Okta: Strong Growth And Abundant Potential

Okta (Nasdaq:OKTA) is a high-growth leader in identity services, an area with tremendously promising opportunities for growth. The business was already producing outstanding performance before the coronavirus pandemic appeared on the scenario, and a globally distributed workforce in times of shelter at home policies all over the world is driving accelerating adoption for identity services.

Okta stock is not cheap at all at current prices, but the business is strong enough to grow into its valuation over the next several years.

An Outstanding Growth Business

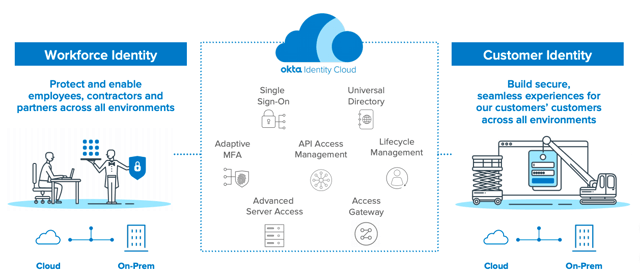

The company provides identity solutions for the workforce and customers. Workforce identity is the largest and most established segment, and it guarantees that the right employees and contractors will get access to the right networks and data in due time. Customer identity is a relatively new growth area for the company, and Okta is focused on both identity security and providing a seamless experience to the end-user in this business.

Source: Okta

Okta is benefiting from major growth tailwinds based on multiple drivers.

- Due to the rapid growth of cloud and hybrid IT, identity has become increasingly complex as organizations move to the cloud.

- The global trend toward digital transformation means that every company is now a technology company, and businesses of all kinds need help at implementing identity solutions that can meet their specific requirements.

- Cybersecurity is a major concern nowadays. According to management, more than 70% of hacking-related breaches are caused by stolen credentials, and identity protection is of paramount importance.

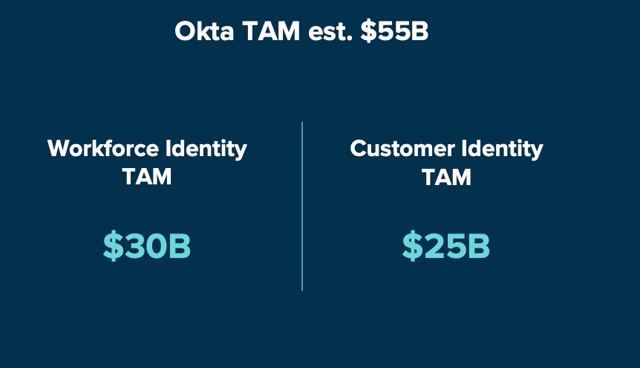

When considering the size of the total addressable market, the company believes that it could be as high as $55 billion. Okta is expected to make $771 million in revenue during the fiscal year 2021, so the company is barely scratching the surface in comparison to its long-term growth opportunities.

Source: Okta

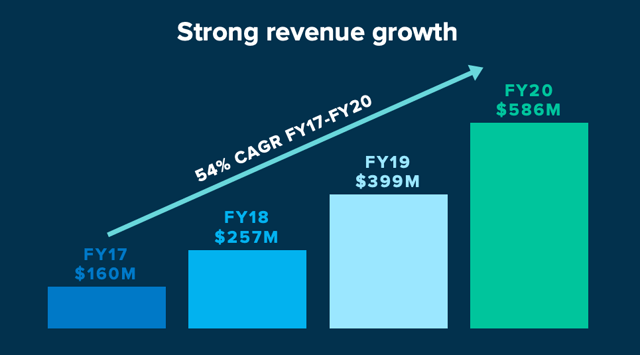

Financial performance has been truly outstanding in recent years, with revenue growth reaching 54% annually since 2017. Management comments during the company's investor day on April 1 confirmed that the business keeps firing on all cylinders based on recent data, and several research firms increased their price targets for Okta after the conference.

