Own Rising Growth Stocks Like Facebook

The Broad Market Index was down 0.37% last week and 72% of stocks outperformed the index.

The financial statement update for the second quarter started in earnest last week with 300 companies reporting. With the recent SEC filing update our OTOS database is now so far 23% complete and the volume of SEC filings will increase in the coming weeks.

It is still too early to calculate a market level result but as we might have expected given last year’s low virus-impacted comparison - the improvements look dramatic so stay tuned for more updates!

Federal Reserve & T-Bonds

It is this "low base effect" that the federal reserve is using to support the "inflation is temporary" argument that justifies an ever more dangerously ultra-loose money policy.

Last month, the long Treasury bond portfolio was up 3.7% and the yield on the 30-year U.S. treasury bond dropped from 2.25% to 1.9% in the same month that measured inflation rose from 5% to 5.4% up from 1.4% in January when long treasury bonds yielded 1.9%.

Clearly, no rational investor would buy (or hold) a long treasury bond and it is only the vast ongoing purchases of securities by the Federal Reserve that keeps rates this low. Markets flush with liquidity have been important to minimizing the damage to company finances that the virus could have been.

Cash On Demand

Our warning last year that companies were financially vulnerable and that widespread insolvency would bring on many bankruptcies has, so far, been a smaller problem as access to liquid capital markets provided even insolvent companies with the cash needed to avoid Chapter 11.

Hyper-Inflated Real Estate Market

Ultra-loose money policy and unsustainably low-interest rates have hyper-inflated the real estate market. In US cyclical history we see big-ticket consumer purchases (autos and housing) lead an industrial growth cycle at both the trough and the peak of the cycle.

The strong (and hyper privileged) US real estate market is critical to the sustained industrial acceleration that is underway now.

Take advantage of the important opportunities created currently by depressed share prices among industrial companies and improve the acceleration attributes of your portfolio.

The best hope of preserving our capital in the difficult years to come is to own rising growth companies like Facebook.

Facebook $356.300 BUY This Rich Company Getting Better

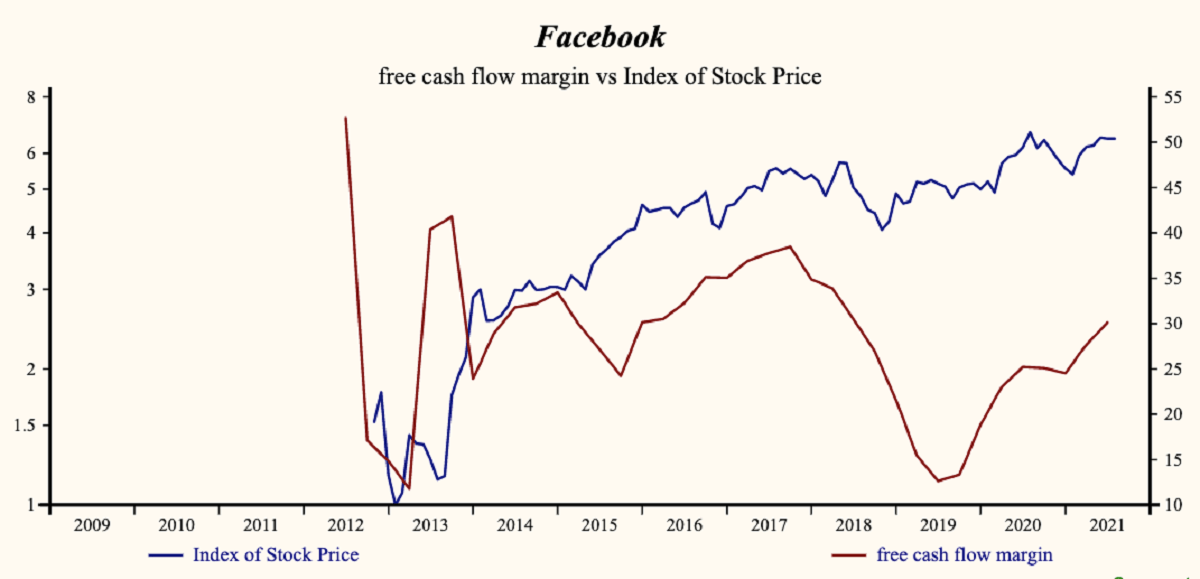

Facebook, Inc. (Nasdaq: FB) has been an exceptionally profitable company with an inconsistently high cash return on total capital of 23.3% on average over the past 9 years. Over the long term, the shares of Facebook have advanced by 547% relative to the broad market index.

