PagerDuty Could Get Sacked When Lockup Expires

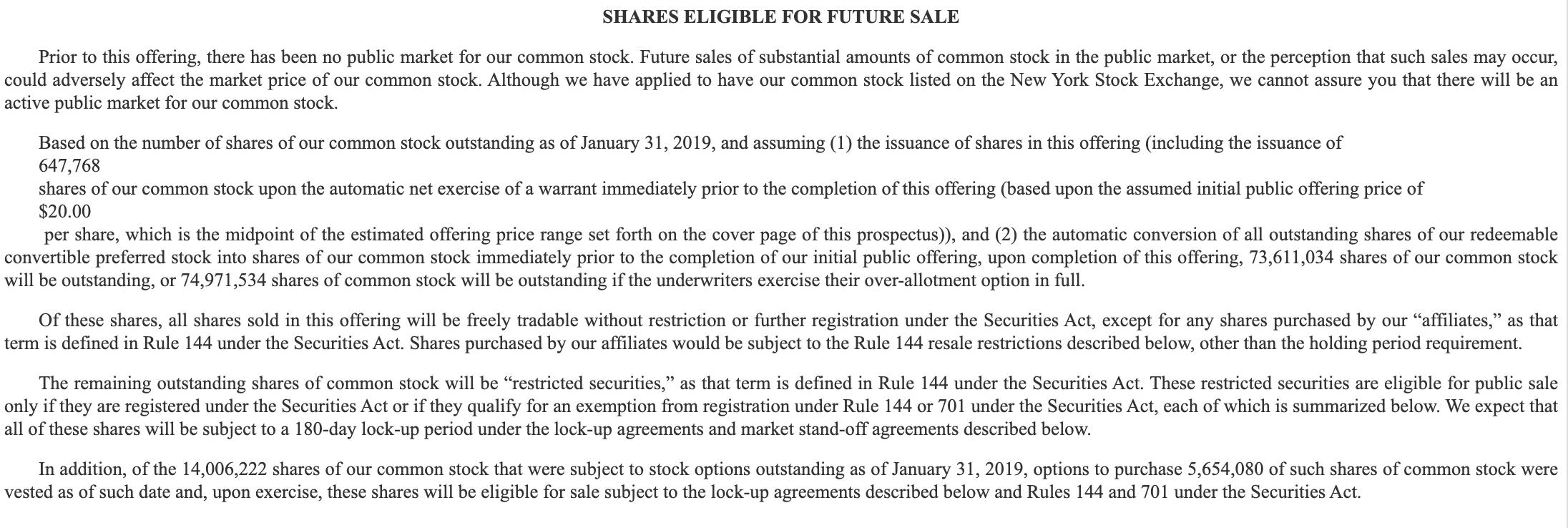

When the IPO lockup period ends for PagerDuty (PD) on October 8th, its pre-IPO shareholders and company insiders will have the opportunity to sell large blocks of currently-restricted stock. Currently, more than 64 million shares of PD are subject to the IPO lockup. The number of currently-restricted shares dwarfs the 9.07 million shares offered in the IPO.

(Click on image to enlarge)

(Source: S-1/A)

We expect that PD's pre-IPO shareholders and company insiders will be eager to cash in on some of their gains. PD has a return of 22% from IPO. Any significant sales could flood the secondary market and cause a sharp, short-term decline in share price. Aggressive, risk-tolerant investors should consider shorting shares of PD ahead of the IPO lockup expiration.

Note: PagerDuty shares may be hard to borrow and difficult to short. We suggest that experienced investors consider other opportunities for short exposure such as options.

Business Overview: Provider of Incident Management Technology

PagerDuty provides incident management technology through its proprietary electronic platform. They offer 24/7 digital services that identify potential issues and opportunities using real-time data. The company began by offering automation of on-call rotations and grew into the current platform that enables companies of all sizes manage their digital operations more efficiently.

(Source: S-1/A)

The company has more than 300 integrations that allow them to gather and analyze data from many popular technologies including Slack, Salesforce, ServiceNow, Atlassian, Splunk, New Relic, HashiCorp, AWS, and Datadog. Their services include end-to-end digital operations such as gathering digital data, analyzing that data, identifying threats and opportunities, responding to and engaging teams, and learning from actions. In addition, PagerDuty offers a modern incident response, event intelligence, analytics, business visibility, and on-call management.

Its clients include IBM Cloud, Allstate, Yelp, Twilio, Shopify, Pantheon, Nelnet, Nextdoor, Gap, Instacart, SAP Concur, and Conde Nast.

The company was founded in 2009 in Toronto, Ontario. It currently has approximately 525 employees and keeps its headquarters in San Francisco, California.

The business overview was sourced from the firm's S-1/A and website.

Financial Highlights

PagerDuty reported second-quarter financial highlights for the period ending July 31, 2019:

- Revenue reached $40.4 million for an increase of 45 %.

- GAAP gross margin was 84.9%.

- GAAP operating loss was $14.4 million totaling 35.6% of revenue,

- GAAP net loss was $12.6 million versus $12.6 million for the same period last year.

- Net cash from operations was $2.2 million totaling 5.3% of revenue

- Free cash flow was positive totaling 3.3% of revenue or $1.3 million

- Cash and Cash Equivalents were $341.1 million as of July 31, 2019.

Financial Highlights were sourced from the company's website.