Source: Okta

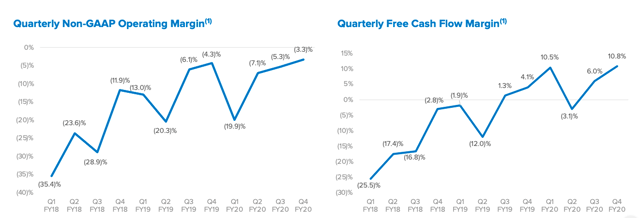

Most high-growth companies in the sector are losing money due to aggressive reinvestment needs to support long-term growth. Okta, on the other hand, is already generating positive free cash flows, and management has ambitious targets over the middle term.

Okta intends to deliver revenue growth rates in the range of 30% to 35% over the next five years and a free cash flow margin of 20-25% in fiscal 2024. These targets are not easy to achieve, but they are not unrealistic either when considering the company's track record and future opportunities.

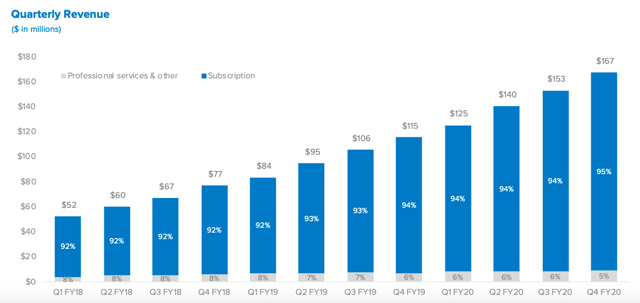

Total revenue was last quarter reached $167.3 million, an increase of 45% year over year. Subscription revenue was $158.5 million, an increase of 46%. Remaining Performance Obligations (RPO) reached $1.21 billion, growing by 66% year over year.

Source: Okta

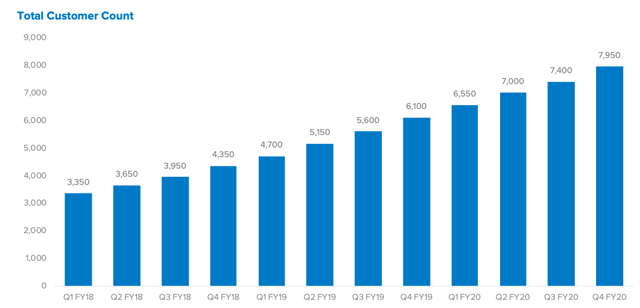

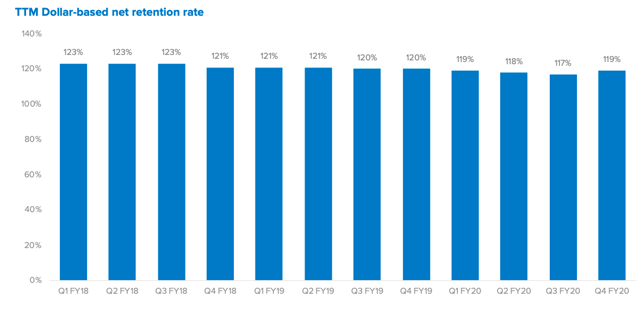

Looking at the long-term trajectory of both customer count and retention rates, the numbers are more than healthy. Okta is consistently gaining new customers while also making more revenue per customer, with the net dollar retention rate in the neighborhood of 120% over the past several years.

Source: Okta

It can be difficult for an outside investor who is not an industry expert to assess the technological strength of a company such as Okta. However, the fact that customers keep spending more money on the company's solution is clearly a positive reflection in this area.

Source: Okta

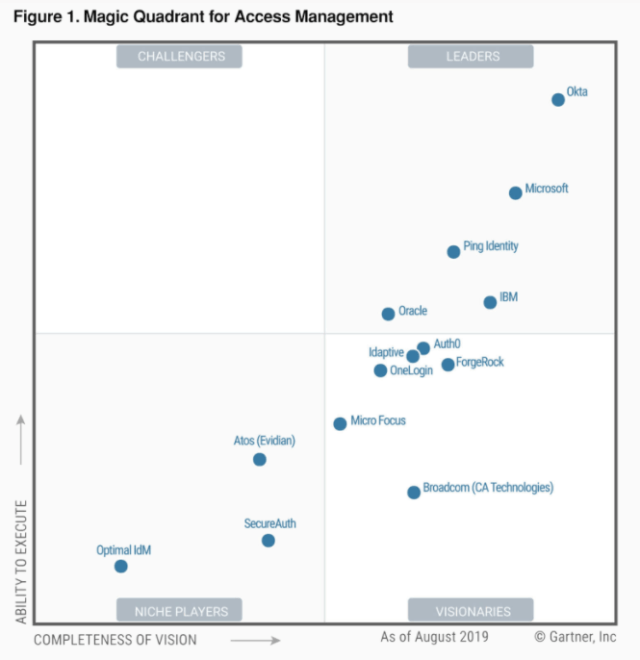

Looking at other sources of information, Gartner recognizes Okta as a market leader in its main market.

