Parsing And Digesting Earnings Soup

Photo by Scott Graham on Unsplash

With modest fresh economic data on the horizon for today, just the June Existing Home Sales report, and no Fed speakers on deck, investors will be picking through quarterly earnings reports from the likes of NXP Semiconductor (NXPI), General Motors (GM), UPS (UPS), Coca-Cola (KO), Polaris Industries (PII), and Lockheed Martin (LMT). The aim will be fourfold - shareholders of reporting companies will want an update on their company’s prospects. Investors will parse the comments ahead of companies in which they own report their quarterly results and listen to manage comments about various sectors and drivers of the economy. They will also take stock of the growing number of earnings reports for S&P 500 basket companies to determine if market expectations. Lastly, in the sea of company updates they will look to better distinguish areas of strength from weakness, or at least areas which seem to be slowing down.

For example, UPS missed June quarter expectations with revenue falling 1.1% YoY to $21.82 billion, below the $22.17 billion consensus. The company’s earnings press release was sparse when it came to details on the quarter, which means we should expect some tough questions during the company’s earnings call. ATV and recreational vehicle Polaris Industries, offered far more color on its June quarter miss and reduced outlook for 2024 - “The second quarter proved challenging as our industry continued to contend with elevated interest rates, inflation, and an increasingly cautious dealer and consumer... Reducing dealer inventory is a central priority, both through intentional retail driving efforts and adjusting our production forecasts to further cut back on dealer shipments.”

The read through on Polaris’s comments are consumer demand for its products is tepid at best, more likely weak. Because ATVs and related recreational vehicles are primarily discretionary items, it’s fair to say these results support a more cautious and selective consumer. We see that benefitting our Cash Strapped Consumer strategy. Meanwhile, Quest Diagnostics (DGX), delivered a beat and raise June quarter, due in part to greater testing demand tied to our Aging of the Population strategy. Quest tossed out its efforts in automation and AI in its press release, potentially providing AI use cases the market is increasingly looking for.

As it relates to our EV Transition model, the following comment from GM CEO Mary Barra in the June quarter Letter to Shareholders caught our attention: “As excited as we are about our EVs and our early success, we are committed to disciplined volume growth, which is the key to earning positive variable profits from our portfolio in the fourth quarter, which remains our goal.” The GM earnings call will likely be peppered with questions about the company’s EV targets, especially following the one we share below from Volkswagen’s (VWAGY) Porshe about its 2030 EV target.

While GM bested Wall Street figures for the June quarter, chip company NXP Semiconductor (NXPI) saw revenue for its automotive segment fall both sequentially and year over year. That will likely lead to questions for GM, but also Ford Motor (F) and Stellantis (STLA) about inventory levels and expected production in 2H 2024. On the bright side for NXP, its Industrial & IoT revenue climbed 7% QoQ while its Communications Infrastructure segment rose 10% on that basis and its Mobile business jumped 21% YoY. All positives for our Digital Infrastructure strategy.

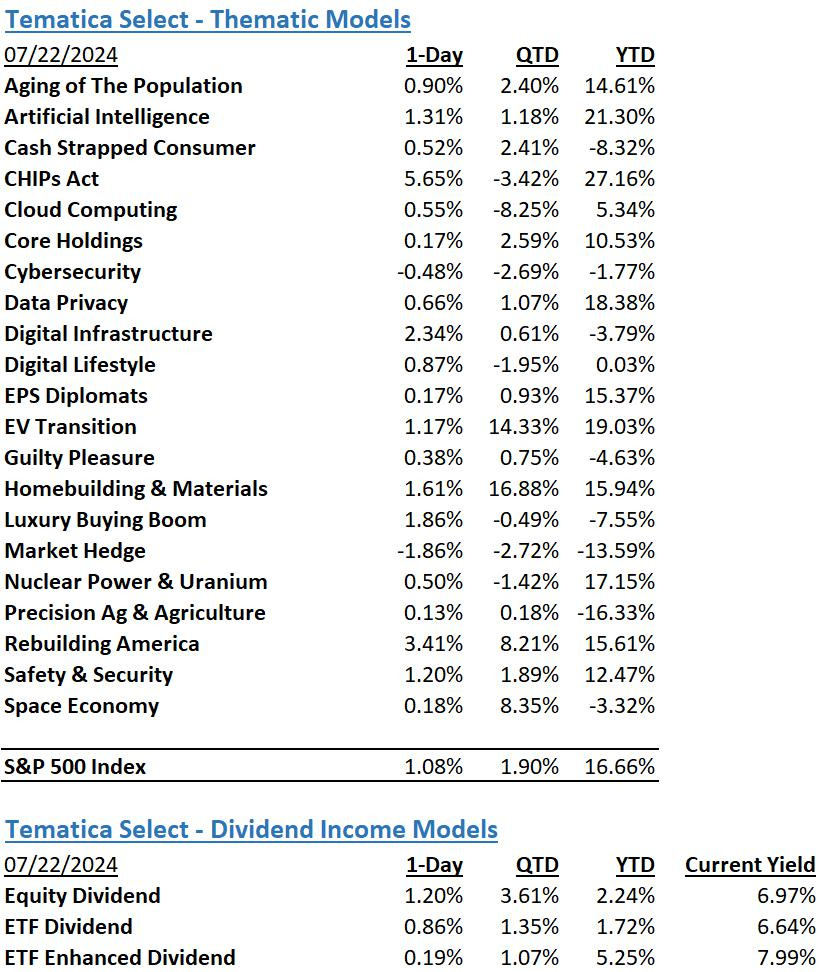

And that’s just today. With the June quarter earnings season heating up as we move through the week, and again next week, there will be a plethora of insights to help you update your investment “mosaic”, “tapestry” or whatever you might call it. Rest assured, that’s what we’ll be doing for our strategies discussed in more detail below.

More By This Author:

June CPI On Deck But Keep An Eye On The Earnings BallWhat Grade Would You Give The Fed?

Pending Home Sales, Nike Earnings & Friday PCE

Disclosure: None.