Management

CEO and Director Jennifer Tejada has served in her positions since July 2016. Her previous experience comes from senior positions at Keynote Systems and serving on the board of Estee Lauder Companies Inc. She earned a B.S. from the University of Michigan.

CFO Howard Wilson has served in his position since September 2018. He served as acting CFO from December 2017 to September 2018. His previous experience comes from senior financial positions at The BluePrint Lab and Dynatrace LLC. He earned a B.Sc. in Information Systems and Psychology from the University of South Africa.

Management biographies were sourced from the company's S-1/A.

Competition: AT&T, BAE and DXC Technologies

Currently, the top providers of incident response management services include AT&T (T), BAE, BT, DXC Technologies (DXC), IBM (IBM), NTT, Secureworks (SCWX), Symantec (SYMC), Trustwave, Verizon (VZ), OpsGenie, and VictorOps.

Early Market Performance

The underwriters priced the IPO at $24 per share. Its expected price range was originally $21 to $23. The stock closed on the first day of trading at $38.25 for a first-day return of 59.4%. The stock currently has a return from IPO of 22%.

Conclusion: Short PD Ahead of IPO Lockup Expiration

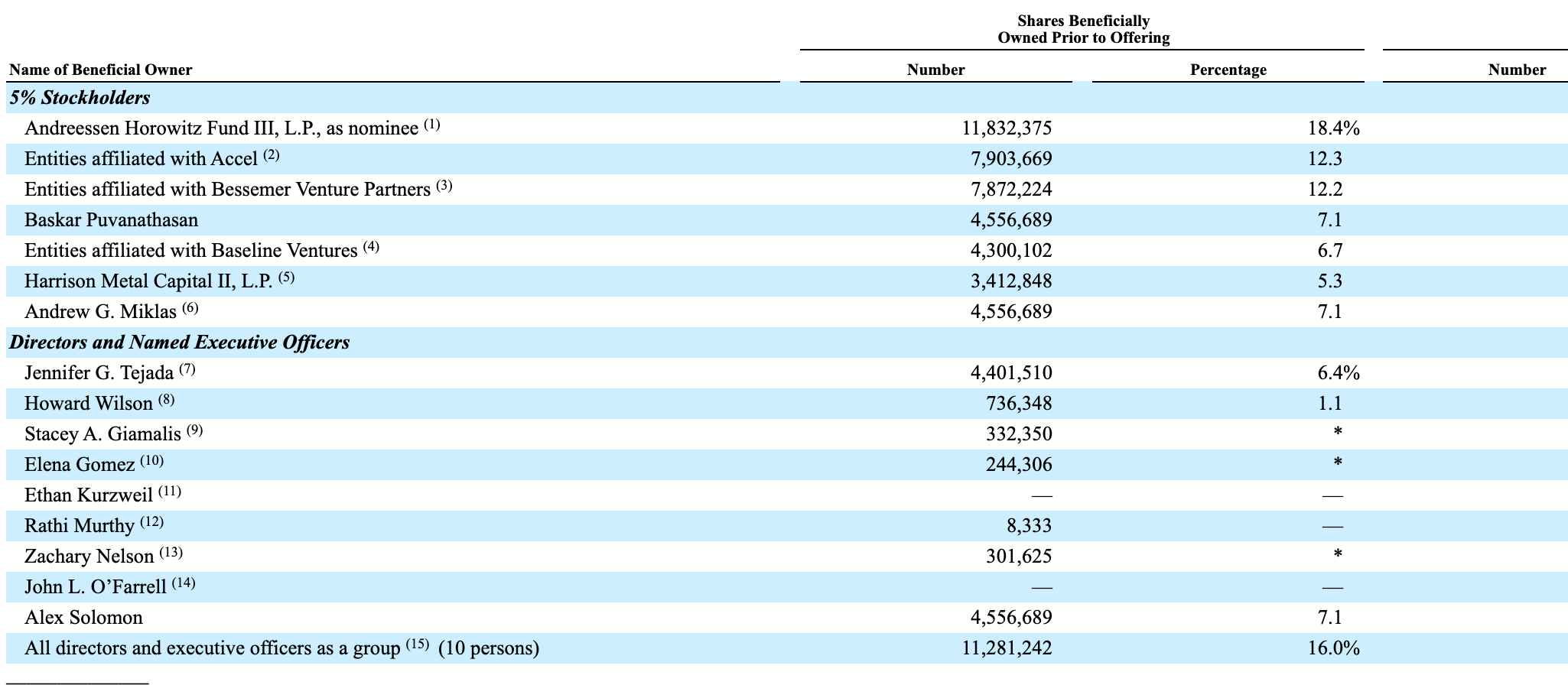

When the PagerDuty IPO lockup expires on October 8th, company insiders and pre-IPO shareholders will be able to sell more than 64 million shares of currently-restricted stock. The number of currently-restricted shares dwarfs the 9.7 million shares of PD offered in the IPO.

This group of pre-IPO shareholders and company insiders includes numerous executives and VC firms.

(Click on image to enlarge)

(Source: S-1/A)

Any significant sales of currently-restricted stock when the lockup expires could flood the secondary market and send PD's share price sharply lower in the short-term. Aggressive, risk-tolerant investors should consider shorting shares of PD ahead of the company's October 8th lockup expiration. Interested investors should cover short positions during the October 9th and October 10th trading sessions.

Disclosure: I am/we are short PD.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any ...

more