Orion Energy Systems - A Top 100 Stock

Editors' note: This article discusses one or more penny stocks and/or microcaps. Such stocks are easily manipulated; do your own careful due diligence.

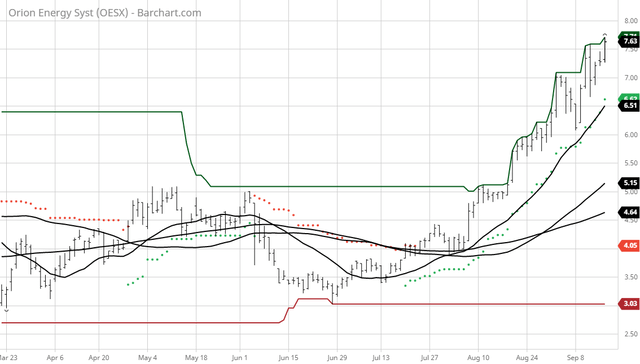

The Barchart Chart of the Day belongs to the lighting systems company Orion Energy Systems (Nasdaq:OESX).I found the stock by sorting Barchart's Top 100 Stocks list first by the most frequent number of new highs in the last month then used the Flipchart feature to review the charts for consistent price appreciation.Since the Trend Spotter signaled a buy on 7/23 the stock gained 84.75%.

Orion Energy Systems, Inc. researches, designs, develops, manufactures, implements, markets, and sells energy management systems for the commercial office and retail, area lighting, and industrial markets in North America. The company operates in three segments: Orion U.S. Markets Division, Orion Engineered Systems Division, and Orion Distribution Services Division. It offers interior light-emitting diode (LED) high bay fixtures; smart building control systems, which provide lighting control options and data intelligence capabilities for building managers; and LED troffer door retrofit for use in the office or retail grid ceilings. The company also offers various other LED, HIF, and induction fixtures for lighting and energy management need comprising fixtures for agribusinesses, parking lots, roadways, retail, mezzanine, outdoor applications, and private label resale. In addition, it provides lighting-related energy management services, such as site assessment, site field verification, utility incentive, and government subsidy management, engineering design, project management, and installation; and sells and distributes replacement lamps and fixture components into the after-market. The company serves customers directly, and through independent sales agencies and distributors, and energy contractors, and electrical service companies. Orion Energy Systems, Inc. was founded in 1996 and is headquartered in Manitowoc, Wisconsin.

Barchart technical indicators:

- 100% technical buy signals

- 198.10+ Weighted Alpha

- 157.77% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 13 new highs and up 52.91% in the last month

- Relative Strength Index 71.68%

- Technical support level at 7.36

- Recently traded at 7.6 with a 50 day moving average of 5.15

Fundamental factors:

- Market Cap $223 million

- P/E 36.05

- Revenue expected to grow 34.40% next year

- Earnings estimated to increase 200.00% next year and continue to compound at an annual rate of 25.00% for the next 5 years

- Wall Street analysts issued 3 strong buy recommendations on the stock

- The individual investors following the stock on Motley Fool voted 226 to 21 that the stock will beat the market

- 4,070 investors are monitoring the stock on Seeking Alpha

Disclosure: None.