Organigram Inc. Q3 Financials Show Major Improvements

Organigram Holdings Inc. (Nasdaq: OGI) (TSX: OGI), a licensed producer of cannabis, announced its results for the third quarter ended May 31, 2021, as follows:

Q3 Financial Highlights

(All results are presented in Canadian dollars and compared to the previous quarter. Go here to convert into other currencies.)

- Gross Revenue: +50.9% to $29.1M

- Net Revenue: +38.8% to $20.3M

- Gross Profit: increased to $2.1M from $(17.2)M

- SG&A: +21.8% to $13.6M

- Net Loss: reduced by 94.0% to $(4.0)M

- Adj. EBITDA: decreased to $(10.2)M

Operational Highlights

- In late March 2021, Organigram:

- launched the Edison Black Cherry Punch, I.C.C. and Slurricane strains in a package of three half-gram pre-rolls and

- introduced Skyway Kush as the first strain in the Company’s Indi portfolio and currently offers THC in the range of 20% to 23%.

- In late April 2021, the Company launched another two new high potency Edison dried flower strains, GMO Cookies, and MAC-1 , with a THC range of 20-26% and available in 3.5g format or a package of three half-gram pre-rolls.

- In March 2021, the Company expanded the successful SHRED brand with the introduction of a Jar of Joints, a convenient jar of 14 half-gram pre-rolls in SHRED’s Tropic Thunder.

- In late May 2021, the Company launched Big Bag o’ Buds, an indoor-grown, strain-specific, dried flower in a 28g value format containing a minimum of 17% THC.

Management Commentary

Paolo De Luca, Chief Strategy Officer, said:

- “The ongoing investment in our genetics and cultivation program has yielded some exciting new dried flower products with more genetics and derivative product launches planned for the near term.

- Sales are trending higher to date in Q4 supported by a strong outlook for the industry as the number of cannabis retail stores continues to grow and existing stores are permitted to re-open their doors to customers.”

Derrick West, Chief Financial Officer, said:

- “On the expense front, we are encouraged by the progress we have made in reducing cultivation costs and capturing economies of scale as we ramp up cultivation.

- In combination with commercial strategic initiatives, we have also identified a number of additional cost efficiency opportunities focused on enhancing our gross margin profile.

- We anticipate starting to see the benefits from these cost reductions during Q4 Fiscal 2021.”

Outlook

Net revenue

- Organigram currently expects Q4 2021 revenue to be higher than Q3 2021 largely due to:

- stronger forecasted market growth as COVID-19 restrictions lift (permitting cannabis retail stores to reopen to foot traffic) and the number of retail stores continues to grow;

- the Company is better able to fulfill demand for its revitalized product portfolio with increased staffing

- and an incremental revenue stream from the first sales of soft chews expected in Q4 2021.

Adjusted gross margins

- The Company expects to begin to see a sequential improvement in adjusted gross margins in Q4 2021 largely due to:

- lower product cultivation costs (from higher plant yields),

- increased automation such as the new pre-roll machine which reduces the reliance on manual labour,

- product category and brand sales mix with the recent launches of new higher margin dried flower cultivars under the Edison and Indi brands

- the resumption of higher margined international shipments to Canndoc Ltd. whose sales are anticipated to represent a greater proportion of the Company’s revenues,

- the launch of more high margin multi-pack pre-rolls and 1g vape cartridges

- and greater investment in automation to drive cost efficiencies and reduce dependence on manual labour.

SG&A expenses

- Q4 2021 SG&A is expected to be higher than Q3 2021 largely due to:

- more research and development work at the CoE

- and increased selling and marketing expenses as stores reopen to foot traffic and the retail network expands.

International Sales

- Shipments to Canndoc Ltd. are expected to resume in Q1 2022 contingent upon the timing and receipt of regulatory approval from Health Canada, including obtaining an export permit.

Liquidity and Capital Resources

- On April 1, 2021, the Company repaid all outstanding balances (approximately $58.5 million) under its credit agreement with BMO and a syndicate of lenders, which will result in annual interest savings of $2.7 million (based on the outstanding balance at the time of repayment).

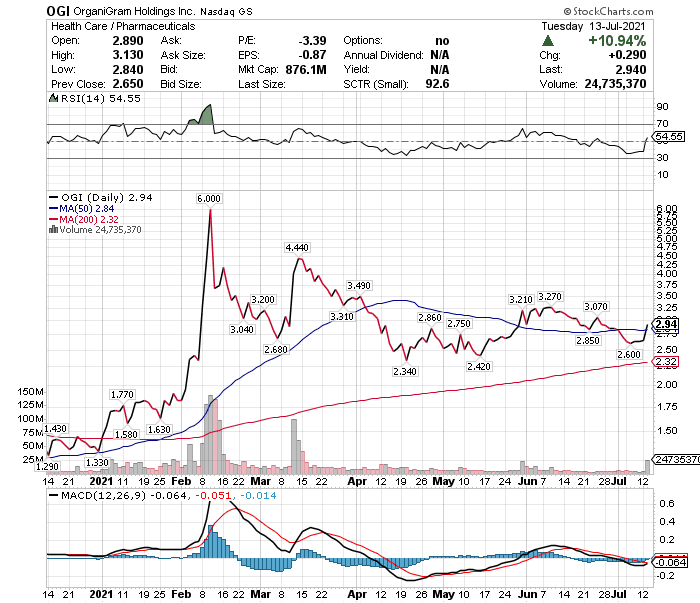

Stock Performance

As illustrated in the chart below, Organigram stock has more than doubled since the beginning of the year and, with the 10.9% increase today, is now up 121% YTD.

Visit munKNEE.com and register to receive our free Market Intelligence Report newsletter (sample more