Oil And Equity Price Trend Conundrum

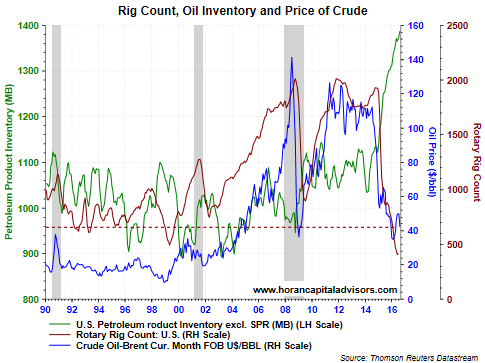

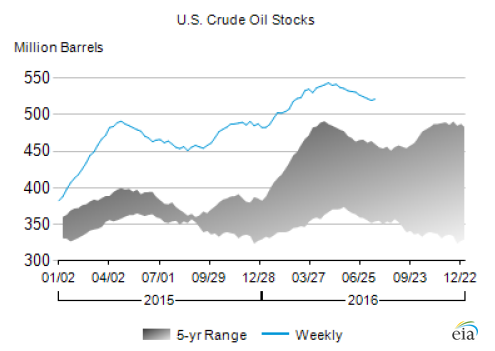

A part of the anticipated improvement in forward earnings for the S&P 500 Index is an improvement in the energy sector. The health in the energy sector has spillover into other sectors of the market like the industrial sector that sells into the energy space. Of late, however, oil prices have pulled back significantly from over $50/bbl in June and dropping below $40/bbl yesterday. This decline in price can be directly attributable to the elevated supply of crude.

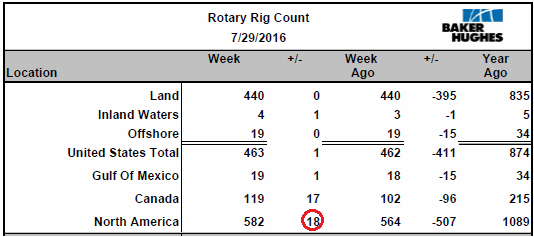

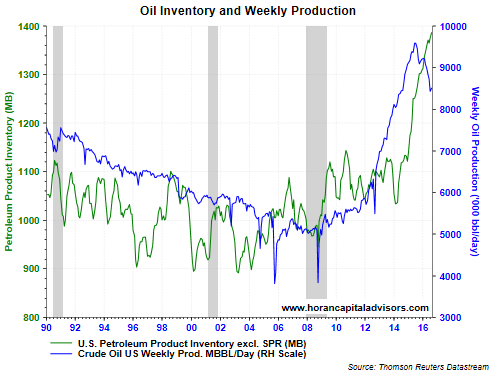

The maroon line in the above chart shows the dramatic decline in the Baker Hughes U.S. rotary rig count. In spite of the rig count decline, supply (green line) continues to increase nearly unabated; thus, keeping downward pressure on the per barrel price of crude oil. Disappointingly for oil investors, rig count has seen a recent uptick.

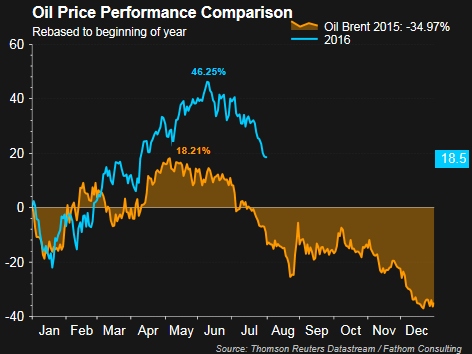

An uptick in rig count and continued supply growth has negatively impacted crude's recent performance. Crude's performance in 2016 seems to be following a similar path as crude's price movement in 2015.

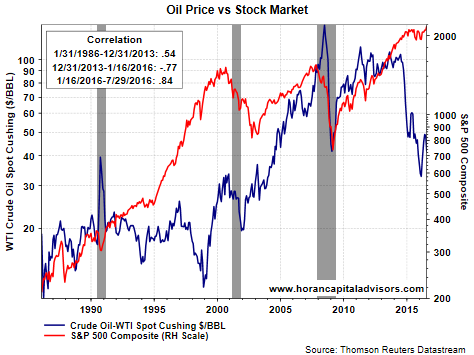

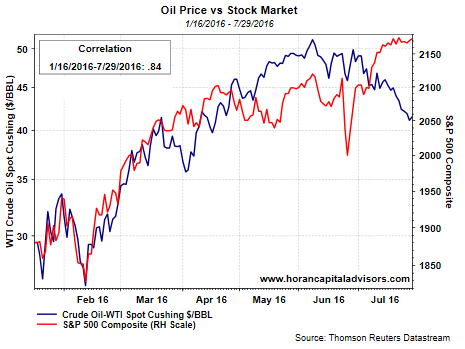

The equity market has a heightened focus on crude given the positive correlation between crude oil prices and the S&P 500 Index. Going back to 1996 the correlation of crude and the S&P 500 Index is +.37. During the fracking boom this correlation broke down and had a correlation of minus .77. In 2016 though, the correlation between the S&P 500 Index and oil again turned positive at a positive .84. So, this generally positive correlation between crude oil prices and the S&P 500 Index helps explain the investor focus on crude oil prices relative to equity prices.

And finally, a silver lining may be appearing in that weekly oil production has been in a year long decline. Unfortunately, overall inventory levels continue to increase and rig count has turned higher. If this decline in production is sustained, oil price stability could be realized and thus a continued advance in equity prices.

With the elevated supply level though, it will take sometime to work off excess inventory.

Disclosure: None.

Thanks for sharing