Nvidia Q1 Preview: Can Momentum Continue?

We’re through the bulk of the 2023 Q1 reporting cycle. So far, results have primarily been good enough to keep sentiment in check, with us avoiding the earnings ‘apocalypse’ many warned us of.

Of course, we’re not entirely out of the woods yet, with technology titan NVIDIA (NVDA) slated to reveal its Q1 results on Wednesday, May 24th, after the market’s close.

We’re all highly familiar with NVDA, the worldwide leader in visual computing technologies and the graphic processing unit (GPU) inventor. The company has gained widespread attention amid the artificial intelligence (AI) wave, helping shares deliver outsized returns year-to-date.

But how does the company shape up heading into earnings? We can use results from a peer, Advanced Micro Devices (AMD), as a small gauge. Let’s take a closer look.

Advanced Micro Devices

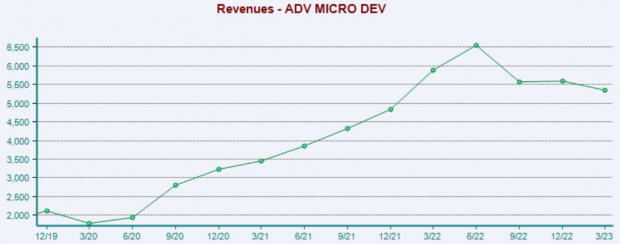

AMD posted results above expectations, exceeding the Zacks Consensus EPS Estimate by roughly 7%. Quarterly revenue totaled $5.3 billion, marginally above estimates and reflecting a 9% year-over-year pullback.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Shares didn’t see a great reaction initially post-earnings, as we can see illustrated by the green arrow circled in the chart below. Still, they’ve recovered nicely over the last several weeks.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Regarding segments, revenue from Data Center totaled $1.5 billion, roughly 11% below the Zacks Consensus Estimate. Further, AMD’s Embedded segment posted sales of $1.3 billion, down significantly year-over-year but exceeding the Zacks Consensus Estimate by more than 15%. Both segments are critical, accounting for over half of quarterly revenue.

AMD CEO Dr. Lisa Su said, “We executed very well in the first quarter as we delivered better than expected revenue and earnings in a mixed demand environment.”

NVIDIA

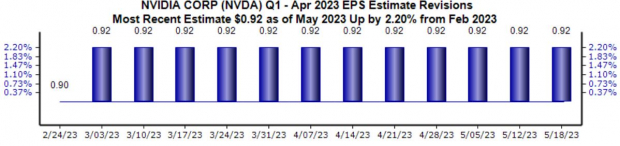

Analysts have been slightly bullish for the quarter to be reported, with the $0.92 per share estimate being revised higher by a modest 2.2% since the end of February this year.

(Click on image to enlarge)

Image Source: Zacks Investment Research

In addition, our consensus revenue estimate presently sits at $6.5 billion, reflecting a 21% pullback from the year-ago quarter. It’s worth noting that this estimate has been revised downwards by a marginal 0.2%.

Below is a chart illustrating the company’s revenue on a quarterly basis.

(Click on image to enlarge)

Image Source: Zacks Investment Research

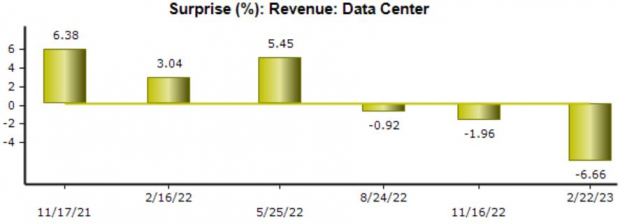

The company’s Data Center segment includes its AI operations; for the upcoming release, we expect Data Center revenue to reach $3.9 billion, reflecting a solid increase from the year-ago quarter. As shown below, NVDA has failed to exceed the Zacks Consensus Estimate for the segment in three consecutive quarters.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Of course, many will also closely monitor the company’s Gaming results as the PC market has rapidly cooled. We expect NVIDIA’s Gaming segment to post revenue of $1.9 billion for the quarter, down a steep 46% from the year-ago quarter.

Bottom Line

With earnings season winding down, market participants pivot their focus to NVIDIA, one of the last noteworthy tech companies yet to report.

A peer, Advanced Micro Devices (AMD), posted a double-beat but was negatively impacted by a slowing PC market.

Analysts have been slightly bullish for NVDA’s release, with the quarterly EPS estimate being revised marginally higher over the recent term. Heading into the release, NVIDIA (NVDA) is a Zacks Rank #3 (Hold) with an Earnings ESP Score of 2.4%.

More By This Author:

Dividend Stocks: The Surprising Truth3 Large-Cap Dividend Mutual Funds To Buy As A Crisis Looms

3 High-Yield Mutual Funds To Buy Amid A Volatile Market

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more