Optimize Your Portfolio Review

Image Source: Pixabay

I’ll grant you that reviewing one's portfolio isn’t exciting. It can be tedious, honestly. However, if this process is skipped, you may be unaware of key events and information. You could end up with rock bottom stock prices, or dividend cuts could take you completely by surprise.

I cannot stress enough that you should never make a trade based solely on short-term performance. While the past two years have been frustrating, don’t deviate from your investment process.

You probably have losers in your portfolio. Does that mean you should sell them? Absolutely not. Should you ignore your losers? Absolutely not. The proof is in the pudding. You need several ingredients to make a delicious pudding. If your core recipe is a proven success, you can live with a bit too much sugar or salt.

Ignore the Noise

While tracking short-term performance can highlight some weaknesses, it can also bring up a lot of noise from the market. Over the past two years, we’ve had to deal with supply chain disruptions, inflation, rising interest rates, and a war. That’s enough to create a lot of noise and much uncertainty.

Our latest quarterly portfolio review had very little to do with the current state of the market. All changes resulted from examining macroeconomic trends, reviewing the quarterly results, and reviewing the overall portfolio. This quarter was all about rebalancing our positions.

You’re the one who knows how much risk you can tolerate and how you feel when you see a $5,000, $10,000, or $50,000 drop in value. You’re the one who knows if you need that money in three months or in 30 years, and how you sleep at night when you think about your portfolio. That’s why doing your due diligence and reviewing your portfolio regularly is so important: personal finance is, well, personal.

To help you, here are the things I look at, in order, during my own review.

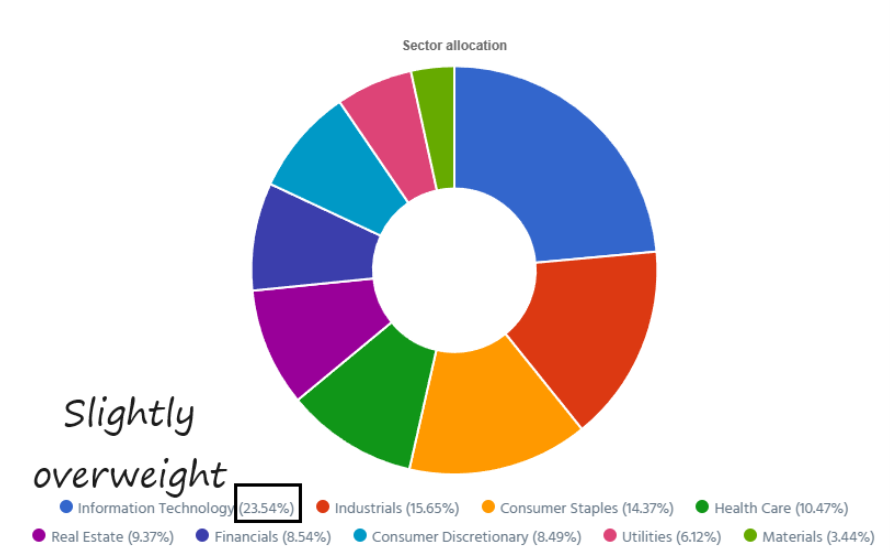

Sector Review

In general, asset allocation (the split of investments between equities, ETFs, bonds, etc.) explains about 90% of the variability of a portfolio’s returns over time (according to research conducted by Ibbotson & Kaplan). Notice I didn’t write “investment returns,” but rather “variability.”

When you review your portfolio, asset allocation (and sector allocation to a lesser extent) explains most of the fluctuations you observe. As fluctuations are the results of short-term movements, being exposed to an asset class or a sector (or not) explains the ups and downs of your portfolio.

Within equity investments, for example, someone heavily concentrated in technology stocks, consumer discretionary, and REITs likely did terribly in 2022. In contrast, an investor focused on energy stocks may feels that 2022 was a great year. Different allocations lead to different results.

To avoid major volatility, I aim to keep my favorite sectors close to 20% of my portfolio and not exceed this limit. I like my portfolio to include at least 7-8 sectors. This ensures that I’m rarely overexposed and that I can ride multiple tailwinds.

