Nvidia: What Was Good, What Was "Meh" In The Latest Earnings Report

Image Source: Pixabay

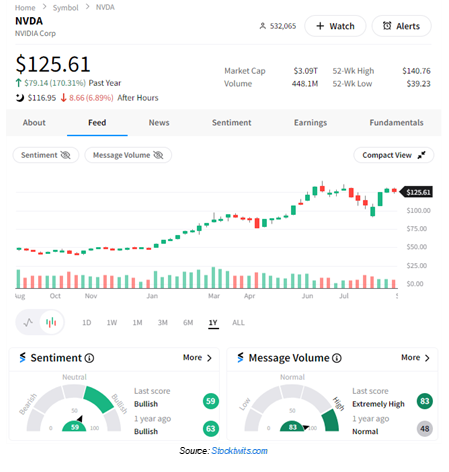

I’m going to quickly recap the biggest numbers and themes from Wednesday’s Nvidia Corp. (NVDA) report. Nvidia shares fell after it came out, though Stocktwits community sentiment seemed to remain in ‘bullish’ territory. We’ll have to wait and see how the stock reacts in the coming days, though for now, investors have been a bit on edge, notes Tom Bruni, head of market research at The Daily Rip by Stocktwits.

First, the company’s adjusted earnings per share of $0.68 on revenues of $30.04 billion topped the expected readings of $0.64 and $28.70 billion, respectively. Additionally, it’s expecting $32.50 billion in current-quarter revenue, representing 80% year-over-year growth and beating the $31.70 billion anticipated by analysts.

After three straight periods of 200% year-over-year growth, comps have clearly been getting a lot more difficult, with its sequential (quarter-over-quarter) growth also slowing. With Nvidia’s data center business now accounting for 88% of total revenues, the importance of its next-generation Artificial Intelligence (AI) chip, Blackwell, cannot be understated.

Nvidia's CFO said the company expects to ship several billions of dollars in Blackwell revenue, and CEO Jensen Huang added, “The change to the mask is complete. There were no functional changes necessary.”

On top of that, the company increased the size of its buyback program by $50 billion, adding to the recent authorization of $7.5 billion.

Despite the strong headline numbers and continued optimism from management, investors have been questioning just how sustainable the recent AI hype cycle can be, especially since it remains unclear when the technology will contribute to companies' bottom lines.

Super Micro Computer Inc.’s (SMCI) troubles have also been weighing on Nvidia, given it’s the company’s third-largest customer. Super Micro Computer dropped around 20% this week after delaying its annual report just a day after Hindenburg Research published a short report questioning the company’s accounting practices.

And speaking of AI, it’s worth noting OpenAI has been in talks to raise additional funds at a valuation above $100 billion. Clearly, the AI hype is still alive and well in the private markets.

About the Author

Tom Bruni is the head of market research at Stocktwits, where he publishes the brand’s flagship market recap newsletter, The Daily Rip, for one million subscribers and oversees the platform’s growing publishing efforts.

Mr. Bruni has been at the intersection of finance and media for the last decade, regularly featured in the Wall Street Journal, Bloomberg, Reuters, Barron’s, and more. He holds both CPA and CMT licenses and graduated with an accounting degree from Molloy University in 2016.

More By This Author:

Three Reasons Why I'm Less Worried About The US EconomyUse This ETF To Profit From Gains In Indian Stocks

We've Avoided Recession. But Investors Shouldn't Get Too Comfortable

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more