Otis Vs. Carrier: Which Spin-Off To Buy?

Recently, United Technologies (UTX) broke up into three independent public companies. First, it spun off its two non-aerospace divisions: Otis Worldwide Corp (OTIS) and Carrier Corporation (CARR). Then, it merged the remaining aerospace company with Raytheon (RTX) to create an aerospace/defense giant.

Thanks to United Technologies’ dividend history, Otis, Carrier, and Raytheon are all considered Dividend Aristocrats. Today, we will provide an overview of both dividend paying spin-offs, and share which stock is more attractive today. Let’s start with Otis.

Otis Business Overview

Otis is the world’s largest elevator and escalator manufacturing, installation, and service company. Otis now designs, manufactures, sells, and installs a wide range of passenger and freight elevators, as well as escalators and moving walkways.

In addition to new equipment, Otis provides modernization products to upgrade elevators and escalators, as well as maintenance and repair services for both its products and those of other manufacturers. Otis serves customers in the commercial, residential, and infrastructure property sectors around the world.

Otis revenue is divided 43% / 57% between their two segments: New Equipment and Service. However, 80% of profit comes from Service. As a result, Otis’ business is relatively defensive because elevators and escalators need to be serviced in both good times and in bad. For example, during the Great Financial Crisis, Otis experienced a 21% sales decline, yet operating income only fell by 1%.

Otis Strategy

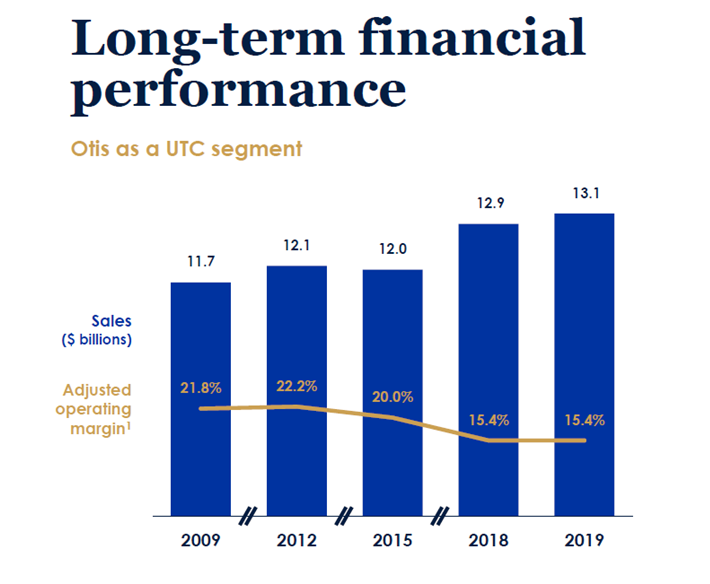

Over the last ten years, revenue has grown modestly, but operating margins have declined.

Recently, operating margins have stabilized and remain ~100bps higher than peers. Management expects modest margin expansion going forward. On the revenue front, Otis’ primary goal is to accelerate growth through four primary initiatives.

The first initiative is to sustain new equipment sales growth. Since 2014, Otis has increased its number of patents by over 200%. It has also grown market share by 1.5%. Both of these show evidence of the commitment to new equipment growth.

The second strategic imperative is to accelerate service portfolio growth. Otis views itself as essentially a service company. As discussed above, revenue is more or less equally divided between equipment sales and services, but almost 80% of operating profits come from service. The life cycle of an elevator is about 25 years. Profit from service is about 2.5 times the profit from the initial sale.

Otis enjoys a 94% retention rate on service contracts, and currently provides service for about 2 million units. The company has enjoyed a 4% maintenance unit portfolio growth since 2016, and 3% productivity improvement since that same year. Management expects these trends to continue.

The third strategic initiative is to advance digitization in the company. More than 28,000 devices have been deployed so far with digital capability. There are 10 productivity and customer-facing apps that are now available. Service technicians are now deployed with iPhones that have substantial productivity enhancing capabilities. For example, one app allows the technicians to evaluate the functionality of an elevator very quickly by placing sensors in the elevator. Otis is developing the next generation of connected elevators and escalators using the latest Internet of Things (‘‘IoT’’) technology.

The fourth strategic initiative is to focus and empower the organization. Otis keeps an employee empowerment score and has seen a 5 point rise in recent years. The average tenure of their 33,000 service technicians is now 11 years.

