Nvidia: Why Almost $50 Billion In Sales Still Wasn't Enough

Image Source: Pexels

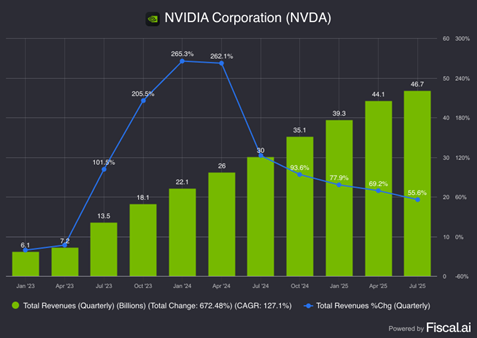

Nvidia Corp. (NVDA) nearly pulled in $50 billion, but was it enough? The stock fell after the initial release, where revenue came in as expected overall. The company also barely met or missed estimates for data center sales, depending on which analyst you talk to, explains Tom Bruni, editor-in-chief of The Daily Rip by Stocktwits.

The company pulled in revenue of $46.7 billion, up 56% year-over-year, with adjusted earnings per share of $1.05. The company expects Q3 revenue of $54 billion, plus or minus 2%, estimated at $53.4 billion. If that 2% give or take comes in low, it looks like the company is barely keeping up with expectations.

Data center revenue was $41.1 billion, missing some higher estimates of $41.3 billion. Nvidia did not generate revenue from H20 China sales, despite only receiving the ability to sell the chips in August. CFO commentary noted that the Q3 forward-looking revenue forecast did not include China chip sales.

Nvidia approved a $60 billion buyback, and it’s due to pay out 1 cent per share in dividends on Oct. 2. That’s just in time to buy Halloween candy -- or, in this case, enough for a single Skittle.

All in all, the company’s nearly $50 billion in revenue looks fantastic. But as Bloomberg analysts pointed out, Nvidia is the most highly valued public company. Plus, compared to last year’s 100%-plus jump in revenue, a 56% gain looks paltry for investors demanding more.

About the Author

Tom Bruni is editor-in-chief & VP of community at Stocktwits, the largest social network for investors and traders, where he leads the company’s newswire, newsletters, and other publishing efforts. For the last decade, Bruni has been at the intersection of finance and media, regularly featured in The Wall Street Journal, Bloomberg, Reuters, Barron’s, and more. He holds both CPA and CMT licenses and is co-chair of the NYC Chapter of the CMT Association.

More By This Author:

Traders: Money Flow Analysis Says To Focus On This Group Of StocksGDOT: A Compelling Turnaround Play In The Fintech Space

Bitcoin Vs. Ethereum: Why I'm Closely Watching Their Trading Relationship