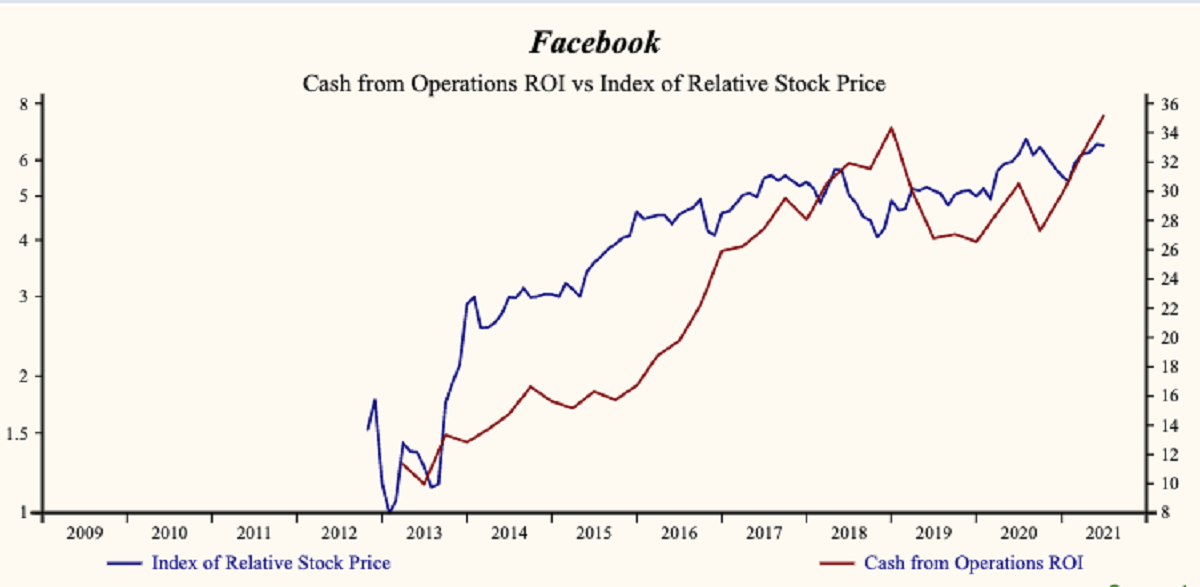

The shares have been very highly correlated with trends in Growth Factors. A dominant factor in the Growth group is Cash Flow form Operations (ROI) which has been 87% correlated with the share price.

Sales Growth Up Again

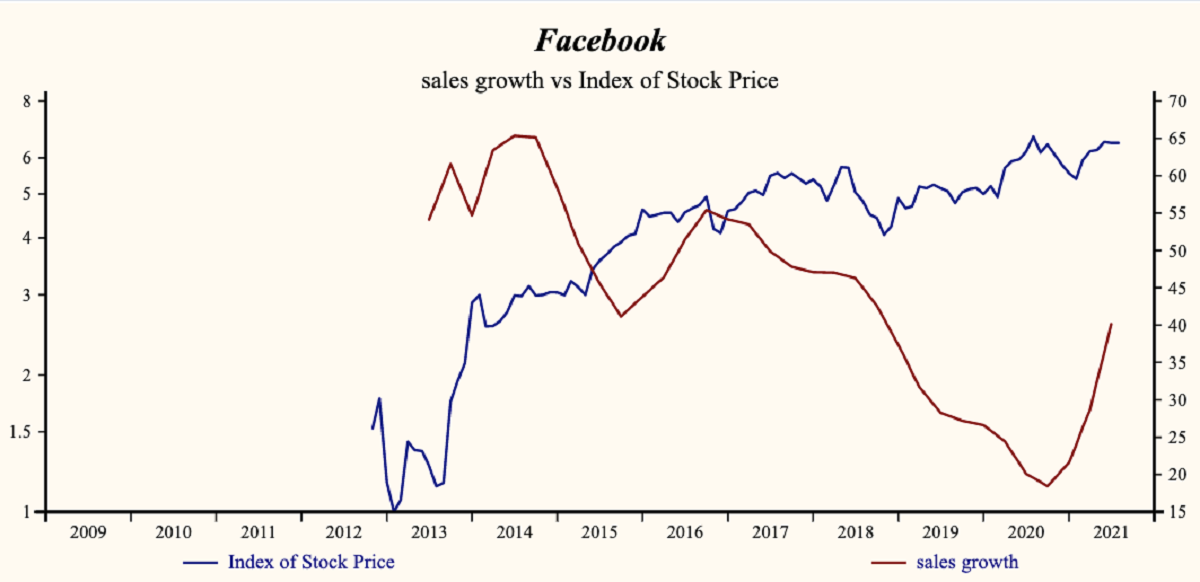

Currently, sales growth is 40.1% which continues to advance strongly from its 2020 low. Receivable turnover has remained low and steady reflecting a strong quality of sales.

