Nvidia And 2 Other Tech Reports To Watch Next Week

Image Source: Pixabay

The 2025 Q2 earnings season is entering its closing act, with just a handful of S&P 500 companies yet to reveal their results at this stage. The period has been one of resilience, with an above-average number of companies exceeding expectations alongside favorable top and bottom line growth rates.

And looming large next week is NVIDIA (NVDA - Free Report) , undoubtedly one of the most important reports we’ll receive concerning Q2 results. A lot rides on the AI favorite’s results for obvious reasons, likely to dictate the next move of the broader AI trade overall.

Let’s take a closer look at what analysts expect for the titan.

NVIDIA Expectations

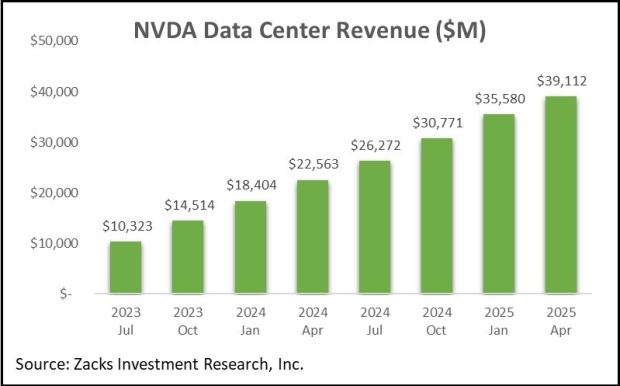

Snowballing demand for its Data Center products has been the name of the game for NVIDIA over recent years, posting unbelievable growth. The AI poster child again delivered rock-solid results in its latest quarterly report, with Data Center sales of $39.1 billion reflecting a 73% increase from the $22.5 billion reported in the same period last year.

Below is a chart illustrating NVIDIA’s Data Center sales on a quarterly basis. The growth here has been spectacular given NVIDIA’s size, helping underpin the bright outlook many forecast for the technology in the coming years.

Our consensus estimate for Data Center sales stands firm at $40.9 billion, 55% higher than the year-ago figure of $26.3 billion. Growth remains robust.

Image Source: Zacks Investment Research

Importantly, shares aren’t expensive on a historical basis heading into the print, with the current 36.8X forward 12-month earnings multiple well below the five-year median and steep five-year highs of 106.3X. Relative to the S&P 500, the multiple reflects a 63% premium.

Image Source: Zacks Investment Research

It’s worth noting that NVDA shares traded well above current valuation levels in 2020 and 2021, a period when the AI theme had yet to emerge and when shares were primarily driven by its gaming results, which have quickly become a smaller part of its overall business.

The current PEG ratio works out to 1.3X, again beneath the five-year median and steep five-year highs of 5.5X. A higher multiple for NVDA isn’t concerning given its forecasted growth, with investors having little issue forking up a premium to obtain exposure to the AI frenzy.

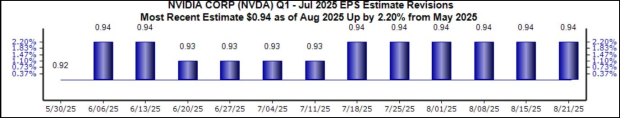

Analysts have primarily remained silent concerning their EPS revisions, with the current $0.94 Zacks Consensus EPS estimate up just a few pennies since the beginning of June but suggesting 47% YoY growth.

Below is a chart illustrating the EPS revisions trend since the beginning of June.

Image Source: Zacks Investment Research

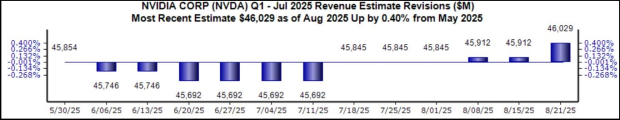

More surprisingly, analysts have also been primarily muted concerning their revenue expectations as well, with the $46.0 billion expected up 0.4% over the same timeframe and suggesting 53% YoY growth.

But as shown below, positive revisions hit the tape following the release of a few other AI-related companies, undoubtedly a bullish takeaway.

Image Source: Zacks Investment Research

While revisions haven’t been heavily skewed to the upside, the stability here for both the top and bottom line is also a positive takeaway, particularly following the release of other companies’ results throughout the Q2 cycle.

Keep in mind that NVDA also pays a small dividend. While the yield may be muted, the stock remains one of the strongest plays on the AI frenzy out there, providing a stellar blend of growth paired with income-generating abilities.

Other Important Tech Companies Reporting

In addition to beloved NVIDIA, we’ve got a few other tech names on the docket this week, including CrowdStrike (CRWD Quick QuoteCRWD - Free Report) and Snowflake (SNOW Quick QuoteSNOW - Free Report) .

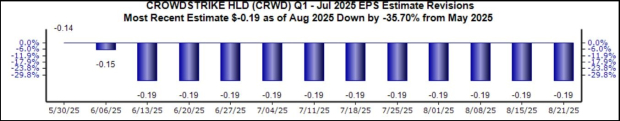

Concerning CrowdStrike, the company is expected to see a 20% decline in adjusted EPS on 19% higher sales. Analysts have been notably bearish for CrowdStrike’s release, with the -$0.19 per share loss expected down 35% since the beginning of June.

Image Source: Zacks Investment Research

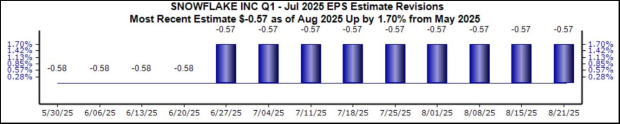

Concerning Snowflake, current expectations allude to 44% adjusted EPS growth on 24% higher sales, with the stock also presently sporting a Style Score of ‘B’ for growth. Analysts have been more bullish on Snowflake’s release, with both EPS and sales expectations getting revised higher over the same timeframe.

Image Source: Zacks Investment Research

Bottom Line

The 2025 Q2 earnings season is nearing its end, but we’ve still got beloved NVIDIA (NVDA) to report. It’ll wrap up for the reporting period for the broader Mag 7 group, whose results were again positive throughout the Q2 cycle.

Outside of NVIDIA (NVDA) , several notable tech stocks – Snowflake (SNOW - Free Report) and CrowdStrike (CRWD - Free Report) – are also on the docket.

More By This Author:

Earnings Season Matters, Why?

4 Traits Outperforming Stocks Possess

Walmart & Target Earnings: Will Performance Disparity Continue?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more