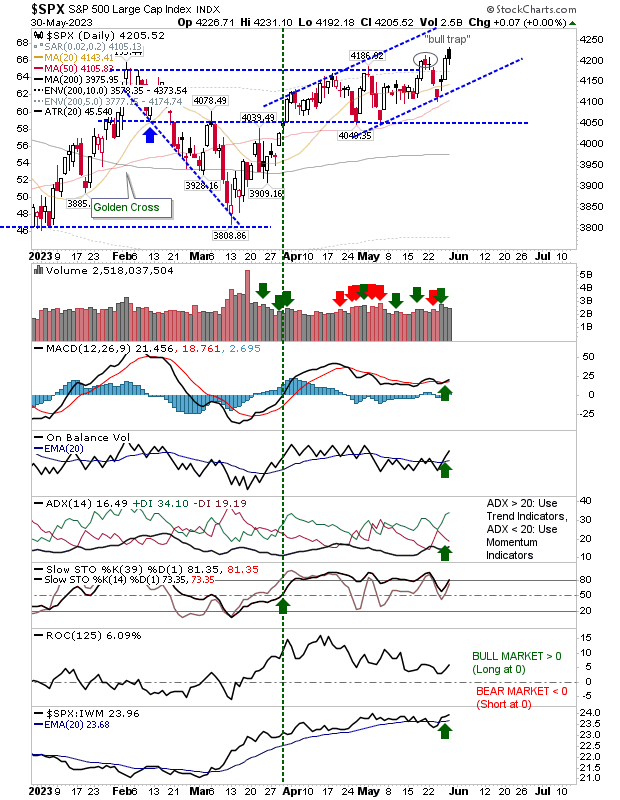

The S&P had only just challenged last week's 'bull trap', so the "black candlestick" is not one to be considered to be of menace. Realistically, this looks to be an extension of the trading range begun in April, but currently extending into a new upper range; I have redrawn a rising channel to reflect this change. Technicals are net bullish, even if the likes of the MACD and On-Balance-Volume remain vulnerable to whipsaw. The S&P is again outperforming the Russell 2000, although this could change quickly following a strong run since March.

The Russell 2000 (IWM) closed not with a "black candlestick" but a bearish cloud cover, but even this has less significance if momentum is not overbought, which is the case here. For better, or worse, the Russell 2000 has been stuck in a trading range since March and today's action hasn't changed that. The key watch is On-Balance-Volume. Because today finished down, selling volume has accelerated the losses in this indicator, moving OBV in favor of distribution.

For tomorrow, watch how the black candlesticks in the Nasdaq (and S&P to a lesser degree) play out. I would still look for lower prices in the near term, but it's important the breakouts in the Nasdaq and S&P hold out.

More By This Author:

Solid Gains Into Memorial Weekend As Semiconductors Surge

"Black Candlesticks" Are A Concern For The S&P And Nasdaq

S&P "Bull Trap"?

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more