OraSure: Small Cap Med-Tech M&A Environment Makes It Compelling Buy

A deal was announced earlier today, June 7th, 2016, with Zimmer Biomet (ZBH) agreeing to acquire LDR Holdings (LDRH) for $1, a 65% premium, and paying 4.6X FY17 sales. LDRH specialized in spinal medical technologies and was the best in class name versus peers in terms of FY17 sales growth and gross margins. LDRH also had no long term debt and a healthy cash hoard with 5 years of consistent sales growth.

I expect many more deals in Med-Tech the rest of this year, though the pool of sub $2B market cap companies is relatively small. I want to look across each industry within Med-Tech to find the best M&A candidate looking for growth and above industry-average margins as two keys for being an attractive target.

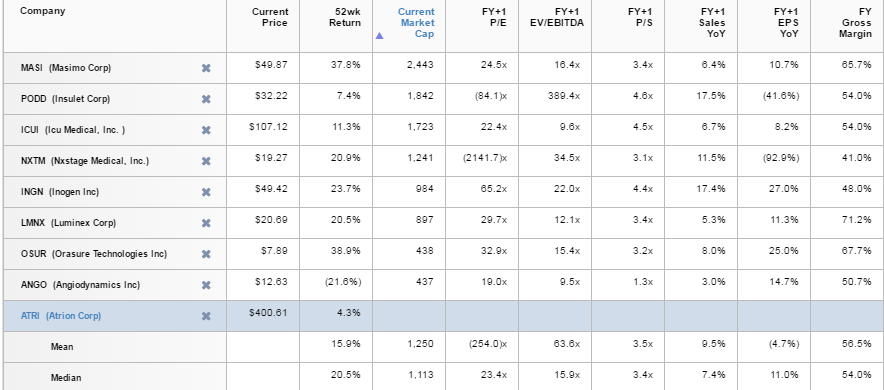

The first area I want to look at it Monitoring, Diagonostics, and Delivery Systems. This group contained 9 stocks under $2.5B market caps, Masimo (MASI), Insulett (PODD), ICU Medical (ICUI), NxStage Medical (NXTM), Inogen (INGN), Luminex (LMNX), Atrion (ATRI), AngioDynamics (ANGO), and OraSure Tech (OSUR). PODD is the only name in the group that has seen unusual call buying.

I have put these names into a Sentieo Comparison:

(Click on image to enlarge)

