OncoSec Medical: Promising Cancer Treatment Overlooked By Market

Small biotechs offer some of the biggest risk/reward equations in the market. The farther the company is through trials and the more cash on the balance sheet, the better the risk/reward equation for investors.

One such small biotech that falls into this category is OncoSec Medical (ONCS) that has a promising immunotherapy treatment for cancer. As the small biotech makes progress with clinical trials, the stock slumps as the fickle stock market can lose interest despite the progress providing an opportunity to alert investors.

Promising Platform

OncoSec Medical is working towards an unmet medical need in melanoma with a rather strong balance sheet for the stock valuation. The combination provides an intriguing opportunity, especially considering the company has an upcoming catalyst with the release of clinical data at the cancer symposium on February 23.

The company as a solid pipeline for a biotech with a market cap of only $27 million. OncoSec has Phase 2 trials in the works for metastatic melanoma combination with Keytruda and triple-negative breast cancer providing plenty of near-term catalysts to boost appeal of the stock.

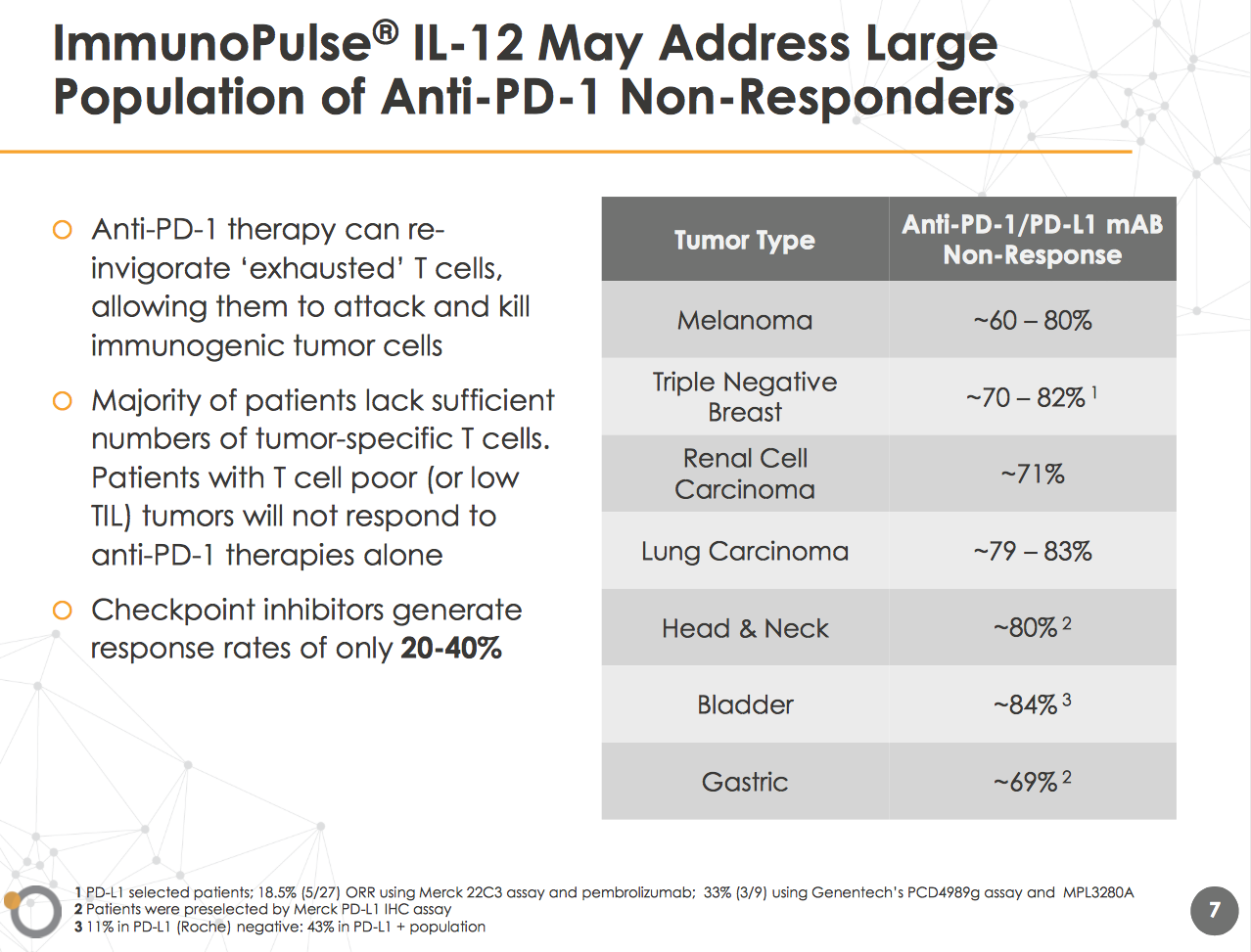

The proprietary ImmunoPulse technology platform is targeted at patients that do not respond to anti-PD-1 therapy. As the below slide highlights, the ImmunoPulse IL-12 may have the ability to address a large population of non responders with the initial focus on melanoma and triple-negative breast cancer. The majority of patients have low TIL tumors that reduce the response to anti-PD-1 therapies.

The OncoSec approach aims to use electroporation and ImmunoPulse IL-12 to illicit a priming response. These patients with the above cancers that don't respond to checkpoints tend to not have inflamed tumors which is where IL-12 comes into the equation. OncoSec is working on the approach with metastatic melanoma patients that in essence need the tumors inflamed in order to prime the immune system.

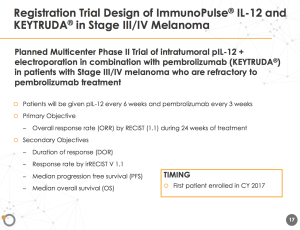

The company is running a Phase 2 melanoma combination trial with Keytruda where the patients aren't expected to respond to the checkpoint alone. The initial results are very promising.

Back in November, OncoSec released interim efficacy and safety data from a Phase 2 trial led by the University of California, San Francisco. The trial showed that 15 patients predicted to not respond to an anti-PD-1 had an overall response rate of 40% when using IL-12 and Keytruda in combination. The data showed that 4 patients had a complete response and 2 patients had a partial response.

Previous test results have shown a roughly 70% ORR in advanced melanoma patients treated with IL-12 followed by an anti-PD-1. As well, the test results show little in the way of side effects.

