Nvidia Crashes $1 Trillion Party, Perhaps Not For Long

Image Source: Unsplash

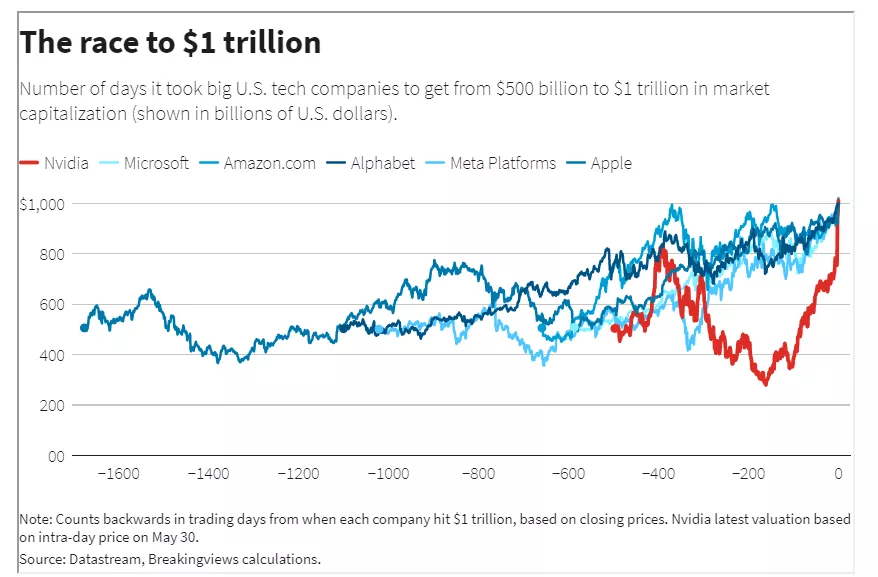

Nvidia (NVDA) has made a boisterous entry to the $1 trillion club, but it might not remain there for long. The chipmaker on Tuesday joined Apple (AAPL), Alphabet (GOOGL), Amazon.com (AMZN), and Microsoft (MSFT) in the elite gang of firms with a thirteen-digit market capitalization. But given its fast and choppy ascent, Nvidia’s experience might prove more like that of electric-vehicle maker Tesla, which crashed the mega-stock party, only to find itself out on the curb not long after.

While Nvidia has been around for ages – it was founded in 1993, making it older than Amazon and Alphabet – its valuation growth of late has been prodigious. The company’s revenue has expanded at an average annual rate of around 20% for decades. But demand for Nvidia chips got a boost during the pandemic, driven by demand among cryptocurrency miners. A global chip shortage propelled Nvidia still higher. And now an AI boom has really put a rocket under Nvidia’s valuation. The company expects sales to grow more than 60% this quarter. Its trip from $500 billion to $1 trillion has taken about 500 days, which is about one-third of what it took Apple.

What goes up quickly can come down quickly though. Nvidia trades at 40 times estimated EBITDA over the next 12 months, about twice as much as its peers. Should growth or exuberance take a hit, it could drop out of the trillion-dollar club. Unlike Apple or Google-owner Alphabet, the brand has little consumer cachet to fall back upon. Because it mostly makes hardware, unlike Amazon or Microsoft, supply-chain disruptions are an ever-present risk. Plus, from cryptocurrency to AI, it is going from one spectacular fad to another. Founder Jensen Huang worked hard to get into the trillion-dollar party, but he should fill his pockets with canapés while he can.

Context News

Nvidia’s market capitalization passed $1 trillion on May 30. The semiconductor firm designs chips for graphics, networking, and training artificial intelligence systems. It said on May 24 it expected revenue in the current quarter to increase about 64% from the same period last year to around $11 billion. Alphabet, Amazon.com, Apple, and Microsoft are the four other United States-based companies worth over $1 trillion, according to Refinitiv data.

More By This Author:

STOXX 600 Earnings Outlook 23Q1 - Tuesday, May 30What’s Driving UK Investor Equity Exposure, And Where Is It Heading?

Q1 2023 U.S. Retail Scorecard – Saturday, May 27