Margin Pressure Reverses

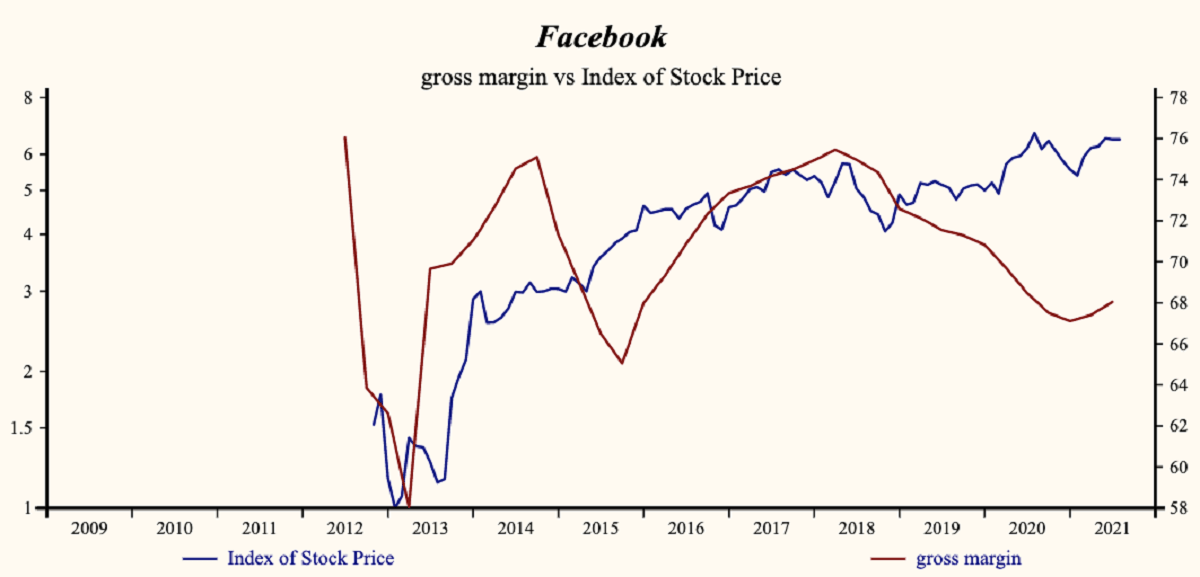

The company is now recording a low and rising gross profit margin. This is the second consecutive increase in the gross margin thereby putting an end to persistent decline.

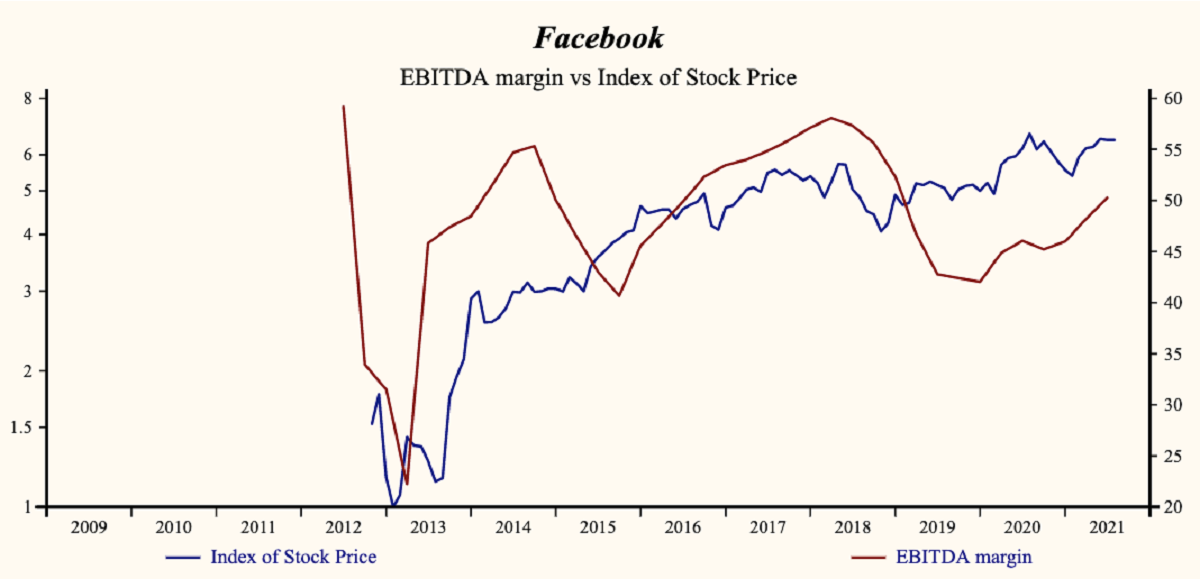

Sales, General & Administrative (SG&A) expenses are low in the record of the company and is also falling. That implies that the company has limited capability to accelerate EBITD relative to sales with lower costs. SG&A expenses are falling at a more rapid rate than the gross margin producing a rising EBITD profit margin.

Bottom Line Is Stable Now

This is a poor-quality growth trend to the extent that lower costs can insulate the bottom line from top-line weakness for only a short time. The signs of margin pressure can be seen in cash flow from operations (ROI) as it remains high and rising but free cash flow growth on the other hand is slowing down putting its stability in question.

Facebook Shares At A Discount?

More recently, the shares of Facebook have advanced by 53% since the November 2018 low. The shares are now trading at the upper-end of the volatility range in a 32-month rising relative share price trend. Any correction in the share price would provide a very good opportunity to buy the shares of this evidently accelerating company.

Despite the recently advancing share price this provides a good opportunity to buy the shares of this evidently accelerating company.

Look for MoneyTrees with longer trunks, greener globes, and trimmer, golden pots.

Investors do not wait. Act now!

(Click on image to enlarge)

Disclaimer: This article is not an investment recommendation, Please see our disclaimer - Get our 10 ...

more