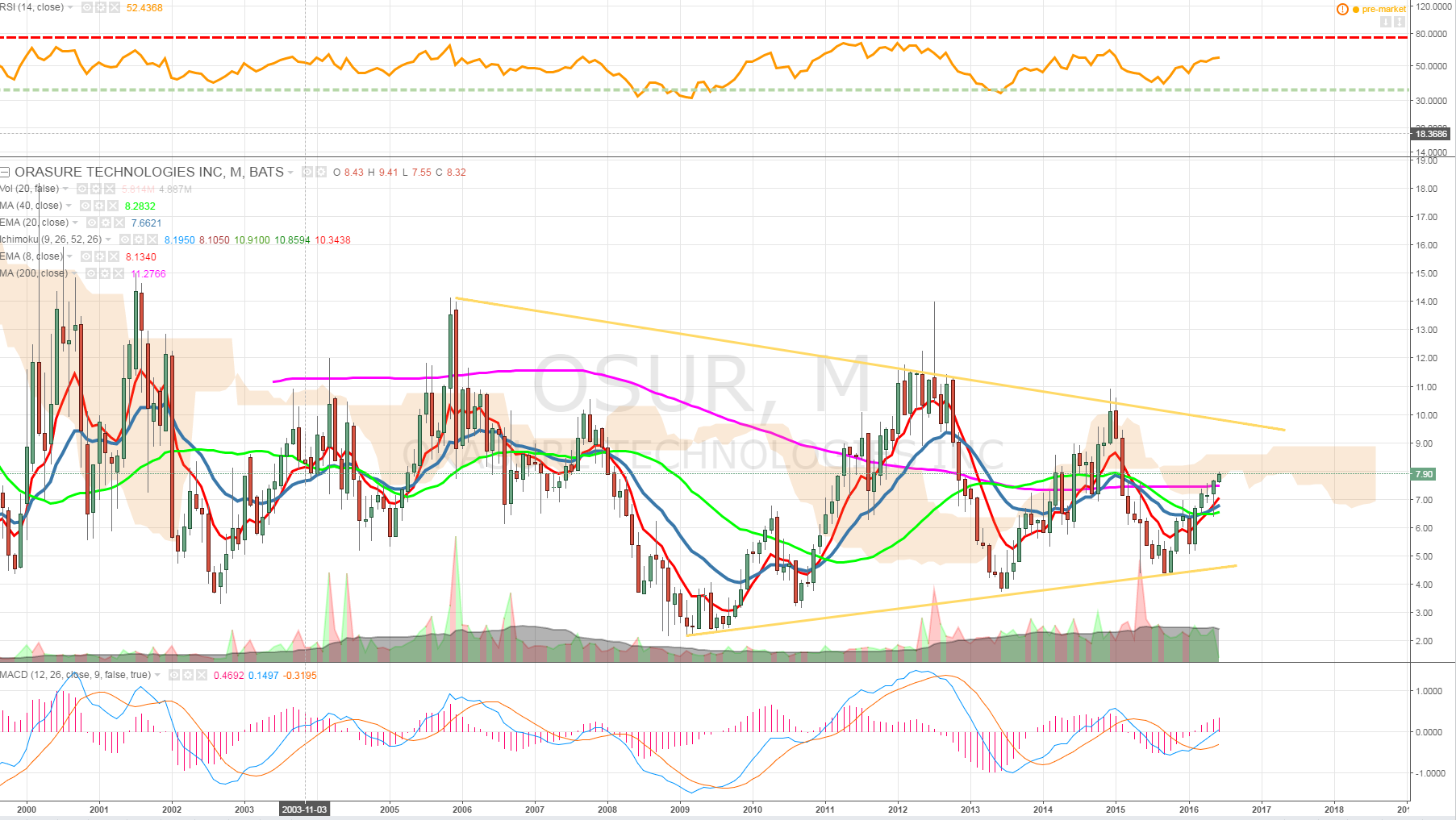

LMNX, MASI, and OSUR are the clear margin leaders. Each of these has steady sales growth over the past 5 years, but MASI has a Debt/Equity of 0.86 which may make it less attractive, while the other two have zero debt and a healthy amount of cash. OSUR trades cheaper than LMNX on FY17 P/S and also is generating stronger revenue and EPS growth. Both LMNX and OSUR could make attractive M&A targets, but OraSure would be the top pick, a small deal considering its $438M market cap. OSUR's chart shows a stock that put in a third higher low in late 2015 and now is pushing up strong, higher each of the last 5 months and moving above weekly cloud resistance with room to make a run to $10 or higher, more than 25% from current levels.

For a closer look at OraSure (OSUR), it is a $438M Company that develops oral fluid diagnostic products and specimen collection devices. Shares trade 32.9X Earnings, 3.6X Sales, 2.69X Book, 19.75X FCF and just 4.28X cash value. OSUR shares have a strong Q4 seasonal tendency averaging more than a 15% gain the past 10 years. Analaysts have an average target of $8.50 for shares with 4 Buys, 14 Holds, and 3 Sells, so a name flying under the radar and sentiment not overly bullish. OSUR recently exceeded sales guidance with strong molecular collection systems increasing revenues 24% Y/Y and HCV sales +130%. Sale sof OraQuick In-Home test rose 38%. OSUR also posted 68% gross margins, compared to 63% the year prior.

In closing, OSUR offers an attractive valuation and low risk at these levels when valued versus peers, and the pick-up in M&A in Med-Tech makes it an attractive acquisition candidate as well.

(Click on image to enlarge)

Not Investment Advice or Recommendation Any descriptions "to buy", "to sell", "long", "short" or any other trade related terminology should not be seen as a ...

more