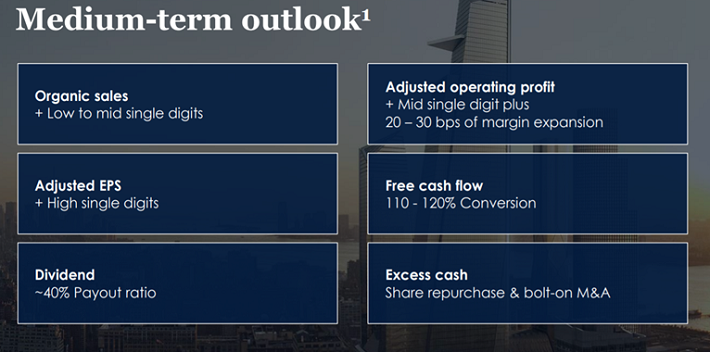

Management believes these strategic initiatives will enable Otis to grow sales over time at a low to mid single digit rate, while expanding operating margins by 20-30 bps per year.

Otis Valuation and Fair Value

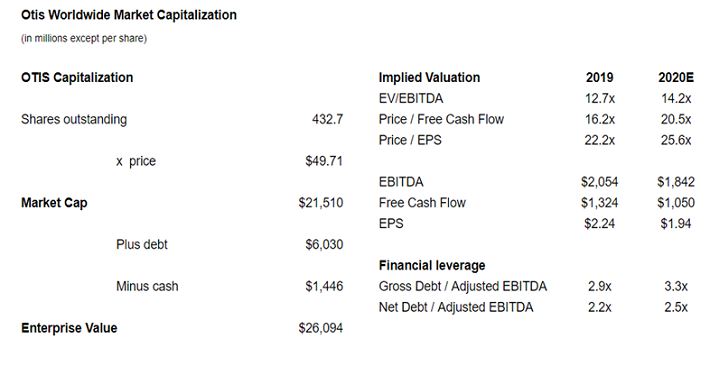

Otis now trades at $49.70 per share, implying a market cap of $21.5 billion, and enterprise value of $26.0 billion. Otis will pay ~40% of its earnings out as a dividend. The company hasn’t declared its first dividend, but I expect the annual dividend to be $0.90, which corresponds to a 1.8% yield.

At this valuation, Otis is trading at an EV/ 2019 EBITDA multiple of 12.7x, and a price to free cash flow multiple of 16.2x.

Otis has two publicly traded peers: KONE (KNYJY) and Schindler (SHLRF). KONE is a Finland based elevator company, while the Schindler Group is a Swiss company that also specializes in elevators. The two are well established large cap companies very similar to Otis, although Otis currently has the biggest worldwide market share. Both have revenue and operating earnings growth that is somewhat better than Otis, with KONE the better of the three, and with virtually no debt and a solid equity base.

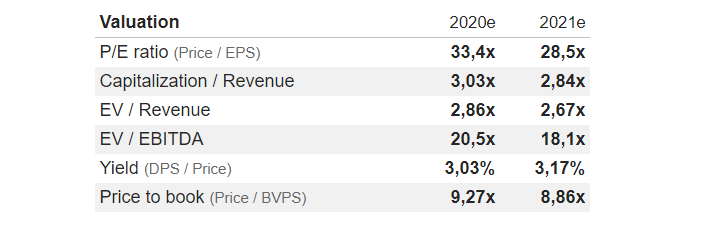

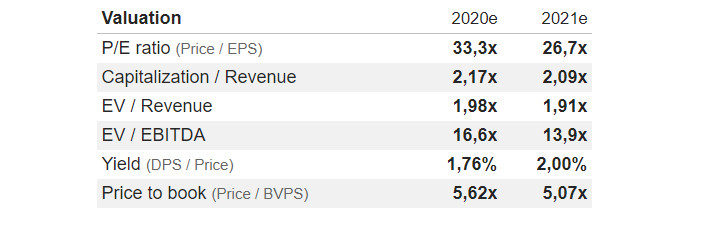

Versus its public peers (KONE and Schindler), it appears that Otis is trading at a slight discount. KONE trades at 33.4x 2020 earnings, and at an EV/2020 EBITDA multiple of 18.1x.

Schindler trades at 33.3x 2020 earnings, and at an EV/2020 EBITDA multiple of 16.6x.

Nonetheless, a slight discount may be warranted given that Otis has historically grown slower than its peers.

On a discounted cash flow basis, Otis is worth ~$23 billion ($54 per share), assuming 4-5% revenue growth, 6-8% net income growth for five years, and 2.5% income and cash flow growth after five years. Based on comparable company analysis and discounted cash flow analysis, Otis appears fairly valued.

Carrier Corporation Overview

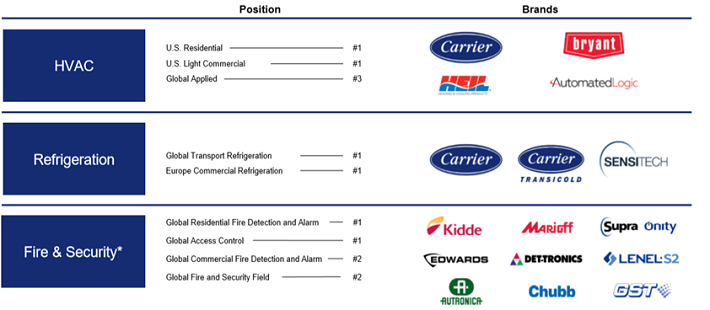

Carrier is organized into three business segments:

- HVAC.