Source: Gartner

The company still has a long way to go until reaching its profitability targets, but Okta has been steadily and consistently making progress in terms of profitability over time, so the business is clearly moving in the right direction.

Source: Okta

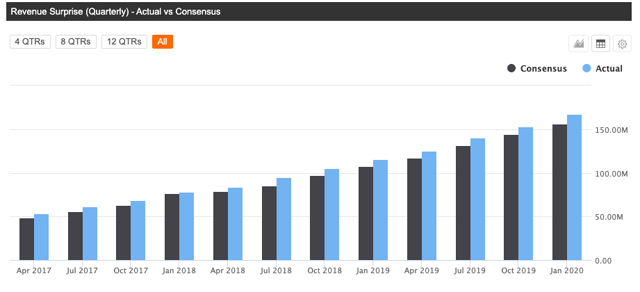

Okta has a relatively short history as a public company, but it is worth noting that the company has exceeded revenue and earnings estimates in each quarter since going public. This is indicating that management tends to provide modest guidance and to overdeliver over time, which is encouraging in terms of assessing Okta's ability to meet its targets going forward.

Source: Seeking Alpha

Risk and Reward

Okta is a market leader in an area with plenty of opportunities for growth in the years ahead. The company is firing on all cylinders and generating positive free cash flow, and there is a good chance that revenue growth will continue being strong while profit margins expand in the next 5 years. Vigorous top-line growth, in combination with expanding profit margins, will provide a double boost to earnings and cash flows.

Competition is always an important risk factor to watch, especially from large players with deep pockets such as IBM (NYSE:IBM) and Microsoft (Nasdaq:MSFT). These companies have a wide reach among large corporations all over the world, and they also have solid reputations for reliability.

However, Okta is a specialized player with the first-mover advantage in top quality identity services, and it benefits from remarkably high customer switching costs. Companies that are relying on Okta for their identity services would be very reluctant to change to another provider due to the risks and difficulties that this transition would potentially carry.

Besides, having a large customer base also means more usage data for Okta, and this data is enormously valuable when it comes to permanently improving the quality of the company's services. Considering the company's competitive strength and world-class technologies, it is not unreasonable to say that a big technology company such as Microsoft could be more interested in buying Okta than trying to compete aggressively in Okta's main areas of strength.

The biggest drawback is arguably valuation, since Okta is trading at a price to sales ratio above 30. The company is one of the most promising businesses in the industry, but this quality is also acknowledged by the market and incorporated into the stock price.

Okta can grow into its valuation over time, and there is a good chance that the stock will deliver double-digit returns over the long term from current price levels. But, still, the stock is fairly priced as opposed to undervalued at around $150 per share.

I am not against buying Okta at these prices, because the company has enough strength to outperform expectations in the future. After all, the best growth opportunities are seldom available at cheap valuations, and these kinds of companies can many times sustain rapid growth for longer periods than what the market is giving them credit for. The bar is set quite high for Okta, but the company does not lack the capability to overdeliver.

However, it is a more conservative assumption to estimate that revenue growth will be around 30% per year in the next five years, which would mean that the stock is fairly valued right now.

For those looking to start building a position in Okta at current prices, it makes sense to start doing it slowly. Perhaps buying one-third of your intended position at these prices and waiting for a better entry price over the middle term with the other two-thirds of the position.

One thing looks quite clear, though, Okta is a high-quality growth stock, and any pullback down the road could represent a remarkably attractive buying opportunity.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in OKTA over the next 72 hours.

Disclaimer: I wrote this article myself, and it expresses my own ...

moreComments

No Thumbs up yet!

No Thumbs up yet!