OncoSec plans to present updated clinical data from the Phase 2 combination study at the ASCO-SITC Clinical Immuno-Oncology Symposium on February 23. The presentation will provide a key update on the progress of treating patients with the difficult to treat late stage melanoma.

Based on positive clinical data, the company will expand on plans for the registration for the Phase 2 trial. The goal is to enroll patients for the ImmunoPulse IL-12 and Keytruda in stage III/IV melanoma trial beginning this quarter.

The market potential in refractory to anti-PD-1/PD-L1 patients is estimated at $500 million according to Data Monitor Healthcare. OncoSec expects an ability to expand the market to a first-line therapy for earlier stage melanoma.

Refreshing Balance Sheet

Possibly the best part about this small biotech is the solid balance sheet. Typically, a stock with this small valuation is due to a small cash balance that will require an immediate fundraising.

OncoSec ended the last reported quarter on October 31 with $24.4 million in cash on the balance sheet. The small biotech did use $4.4 million of cash from operating activities during the quarter. The company projects the funds will last along enough to fund clinical trials well into 2018 to run a melanoma registration-directed clinical study.

With key catalysts including the release of updated clinical data this week and the start of the new Phase 2 trial, the company has the potential to put off any fundraising until the market better recognizes the value of the stock.

High Risks

The risks for any biotech whether small or large are always high due the possible failure of clinical trials to met the stated endpoint. The ongoing losses for research and development aren't guaranteed to produce an FDA approved therapy.

As well, big biopharma companies with deeper pockets could fund a competing immunotherapy and even an approved FDA therapy could fail to become commercially successful. These risks are typical of the sector making the key to find a biotech with a promising technology with an attractive pipeline, therefore, improving the odds.

Takeaway

The key investor takeaway is that OncoSec offers an intriguing investment. The company has the cash balance to fund the clinical program to the point of clinical and regulatory milestones for a Phase 2 study next year. Such a position provides the company plenty of time to unlock value for existing shareholders prior to requiring the need to raise funds or form a partnership with a major pharma company.

While no guarantees exist, OncoSec has the potential to unlock a new market of cancer tumor therapy where current drugs fail to treat a large amount of patients.

I always appreciate being tipped off about these hidden gems, thanks. $ONCS