- Refrigeration.

- Fire & Security.

The company prides itself on its history of innovation, beginning with its founders — Willis Carrier, who designed the world’s first modern air conditioning system; Robert Edwards, who patented the first electric alarm bell; and Walter Kidde, who produced the first integrated smoke detection and carbon dioxide extinguishing system for use onboard ships. In the last two years, Carrier has introduced over 200 new products.

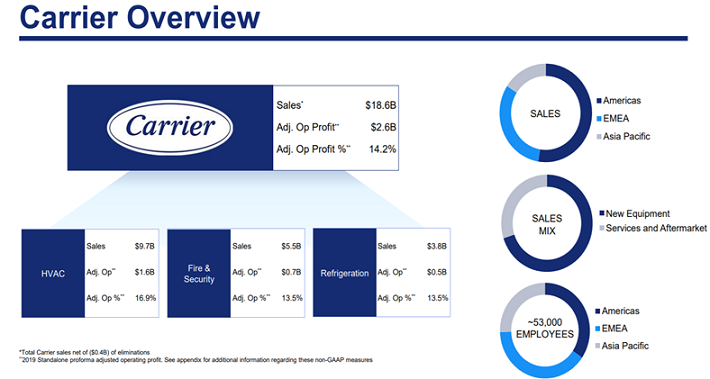

In 2019, Carrier generated $2.6 billion in operating profit and $18.6 billion in sales. As shown below, its sales are diversified geographically.

Carrier is a relatively cyclical business. Revenue declined 21% during the Great Financial crisis, while operating income declined 34%. Given its cyclical nature, we expect the company to face significant headwinds in 2020.

Carrier Strategy

The company has an ambitious strategy to reestablish growth by taking advantage of what management sees as enduring worldwide mega trends. Urbanization, climate change, increasing requirements for food safety, rising standards of living, and needs for increasing energy conservation are all trends that support demand for Carrier products and services.

Carrier’s basic focus is to accelerate top-line growth. The first leg of the strategy will be to grow the base. Management plans to invest in R&D and grow the sales force to enable this growth. Secondly, Carrier will focus on product and geographic extension. The third leg of its strategy is to expand their service business and to embrace digital innovation. Management has brought people to Carrier from other segments of United Technologies and from outside the company who have been successful in growing service businesses.

From 2017 to 2019, Carrier sales increased at a compound annual growth rate of 2%. Management expects its initiatives to reinvigorate growth over the long term. In 2020, sales will decline significantly due to macroeconomic headwinds. Nonetheless, I expect revenue to snap back pretty quickly in 2021, as it did in 2010 following the Great Financial Crisis.

Carrier Valuation and Fair Value

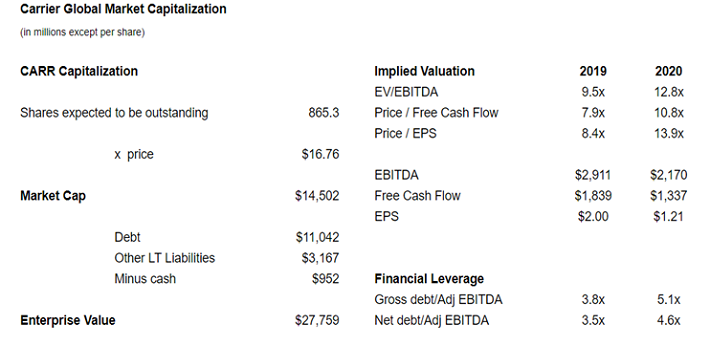

At its current price of $16.76, CARR is trading at a market cap of $14.5 billion, and an enterprise value of $27.8 billion. Carrier expects to pay a $500 million dividend on an annual basis, which corresponds to a 3.4% yield.

Given macro headwinds, EBITDA and earnings per share will decrease significantly in 2020. Nonetheless, CARR trades at 12.9x 2020 EBITDA and 14.1x 2020 earnings per share; a very reasonable valuation.

Carrier’s peers (Trane, Johnson Controls, IR, LII) trade at a median EV/2020 EBITDA multiple of 15.8x, and a median price to earnings multiple of 23.7x. If Carrier were to trade in-line with its peers, it would be valued in the range of $25 to $30 per share, significantly higher than its current price. Discounted cash flow analysis also supports this valuation.

Final Thoughts: Otis vs. Carrier

While Otis has a more resilient business model, it is priced relatively close to our estimate of fair value. As such, we do not recommend buying shares today. On the other hand, Carrier has more cyclical headwinds, but is priced at a significant discount to peers and fair value. It is the more attractive of the two spin-offs.

Disclosure:

This article is written by Rich Howe, CFA, who monitors the stock spin-off market at