Nvidia Gains 12% In March: Will The Momentum Continue?

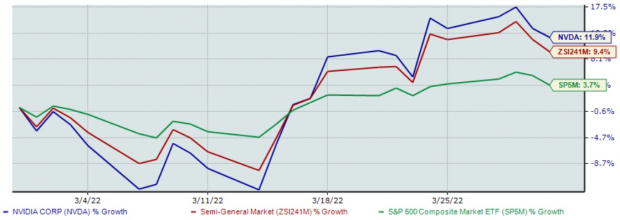

Nvidia Corporation’s (NVDA) stock outperformed the Zacks Semiconductor – General industry and S&P 500 in March 2022. Nvidia’s shares have surged 11.9% in the last month, while the Semiconductor - General industry increased 9.4%. NVDA stock also surpassed the S&P 500 index’s rise of 3.7%.

The stock’s outperformance reflects investors’ sustained confidence in the graphic chip maker at a time when the U.S. stock market has been rattled by the ongoing global macroeconomic and geopolitical uncertainties.

The year so far has been highly volatile for the U.S. stock market, with the global economy witnessing a massive slowdown due to the macroeconomic and geopolitical environment. Year to date, the Dow Jones Industrial Average, Nasdaq Composite and S&P 500 have plunged 4.2%, 8.8% and 4.6%, respectively.

The ongoing Russia-Ukraine war further increased worries for investors who were already concerned about global economic recovery due to increasing crude oil prices, rising inflation and a hawkish policy adopted by the Fed.

The aforementioned global macroeconomic and geopolitical uncertainties are likely to continue weighing on investors’ sentiments, which can result in more volatility in the U.S. equity market.

However, this volatility has created buying opportunities for investors. In the current scenario, investors can look for stocks with strong fundamentals that can stay afloat and grow once the impact of the aforementioned uncertainties cools off.

Considering Nvidia’s resilience against the ongoing macroeconomic and geopolitical uncertainties and its strong fundamentals, it is wise to continue investing in the stock for further gains. The company performed brilliantly last month and over the trailing 12 months and has the potential to continue the momentum as well.

Nvidia One-Month Stock Performance

(Click on image to enlarge)

Image Source: Zacks Investment Research

What’s Driving Nvidia Stock Higher?

Nvidia is the worldwide leader in visual computing technologies and the inventor of the graphic processing unit (GPU). The graphic chip maker is benefiting from the pandemic-induced work-from-home and learn-at-home wave. NVDA has been witnessing solid demand for GeForce desktops and notebook GPUs, which are boosting gaming revenues.

Moreover, a surge in Hyperscale demand is a tailwind for the company’s Data Center business. As more businesses shift to the cloud, the need for data centers is increasing immensely. To cater to this huge demand, data center operators are expanding their operations, which are driving demand for GPUs.

Nvidia GPUs are also gaining rapid traction with the proliferation of AI. The increasing use of AI tools in the data center, automotive, healthcare and manufacturing industries is expected to drive demand for GPUs in the long haul.

The expansion of Nvidia GeForce NOW is expected to drive the user base. Further, the solid uptake of AI-based smart cockpit infotainment solutions is a boon.

The company is also working with more than 320 automakers, tier-one suppliers, automotive research institutions, high-definition mapping companies and start-ups to develop and deploy AI systems for self-driving vehicles.

Impressive Growth Expectations

The Zacks Consensus Estimate of $5.55 per share for fiscal 2023 earnings suggests growth of approximately 25% from the year-ago period. For fiscal 2024, the consensus mark for earnings is pegged at $6.37, indicating a year-over-year increase of 14.7%. The long-term earnings per share growth rate is estimated at 16.8%.

Nvidia has an impressive earnings surprise history. The company outpaced estimates in all the trailing four quarters, delivering an average earnings surprise of 7%.

Analysts have raised estimates for fiscal 2023 and fiscal 2024 over the past 60 days, reflecting their confidence in the company. During the same period, the Zacks Consensus Estimate for fiscal 2023 and 2024 earnings has moved north by 39 cents and 46 cents per share, respectively.

Zacks Rank & Other Stocks to Consider

Nvidia currently sports a Zacks Rank #1 (Strong Buy).

Some other top-ranked stocks from the broader technology sector include Jabil (JBL) , Broadcom (AVGO) and Apple (AAPL). While Jabil sports a Zacks Rank #1, Broadcom and Apple each carry a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for Jabil’s third-quarter fiscal 2022 earnings has been revised upward to $1.62 per share from $1.46 30 days ago. For fiscal 2022, earnings estimates have been revised upward by 67 cents to $7.25 per share in the past 30 days.

Jabil’s earnings beat the Zacks Consensus Estimate in the preceding four quarters, the average surprise being 13.5%. Shares of JBL have rallied 6.8% in March.

The Zacks Consensus Estimate for Broadcom’s second-quarter fiscal 2022 earnings has been revised upward by 10.2% to $8.64 per share over the past 30 days. For fiscal 2022, earnings estimates have moved upward by 7.1% to $35.49 per share over the past 30 days.

Broadcom’s earnings beat the Zacks Consensus Estimate in the preceding four quarters, the average surprise being 1.9%. Shares of AVGO have rallied 7.2% in the last month.

The Zacks Consensus Estimate for Apple’s second-quarter fiscal 2022 earnings has been revised upward by seven cents to $1.43 per share over the past 90 days. For fiscal 2022, earnings estimates have moved upward by a penny to $6.16 per share in the past 60 days.

Apple’s earnings beat the Zacks Consensus Estimate thrice in the preceding four quarters while meeting the same on one occasion, the average surprise being 20.3%. AAPL stock has soared 5.8% in March.

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more