OSK: A Long-Term Dividend Play In The Specialty Vehicle Business

Image Source: Unsplash

Quantitative screens are an excellent starting point to home in on the type of securities you are looking for – high-quality dividend growth stocks trading at fair or better prices in our case. But they are not the end of the stock selection process. After screening the universe of securities, intelligent analysis of the individual securities that appear compelling should be done to better understand their risk and reward profiles. The combination of both quantitative and qualitative methods allows investors to benefit from the strengths of each.

That brings me to OSK. Founded in 1917, the company is a leader in designing, manufacturing, and servicing a broad range of access equipment, commercial, fire and emergency, military, specialty vehicles, and vehicle bodies. Brands under the corporate umbrella include OSHKOSH, JLG, Pierce, McNeilus, JERR-DAN, Frontline, MAXIMETAL, IMT, and Pratt Miller.

On April 30, Oshkosh reported its Q1 results. Revenue declined 9% over the prior year’s quarter. Sales were mixed across the company’s segments, with Access and Defense seeing decreases of 23% and 9%, respectively, while sales of Vocational grew 12%. Adjusted earnings per share decreased 34%, from $2.89 to $1.92, missing the analysts’ estimates by $0.12. But it was the first earnings miss after eight consecutive quarters of wide earnings beats.

Plus, Oshkosh holds a competitive advantage in its niche and has essential offerings for a variety of industries, such as aerial work platforms, fire truck ladders, and refuse collection equipment. The company has leading brands, with a reputation for reliability and longevity, to go along with a comprehensive product line.

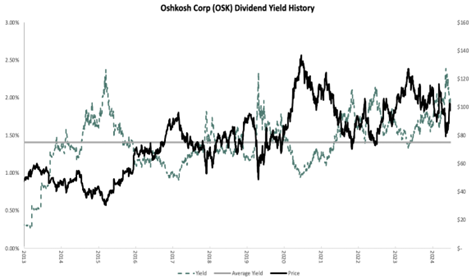

Oshkosh has raised its dividend for 12 consecutive years and is currently offering a 2% dividend yield. Given its solid payout ratio of only 20%, its reliable growth trajectory, and its strong balance sheet, the company can easily continue raising its dividend for many more years.

Recommended Action: Buy OSK.

More By This Author:

XLK: A Familiar Tech Fund That Offers Benefits In This Volatile MarketNasdaq 100: As Market Fate Hangs In The Balance, Watch These Levels

KBR: A Value Play With Construction, Defense, And Energy Exposure

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more