Oxford Lane Capital: 16% Yield But A Troubling History Of Dividend Cuts

Investors that are interested in generating current income have many choices. Dividend stocks, however, tend to be among the favorites due to their meaningful levels of current income, as well as generally rising payouts over time.

Most dividend stocks, however, pay their dividends quarterly. Some stocks set themselves apart by paying their dividends monthly, which allows for more current income and faster compounding of wealth for shareholders.

There are currently only 39 stocks that pay their dividends monthly. One stock that fits this description is Oxford Lane Capital Corporation (OXLC), a stock that offers monthly dividend payments and an annualized yield of 16%.

You can see the full list of stocks with 5%+ dividend yields here.

In this article, we’ll examine Oxford Lane’s business model, growth prospects, and whether its hefty 16% distribution is sustainable moving forward.

Business Overview

Oxford Lane is a publicly-traded registered closed-end management investment company that was founded in 2011. The company seeks to maximize risk-adjusted total returns by investing in debt and equity tranches of collateralized loan obligation vehicles, or CLOs. A CLO is a form of securitization where payments from multiple business loans are pooled together and passed on to different classes of owners in various tranches.

This type of investment can include warehouse facilities, which are financing instruments intended to aggregate loans that may be used to form the basis of a CLO vehicle. Oxford Lane has built its portfolio to exclude real estate, mortgages, or consumer-based debt in order to reduce volatility in its results.

While that may sound complicated, Oxford Lane essentially takes the capital it raises via various sources, including equity, debt, and preferred stock, and lends it via purchasing tranches in CLOs. The spread it earns over and above the cost of financing is how it generates income, which it then uses to pay the distribution. The stock currently trades with a $480 million market capitalization, so Oxford Lane is certainly a smaller stock.

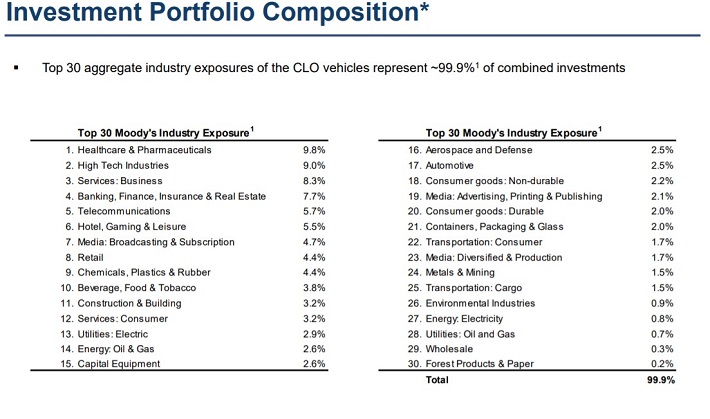

(Click on image to enlarge)

Source: Investor presentation, page 10

The company’s portfolio consists of many different industries that Oxford Lane has assessed as having favorable characteristics for payment on the various vehicles it owns. Healthcare and Pharmaceuticals makes up 9.8% of the portfolio, but no industry has a higher concentration than that, so Oxford Lane’s diversification is very good.

This strong spreading out of risk helps Oxford Lane smooth out its investment results over time and we think this is a sizable plus for holders of the stock.

Not only is the portfolio diversified, but it is highly profitable as well.

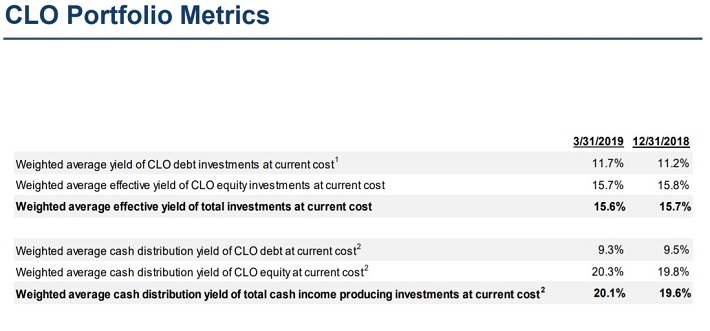

(Click on image to enlarge)

Source: Investor presentation, page 9

These metrics show Oxford Lane’s portfolio characteristics as of the end of 2018 and the end of March 2019, respectively. The company’s weighted average effective yield of total investments is nearly 16% while the weighted average cash distribution yield of income-producing investments is in excess of 20%.

This is due to the high concentration of CLO equity investments as the company’s CLO debt pays just under half that amount, on average. These extraordinarily high yields allow Oxford Lane to generate significant income despite its relatively high cost of funding.

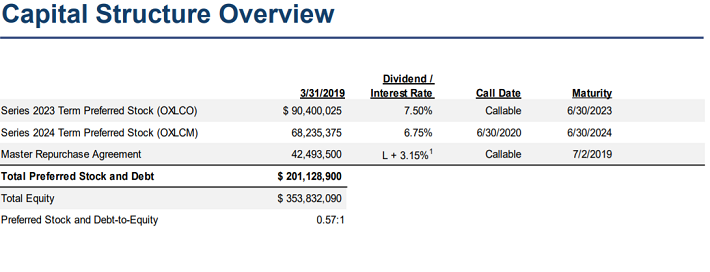

(Click on image to enlarge)

Source: Investor presentation, page 11

The above slide shows what Oxford Lane’s capital structure looks like today, including two preferred stock issues as well as a repurchase agreement, which is a form of debt. The company’s total capitalization is around $550 million, with about $200 million of that coming from preferred stock and debt. The company pays about 7% on a weighted average basis for its preferred stock, while the repurchase agreement floats at LIBOR plus 3.15%, which is about 5.6% today in total. The rest of its capitalization is made up of equity that has been issued over the years.

