Options Market Expectations For The Payrolls Report

Image Source: Pixabay

We have our first payrolls report of 2025 on Friday. Technically, it’s the last report of 2024, but that’s just bookkeeping. Normally I’d write a piece like this on the Thursday before the announcement, but with US markets closed tomorrow for former President Carter’s funeral, today is the last day to act prior to the report.

The current consensus estimates are for an increase of 165,000 Nonfarm Payrolls, down from 227k; an unchanged Unemployment Rate of 4.2%; and Average Hourly Earnings dipping to 0.3% from November’s 0.4%. ForecastEx markets are a bit more optimistic about payrolls, with a 45% probability that the increase will be above 180k, though Unemployment is about 50/50 around 4.2%.

Options traders, however, seem to be a bit more cautious about the market’s potential reaction to those numbers.That’s not surprising, considering that we had two moves of greater than 1% – one up, one down – in three of the prior sessions.Traders are not necessarily skittish, but we see S&P 500 Index (SPX) options pricing in more volatility than usual ahead of the number.

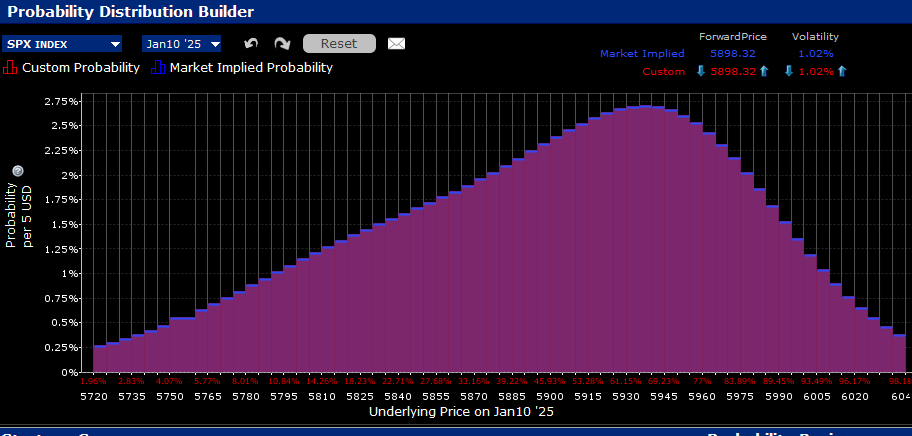

That said, it’s not as though options traders are outright bearish, as the IBKR Probability Lab shows for SPX options expiring Friday.The peak probability is for a move to 5935, about 0.75% above the current index level.There has been a persistent bullish bias priced into short-term options, especially considering the market’s recent propensity for upward moves to predominate over those to the downside, especially on Fridays (aka “Friday Follies”).This week is no exception:

IBKR Probability Lab for SPX Options Expiring January 10th, 2025

(Click on image to enlarge)

Source: Interactive Brokers

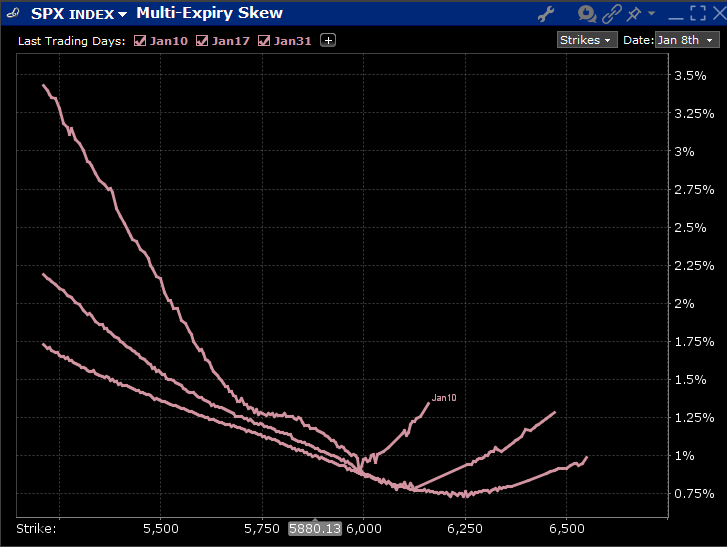

But that doesn’t mean that risk aversion isn’t present.We see Friday’s at-money SPX options trading with an implied volatility (in daily terms) of about 1.15%.This is relatively high, but hardly out of the question in light of recent index volatility.We noted that two of the prior three days saw SPX moves > 1%, and that extends to 5 of the 9 sessions prior to today (3 down, 2 up). That is likely one of the factors causing the relatively steep upside skews that we see for SPX options expiring Friday, but also for those expiring next week and at the end of the month:

Skews for SPX Options Expiring January 10th (top), 17th (middle), 31st (bottom)

(Click on image to enlarge)

Source: Interactive Brokers

It does appear that we have seen a bit more balance between risk and reward come into play during the past few sessions.It is of course too soon to know whether that is a temporary or more long-lasting theme, but with a new administration taking office in under two weeks and a potentially consequential earnings season beginning almost immediately afterwards, it is clear that at least some options traders are pricing in the potential for higher volatility and the need for some prudent hedging and/or risk aversion.That begins with the options most directly affected by Friday’s employment report and continues into those that follow.

More By This Author:

Tariffs? No Biggie, As Long As Nvda Is Up

25 Years Ago Today, Many Of Us Were Terrified

Santa Rally: Down But Not Out

Disclosure: Options (with multiple legs)

Options involve risk and are not suitable for all investors. For information on the uses and risks of options, you can obtain a copy of the Options ...

more