(Click on image to enlarge)

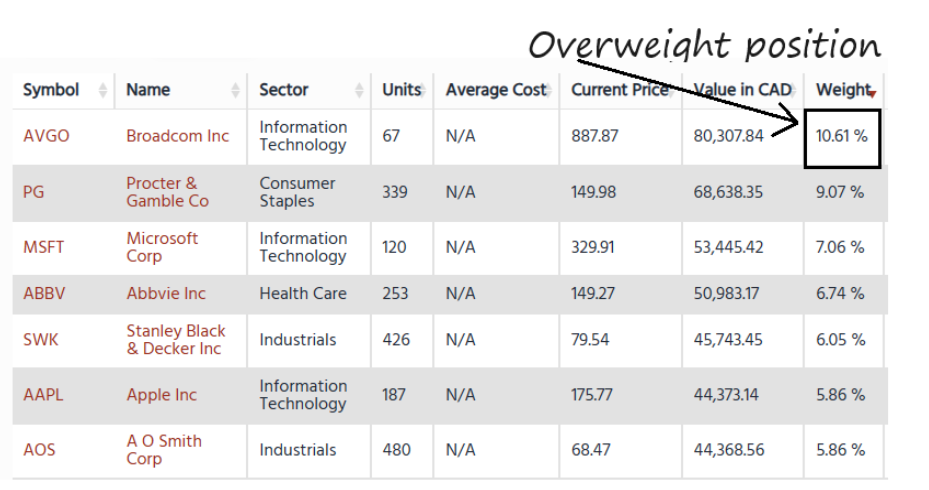

Stock Weight

Similarly, I don’t want my returns to depend on a couple of heavyweight stocks in my portfolio. I’ve had to sell shares of Apple (AAPL) and Microsoft (MSFT) to keep my exposure to a maximum of 15% for a stock; none of my holdings are that heavy now.

In our service portfolios, we try to keep most holdings equally weighted. However, since we manage the portfolio as a real person would, we don’t equally balance stocks every quarter; who has the patience to make that many trades in real life? But, when a stock becomes overweight, we’ll trim a percentage and reallocate the money accordingly.

(Click on image to enlarge)

As you see above, Broadcom (AVGO) was too heavy in our 100 US portfolio. While all the other positions are between 5% and 6%, AVGO was close to 11%. Considering the stock surged, I’m not surprised at having to trim our position.

Stock Review

When satisfied with the weight of each sector and stock, it’s time to look at each stock individually. Most often, a simple look at their dividend triangle and latest quarterly earnings summary is sufficient.

Why? Because business models don’t change overnight; Starbucks won’t stop selling coffee tomorrow nor will Canadian National Railway stop operating railroads. An in-depth analysis isn’t required each time you review your portfolio.

When a company shows a trend of slowing, or worse, absent revenue growth, EPS growth, and dividend growth, I look at the list of replacement stocks I keep on hand. This helps my chances of picking the best replacement security for my portfolio.

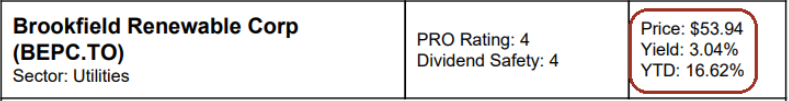

Portfolio & Stock Performance Review

I complete my review by looking at the overall portfolio and stock performance. The goal is to quickly identify anything that might be off. I don’t mind my portfolio being down 10% if the overall market moved in a similar way. If my portfolio is down 10% and the market is up 8%, then I must identify the source of this underperformance.

Whether I underperform or overperform, it doesn’t mean I’ll make trades, but rather that I’ll investigate to understand why it’s happening.

Chart showing yield and year-to-date total return of a stock

Using the 'Pareto Principle,' you can focus on the 20% that generates 80% of your returns. In most cases, no changes are necessary. But failing to monitor your investments could lead to surprise dividend cuts and potential disaster.

None of us can completely avoid mistakes. However, by following a diligent portfolio review process, I can ensure I’m well invested across various sectors and various quality stocks. Therefore, if I make a mistake, its impact is minor.

Last Thoughts

Many times, I barely touch my portfolio and the service portfolios during reviews. The idea is to keep holdings as long as possible to benefit from the power of dividend growth and compounding interest. However, if we notice that many of our positions are either overweight or underweight, as was the case in our last review, we adjust the weighting.

The aim is to sell high and buy low. We trim the outperformers and buy some more of the underperformers that are solid companies. The theme here is “rebalancing.”

More By This Author:

Is It Time to Sell Your REITs?Deluxe Bonds And Dividend Traps

Sniff Out Dividend Cuts