Oracle: A "Sleeper" Play In Tech After Monster Quarter?

Image Source: Pixabay

Where do markets go from here? That depends on the headlines. Meanwhile, Oracle Corp. (ORCL) recently beat both top- and bottom-line estimates for Q4, observes Keith Fitz-Gerald, editor of 5 With Fitz.

Anything that reintroduces FUD – fear, uncertainty, and doubt – has the potential to be a downer. Anything that inspires confidence can create FOMO (the fear of missing out) if there’s a sense that worries like tariffs, rates, and the economy can be relegated to the back seat, so to speak.

My point of view is that we’ll see range-bound conditions for a bit with an upside bias lurking under the hood as Wall Street tries to hide that from the investing public.

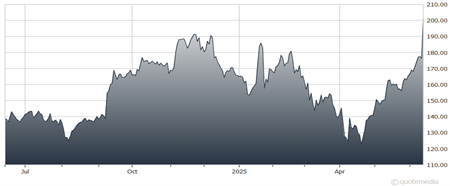

Oracle Corp. (ORCL) Chart

As for Oracle:

- Revenue came in at $15.9 billion, an 11% increase year-over-year.

- Cloud services and support revenues jumped 14% year-over-year, reaching $11.7 billion.

- Cloud infrastructure (IaaS) revenue surged 52% to $3 billion, while SaaS-based cloud applications revenue grew 12% to $3.7 billion.

The company is expecting an even better 2026, with CEO Safra Catz forecasting that total cloud revenue growth will accelerate from 24% in FY25 to over 40% in FY26. Oracle Cloud Infrastructure (OCI) growth alone is projected to top 70%.

I think there’s a very good chance that cloud revenue could accelerate even faster than Catz suggests, though. There’s already more than $1.5 trillion flowing into AI and the advanced manufacturing needed to make it all work.

Which means that Oracle could be a very interesting choice, or a “sleeper” to paraphrase my grandfather, who would often refer to under-recognized baseball players having the potential to significantly outperform expectations.

About the Author

Keith Fitz-Gerald has been called “somebody you should pay attention to” by #1 New York Times bestselling author and personal finance expert Suze Orman, “always insightful” by Constellation Research CEO Ray Wang, and a “market visionary” by Forbes. He has more than 3,000 prime-time appearances to his credit on the Fox Business Network, CNBC, Dubai One, BBC, and other networks around the world.

Mr. Fitz-Gerald’s commentary and market analysis have been featured in such notable publications as the Wall Street Journal, The Times (of London), Wired, and more. He is the principal of the Fitz-Gerald Group which provides consulting services to professional wealth managers.

He personally writes the popular, free 5 with Fitz read by tens of thousands of individual investors, financial advisors, and hedge fund pros around the world daily. Mr. Fitz-Gerald believes anybody can be wildly successful in the financial markets when armed with the right knowledge, education, and tactics.

More By This Author:

Toronto Dominion: A Canadian Bank Stock With Powerful Technical MomentumBEP: A Solid Play For Profiting From Utility Sector M&A

Jobs: Headline Growth Solid, But Some Weakness Behind The Curtain

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more