Passive Income: 3 Dividend Kings Worth A Look

Image: Bigstock

Investors love dividends, as they provide a stream of passive income and help cushion the impact of drawdowns in other positions. And when seeking income, many investors turn to the Dividend Aristocrats, a group of S&P 500 companies that have upped their dividend payouts for a minimum of 25 consecutive years.

However, a step above is the elite Dividend Kings group, which are companies that have increased their dividend payouts for a minimum of 50 consecutive years. Three members of the club – Johnson & Johnson (JNJ - Free Report), PepsiCo (PEP - Free Report), and Sysco (SYY - Free Report) – all deserve consideration from those seeing reliable dividend payouts. Let’s take a closer look at each.

Johnson & Johnson

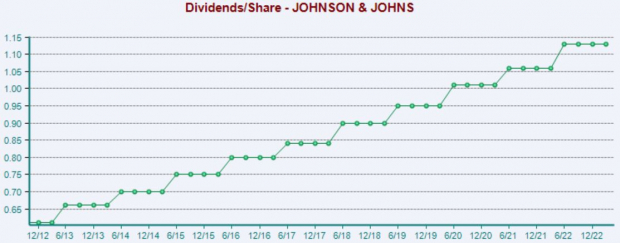

Headquartered in New Jersey, Johnson & Johnson is an American multinational corporation that develops medical devices, pharmaceuticals, and consumer packaged goods. Shares currently yield a solid 2.9% annually. This is paired with a payout ratio that has been sitting sustainably at 44% of earnings.

As we can see below, the company has shown a commitment to increasingly rewarding shareholders.

Image Source: Zacks Investment Research

In addition, shares could entice value-focused investors, with the current 15.2X forward earnings multiple sitting beneath the 16.8X five-year median and the Zacks Medical sector average.

Image Source: Zacks Investment Research

PepsiCo

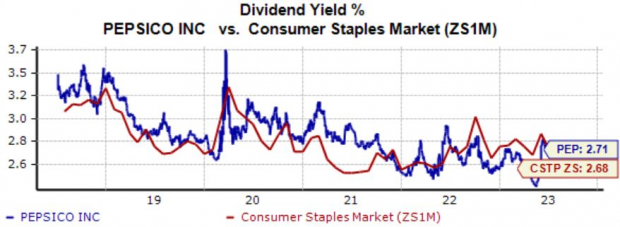

PepsiCo is an American multinational beverage, food, and snack corporation headquartered in New York. Shares yield 2.7% annually, with the company’s payout growing by an impressive 5.5% over the last five years.

Image Source: Zacks Investment Research

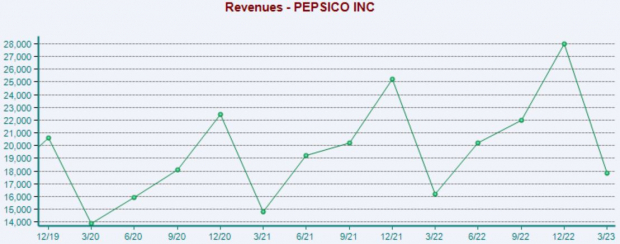

PEP is a consistent earnings outperformer, exceeding earnings and revenue estimates in five consecutive quarters. Just in its latest release, the consumer staples titan delivered a 10% EPS beat and reported revenue 4% above expectations.

As we can see below, the company’s revenue growth is somewhat-seasonal but overall reflects stability.

Image Source: Zacks Investment Research

Sysco Corp.

Sysco markets and distributes a range of food and related products primarily to the food service or food-away-from-home industry. Shares currently yield 2.6% annually, with the payout growing by a solid 7.5% over the last five years.

Image Source: Zacks Investment Research

It’s hard to ignore the company’s growth profile, further reflected by its Style Score of “B” for Growth. Estimates suggest nearly 25% earnings growth in its current fiscal year (FY23) on 12% higher revenues. And in FY24, current projections call for an additional 12% earnings growth paired with a 4% sales climb.

Image Source: Zacks Investment Research

Bottom Line

Targeting dividend-paying stocks is an excellent strategy that investors can deploy. Dividends soften the blow from drawdowns in other positions, provide more than one way to reap a return from an investment, and allow maximum returns through dividend reinvestment.

And all three stocks above – Johnson & Johnson (JNJ - Free Report), PepsiCo (PEP - Free Report), and Sysco (SYY - Free Report) – are Dividend Kings, upping their dividend payouts for a minimum of 50 consecutive years. For those seeking a reliable income stream, all three deserve serious consideration.

More By This Author:

3 Stocks Tailored Toward A Defensive Approach

3 Top Goldman Sachs Mutual Funds Worth Buying Right Now

Is A Beat In Store For Delta Air Lines In Q2 Earnings?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more