Oxford Lane’s most recent earnings report was the end of its fiscal year, and results were good. Net asset value was up quarter-over-quarter from $7.56 to $8.32 as core net investment income, or NII, came in at $0.53 per share. Annualizing that level of NII is good for a run rate of $2.12, which is much stronger than what Oxford Lane has been able to generate in any full year since its founding, so Q4 was quite good.

Oxford Lane’s equity portfolio recorded $22 million in NII during the quarter, while the much smaller debt portfolio generated just $1.5 million in NII. In addition, Oxford Lane recorded almost $30 million in unrealized appreciation on its investments. Quarterly results can certainly be volatile given the nature of the company’s investments, but there was a lot for investors to like in the company’s most recent report.

Oxford Lane’s weighted average yield of its debt portfolio is 11.7% while its equity portfolio is yielding 15.7%.

We see $1.40 in NII for the year that has just started given that this level of income has been pretty constant since the company was formed.

We don’t see any particular catalysts for growth as the company pays out nearly all of its NII in distributions to shareholders, so the asset base is generally stable on a per-share basis, as are the yields on the portfolio.

Growth Prospects

We don’t see a lot of growth ahead for Oxford given some of the concerns raised above. The company earns its income by borrowing at relatively high-interest rates and then purchasing CLOs at better interest rates.

Margins and profitability are therefore dependent upon scale but since the company pays out most or all of its earnings each year, the only way to grow is to issue more equity or more debt, as capital generation through earnings is removed as an option.

Oxford’s common equity share count has ballooned from 2.5 million shares in 2011 to nearly 50 million shares today. NII has grown on a dollar basis thanks to hundreds of millions of dollars in new investment activity, but on a per-share basis, it is roughly flat over time. Given this dilution and other factors, we see -2% annual NII growth over time.

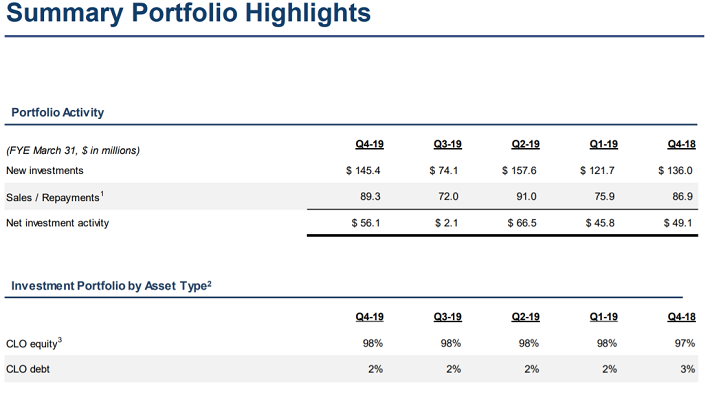

(Click on image to enlarge)

Source: Investor presentation, page 4

This point is illustrated in the above chart as the company has produced ~$220 million in net new investment activity in the past five quarters alone, but NII continues to be largely flat. An ever-rising share count crimps per-share NII growth, which is what investors care about. In short, we don’t see any catalysts for this to change and think that NII-per-share will have a difficult time moving higher.

Dividend Analysis

The dividend is clearly the main draw for investors with Oxford Lane given that its stated purpose is to pay as much as it can to shareholders with the income it generates. The distribution used to exceed NII by a huge margin, but as Oxford Lane has pulled back on the dividend in recent years, it is much closer to NII, increasing its sustainability.

The monthly payout has been 13.5 cents since the beginning of 2018 when Oxford Lane switched from a quarterly distribution schedule to monthly. The company has already announced payouts through September at the same rate, so we see the distribution as flat year-over-year in 2019 at $1.62 per share.

This is still in excess of NII, which we see at $1.40 per share, but Oxford has proven over time it will pay the distribution with a combination of NII and other sources, such as equity or debt. We expect this pattern to continue.

Over time, however, we see a payout of $1.20 as more sustainable given that NII continues to drift lower on a per-share basis. In five years, we expect the monthly distribution to fall to 10 cents, which will still produce a very strong yield, just not as high as it is today at ~16%.

Oxford Lane’s dividend, therefore, certainly cannot be rated as safe given that it has been cut several times just since 2014. However, the company’s fairly reliable NII generation means Oxford Lane will always sport a high yield, even if the distribution is cut, as we are expecting.

Final Thoughts

While Oxford Lane’s distribution is highly attractive today – given its monthly payout and 16% yield – we see meaningful risks. The company’s share count continues to balloon over time, crimping per-share NII and making the dividend ever more expensive.

In addition, its current payout is unsustainable at its projected rate of NII generation, so we see further dividend cuts coming. The 16% yield may be enough to satisfy investors that are willing to take the risk of holding Oxford Lane, but for those that are looking for a safer investment, it may be best to avoid Oxford Lane stock.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more

the yield alone tells you it's a value trap.