Payroll Stocks To Watch As June's Jobs Report Comes In Strong

Image Source: Pexels

Payroll stocks stood out Thursday as June’s Jobs Report came in stronger than expected, marking the 11th consecutive month that the U.S. has exceeded expectations for positive job creation. Employers added 147,000 jobs compared to economists’ expectations of 110,000 after adding 144,000 jobs in May.

Additionally, other highlights included the unemployment rate decreasing from 4.2% to 4.1% versus expectations of 4.3%, while average hourly earnings rose 0.2% month-over-month and 3.7% year-over-year.

Paylocity Holding Corporation (PCTY - Free Report) and Dayforce (DAY - Free Report) were two of the notable standouts among payroll stocks, spiking over +2% and +1% in today’s trading session, respectively. Both land a Zacks Rank #3 (Hold), as software solution providers for Human Capital Management (HCM), including cloud-based payroll services.

Image Source: Federal Reserve Economic Data

Buy-Rated Stocks: PAYX & MMS

As a leading provider of integrated HCM solutions, Paychex (PAYX - Free Report) stock was slightly in the green today and stands out with a Zacks Rank #2 (Buy).

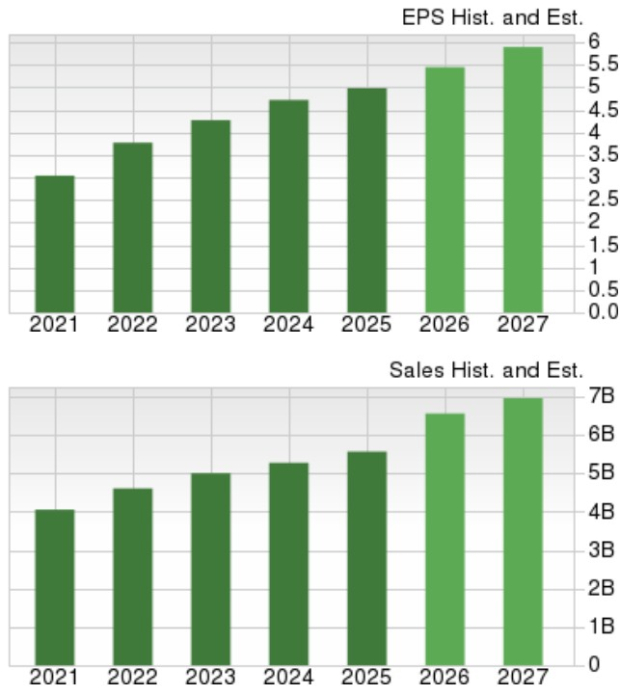

Paychex is still expected to post steady top and bottom-line growth for the foreseeable future, and EPS estimates are modestly higher in the last 30 days for fiscal 2025 and FY26. Notably, Paychex’s integrated HCM solutions extend to payroll, human resources, retirement, and insurance services.

Image Source: Zacks Investment Research

Furthermore, Maximus (MMS - Free Report) stock has remained an appealing buy-the-dip target, down 21% from its 52-week high of $93 a share, and falling half a percentage point on Thursday.

Sporting a Zacks Rank #1 (Strong Buy), Maximus has made the case for being undervalued at 11X forward earnings. Most importantly, to Maximus’s strong buy rating, FY25 EPS estimates have spiked 7% in the last 60 days with FY26 EPS estimates up 4%.

As an operator of government health and human services programs, today’s dip in Maximus stock comes as 7,000 federal government jobs were cut in June, but it's noteworthy that this could be an overreaction, as 47,000 state government jobs were added along with 19,000 social assistance jobs.

Image Source: Zacks Investment Research

Bottom Line

Despite tariff uncertainty and federal layoffs, a resilient labor market helped the stock market’s historic rebound continue on Thursday. Plus, another better-than-expected jobs report certainly makes payroll stocks intriguing and is a positive sign for the economy, with Paylocity, Dayforce, Paychex, and Maximus stock being worthy of consideration in particular.

More By This Author:

Ford Vs GM: Which Auto Stock Is The Better Investment After Revealing Q2 Sales?

These "Cheap" Internet Stocks Could Keep Soaring

Oracle Stock Hits An All-Time High Amid Increased Cloud Demand

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more