OPFI: Top-Ranked Stock To Buy In June

Image Source: Unsplash

The S&P 500 jumped 6% last month for its best May since 1990 and its strongest monthly performance since November 2023. Meanwhile, the Nasdaq surged nearly 10% as Wall Street dove headfirst back into beaten-down technology stocks.

The bulls pressed their advantage to start June, pushing the Nasdaq up 0.7% higher on Monday and 1% through midday trading Tuesday, boosted by strong showings from Nvidia and other tech giants.

The bulls are in charge, fueled by tech earnings growth and trade war progress. Now they are attempting to break above a key trading range before they send the market to new all-time highs.

It’s time to explore how investors can use a Zacks screen to help find some of the best Zacks Rank #1 (Strong Buy) stocks to buy in June and throughout the summer of 2025.

Zacks Rank #1 (Strong Buy) stocks outperform the market in good and bad times. However, there are over 200 stocks that earn a Zacks Rank #1 at any given time.

Therefore, it’s helpful to understand how to apply filters to the Zacks Rank in order to narrow the list down to a more manageable and tradable set of stocks.

Stock Screening Guidelines

Clearly, there are only three items on this screen. But together, these three filters can result in some impressive returns.

• Zacks Rank equal to 1

Starting with a Zacks Rank #1 is often a strong jumping off point because it boasts an average annual return of roughly 24.4% per year since 1988.

• % Change (Q1) Est. over 4 Weeks greater than 0

Positive current quarter estimate revisions over the last four weeks.

• % Broker Rating Change over 4 Week equal to Top # 5

Top 5 stocks with the best average broker rating changes over the last four weeks.

This strategy comes loaded with the Research Wizard and is called bt_sow_filtered zacks rank5. It can be found in the SoW (Screen of the Week) folder.

Here is one of the five stocks that qualified for the Filtered Zacks Rank 5 strategy today…

OPFI: Buy the Soaring Fintech Stock for Upside and Value

OppFi’s ((OPFI - Free Report) ) works with banks to provide financial products and services for “everyday Americans” via its tech-enabled digital finance platform.

OppFi partners with community banks to offer installment loans to middle-income Americans who are underserved by traditional financial institutions because of low credit scores and more.

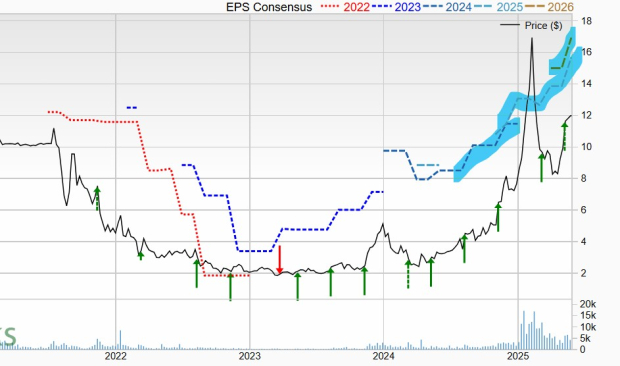

Image Source: Zacks Investment Research

The company’s digital OppLoans platform uses AI-driven underwriting to offer transparent, responsible lending with same-day funding. OppFi also supports financial education through partnerships to help customers improve their financial health.

OppFi is projected to grow its earnings by 30% this year and 9% next year on 10% and 4%, respective revenue expansion. The financial services firm has crushed our bottom-line estimates by an average of 60% in the trailing four quarters, including a big beat-and-raise Q1 in early May. OppFi’s recent upward earnings revisions are part of a much larger uptrend during the past year.

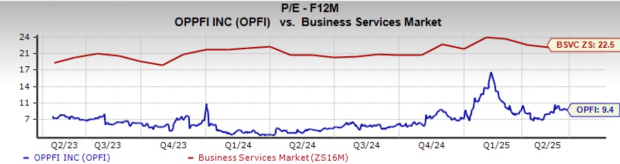

Image Source: Zacks Investment Research

OPFI stock has soared 300% in the past 12 months to crush its Business Services sector’s 13%. Its recent outperformance is part of a 550% two-year run that’s taken it above its summer 2021 levels after it went public via a SPAC.

Despite the surge, investors can buy OppFi stock 22% below its February peaks while holding its ground above its 2021 IPO levels and its 21-day moving average recently. OppFi also trades at a 60% discount to its sector and 45% below its highs at 9.4X forward 12-month earnings.

More By This Author:

2 Under-The-Radar Tech Stocks To Buy Before Earnings: NU, WIXIs Netflix a Must-Buy Tech Stock Down 10% from Its Highs?

Buying The Best Value Stocks In 2025

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more