Palantir: Strong Execution And Attractive Upside Potential

Michael Vi/iStock Editorial via Getty Images

Palantir (PLTR) is in a unique position to be a leading beneficiary of the big data revolution in the years ahead. The business model is compelling, management is executing well, and the stock offers attractive upside potential over the long term.

Compelling Business Model

The expression "data is the new gold" may be a cliché at this point, but this doesn't make it any less true. According to estimates from Research and Markets, the global big data market is expected to reach $108.08 billion by 2027.

These estimates always should be taken with a grain of salt, but massive amounts of data are being generated in our physical and digital activities, and transforming such data into valuable insights and information will be a game-changer for governments and corporations.

In its origins, Palantir was providing software for organizations such as the CIA, the FBI, and the NSA in areas such as counterterrorism and financial fraud. Its software was reportedly used to find and kill Osama bin Laden and to convict Bernie Madoff. Over recent years, the company is expanding into the private sector, for example, helping big financial institutions with fraud detection, streamlining oil production and logistics, and identifying new sales opportunities across different industries.

Palantir is quite unique in terms of its security capabilities and its ability to deliver. There's no room for mistakes when it comes to providing the right tools at the right time to military personnel in the desert, the middle of the jungle, or even in a submarine.

Palantir's platform is mission-critical for both governments and corporations, and elevated switching costs provide a key source of competitive strength. Palantir's software is integrated deeply within the customer's system, and new features are added over time. It can be challenging and risky for a customer to leave Palantir for the competition, especially when considering that Palantir's technical capabilities are hard to match.

Industry-specific know-how is an additional source of competitive advantage for Palantir. As the company gains more customers over time, it also gains more insights to provide the best solutions in such an industry. The bigger the company gets, and the more experience its engineers gather in the field, the stronger it gets from a competitive perspective too.

Strong Execution

Palantir is executing strongly across the board.

- Total revenue grew 49% year-over-year to $341 million last quarter. Billings increased 248% and RPO - Remaining Performance Obligations - jumped 129%.

- Government revenue was $208 million, up 76%. US government revenue increased 83% and international government revenue increased 57%.

- Commercial segment revenue totaled $133 million, up 19% year-over-year.

One of the main growth engines for Palantir over the years ahead will be expansion into the commercial sector. It's interesting to note that the company is still growing at a remarkably strong rate in the US government sector, which shows that Palantir is still far away from reaching saturation point in its main markets right now, while growth opportunities are still extremely young.

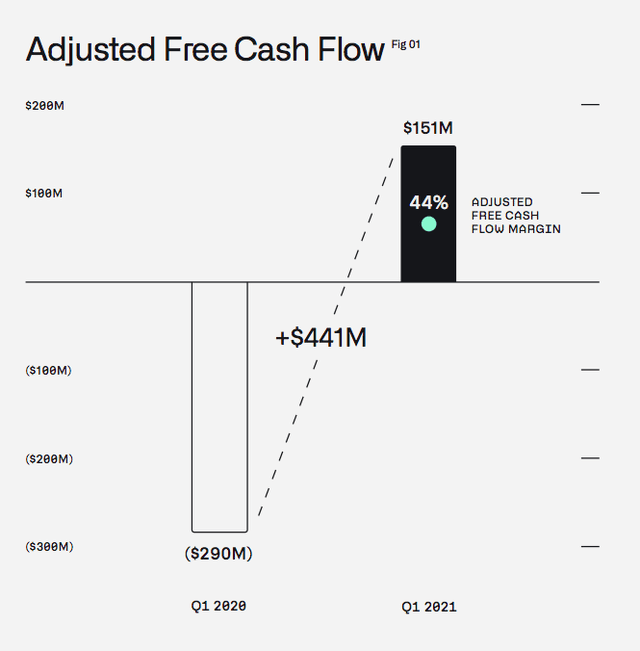

Adjusted free cash flow margin was remarkably strong, at 44% of revenue last quarter. The company is planning to expand its sales team substantially in 2021, and this is going to drive costs higher in the remainder of the year, but it's good to see Palantir making strong progress on the profitability front.

Source: Palantir

The rule of 40 in the software industry is based on the idea that revenue growth plus free cash flow margin should be above 40% for a strong company. In this particular case, 49% revenue growth plus 44% adjusted cash flow margin equals 93%, quite an impressive metric.

Valuation And Fundamental Momentum

Palantir stock is trading at a forward price to sales ratio of 34 times revenue expectations of 2021 and 26 times revenue estimates for 2022. This is not a cheap valuation by any means, but Palantir has the capacity to grow into its valuation and deliver attractive returns for investors in the years ahead.

Management said in the most recent earnings press conference that Palantir is positioned to sustain revenue growth above 30% in the next four years, which probably means that the company believes that it can actually exceed those numbers. Looking at the long-term market opportunity, it wouldn't surprise me to see Palantir beating that 30% guidance and still delivering vigorous growth after the five-year target is achieved and exceeded.

As a reference, many of the most successful companies in cybersecurity, such as CrowdStrike (CRWD), trade at forwarding price to sales ratios of more than 40, although these companies are growing at much faster rates than Palantir and are among the best and most expensive in the sector. A more mature business such as Adobe (ADBE), which is growing revenue at 22% this year, trades at a price to sales ratio of around 18.

