Onto Innovations - Great Revenue And Earnings Projections

Summary

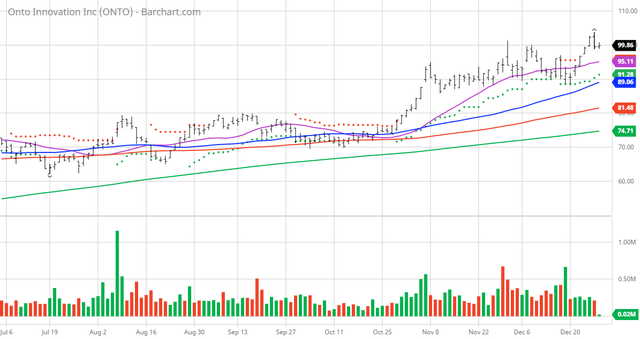

- 100% technical buy signals.

- 4 new highs and up 6.35% in the last month.

- 113.91% gain in the last year.

The Barchart Chart of the Day belongs to the semiconductor technology company Onto Innovations (ONTO). I found the stock by using Value Line Investment Survey to screen for stocks analysts predict will have at least a 12% annual compounded growth rate in both Revenue and Earnings over the next 3-5 years. I loaded that watchlist into Barchart and sorted for the most frequent number of new highs in the last month, then used the Flipchart feature to review the charts for consistent price appreciation. Since the Trend Spotter signaled a buy on 12/22 the stock gained 3.38%.

Yahoo Finance -Onto Innovation Inc. engages in the design, development, manufacture, and support of process control tools that performs macro defect inspection and metrology, lithography systems, and process control analytical software worldwide. It offers process and yield management solutions, and device packaging and test facilities through standalone systems for macro-defect inspection, packaging lithography, probe card test and analysis, and transparent and opaque thin film measurements; and process control software portfolio that includes solutions for standalone tools, groups of tools, or factory-wide suites. The company also provides spare parts and software licensing services. Its products are used by semiconductor wafer and advanced packaging device manufacturers; silicon wafer; light-emitting diode; vertical-cavity surface-emitting laser; micro-electromechanical system; CMOS image sensor; power device; RF filter; data storage; and various industrial and scientific applications. The company was formerly known as Rudolph Technologies, Inc. Onto Innovation Inc. was founded in 1940 and is headquartered in Wilmington, Massachusetts..

Barchart technical indicators:

- 100% technical buy signals

- 108.36+ Weighted Alpha

- 113.91% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 4 new highs and up 6.35% in the last month

- Relative Strength Index 61.74%

- Technical support level at 97.64

- Recently traded at 100.41 with a 50 day moving average of 89.06

Fundamental factors:

- Market Cap $4.91 billion

- P/E 30.53

- Revenue is expected to grow 39.80% this year and another 14.00% next year

- Earnings are estimated to increase 93.30% this year, an additional 21.20% next year, and continue to compound at an annual rate of 12.00% for the next 5 years

- Wall Street analysts issued 4 strong buy and 1 buy opinion on the stock

- The individual investors on Motley Fool have yet to find this stock

- 5,070 investors are monitoring the stock on Seeking Alpha

Disclaimer: The Barchart Chart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stock are ...

more