Palantir is priced for demanding growth expectations, and the valuation does not leave any room for disappointment. But valuation is not excessive in comparative terms when considering growth potential if management keeps executing well and outperforming expectations. This last part, outperforming expectations, is a big piece of the puzzle in terms of assessing return potential.

Strong growth is good, but growth rates consistently above expectations can be even more important. Stock prices reflect a particular set of expectations about the company's future. When a company can outperform those expectations, this typically means that the stock price needs to move higher in order to reflect higher expectations.

In simple terms, if the company's future sales and cash flows are going to be higher than currently anticipated, this ultimately means that the stock is more attractively valued than what valuation ratios are indicating.

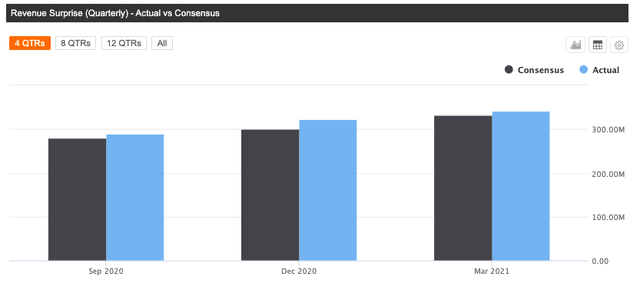

Palantir has reported three quarters as a public company, and it delivered revenue above Wall Street expectations in each of those three quarters. The company's track record as a public business is brief but flawless.

Source: Seeking Alpha

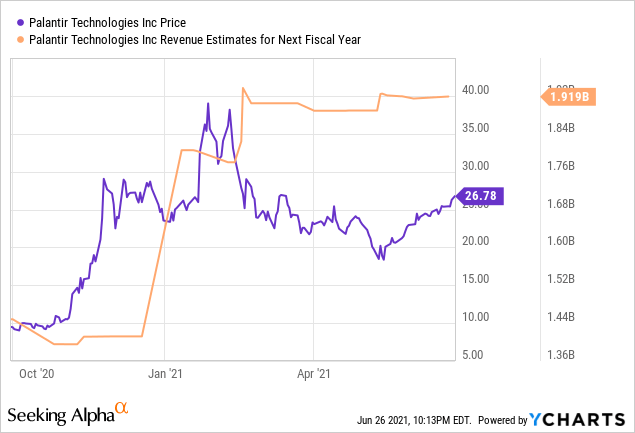

Perhaps more important, consistent execution and a strong outlook have driven increases in forward-looking expectations for Palantir. Revenue estimates for next year have increased from less than $1.45 billion to more than $1.9 billion in a few months.

Data by YCharts

In the short term, market conditions have a huge impact on stock prices, so performance will mostly depend on how growth stocks - broadly speaking - are moving. Over the long term, however, if Palantir can consistently keep outperforming expectations and driving increased expectations about future revenue growth, this should provide a powerful upside fuel for the stock price over multiple years.

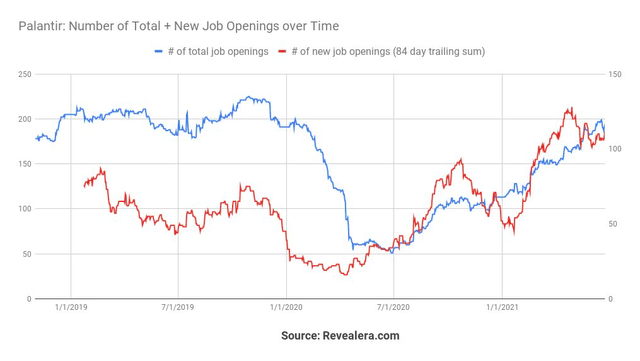

This chart from Reveleara.com shows job openings at Palantir over the past few years. There was a slowdown during the worst part of the pandemic, but now the company is back at full speed. This bodes well in terms of assessing fundamental momentum over the coming quarters.

Source: Revealera.com

The company still has a lot of room for growth. Palantir has only a handful of Fortune 500 customers and less than one-tenth of a percent of annual defense spending in the U.S.

Palantir is aggressively investing in the commercial side of the business to drive accelerating sales growth. The company plans to increase the sales count in the triple digits this year, and it already hired 50 new sales employees in the first quarter.

Since the beginning of February, qualified commercial opportunities in the U.S. and the U.K. are up 2.5 times, and active commercial pilots across the business have more than doubled. Channel expansion is another key growth engine for Palantir, the partnership with IBM (IBM) was announced last quarter, and the company booked its first customer within 16 days of bringing the product to market.

The following quote from the conference call is quite encouraging in that regard:

I mentioned earlier the growth of our customers and pilots. Our sales force combined with outreach and events are generating more high-quality opportunities. What's more, customers are coming to us with a much deeper understanding of our products and the value they unlock, to the point where the first meeting today really now feels like the fourth or fifth meeting from a year ago. The flywheel is turning faster.

Palantir is priced for demanding growth, no doubt about that. However, the company also is outperforming expectations, and fundamental momentum is indicating more upside potential for Palantir stock going forward. Palantir has massive room for expansion and management is executing at a high level.

Disclosure: I am/we are long PLTR, CRWD.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business ...

more