NVDA To The Rescue, But Bitcoin Spoils The Fun

Image Source: Unsplash

When I sat down to dinner with friends last night, one of them greeted me with “we just avoided a crash, didn’t we?”He was of course referring to the positive response to Nvidia’s (NVDA) earnings report yesterday afternoon.Had the data or guidance disappointed, or had Jensen Huang been less strident in his assertions about the lack of an artificial intelligence bubble, a psychologically fragile market could have tumbled.Unfortunately, a slip in a theoretically uncorrelated asset spoiled the morning.

After I began this piece, a troubling phenomenon occurred. Shortly before 11 a.m. EST, I was on a call, being asked about the rebirth of equity market enthusiasm in the wake of good reports from NVDA, Walmart (WMT), and the overdue September jobs data.At that point S&P 500 (SPX) was trading about 1.5% higher.My counterpart asked if I thought the rally could continue, and I said while it was possible, I was becoming concerned because bitcoin was once again flirting with the $90,000 level after rallying earlier in the morning.He asked if I really thought that a break in bitcoin could affect the entire US stock market, and I said, “unfortunately, yes.It’s become such a proxy for speculation that I can’t be the only person using it as a signal.”For better or worse, I was proven correct almost immediately when SPX gave back more than half its gains in minutes.Since then, the rout has continued.

As a long-time systematic trader, it tells me that algorithms are acting upon the relationship between stocks and bitcoin. Traders have always sought to find relationships between asset classes, and there are teams of skilled quants who pore through data, both long- and short-term, seeking inputs that guide their decisions.We called them “leads.”

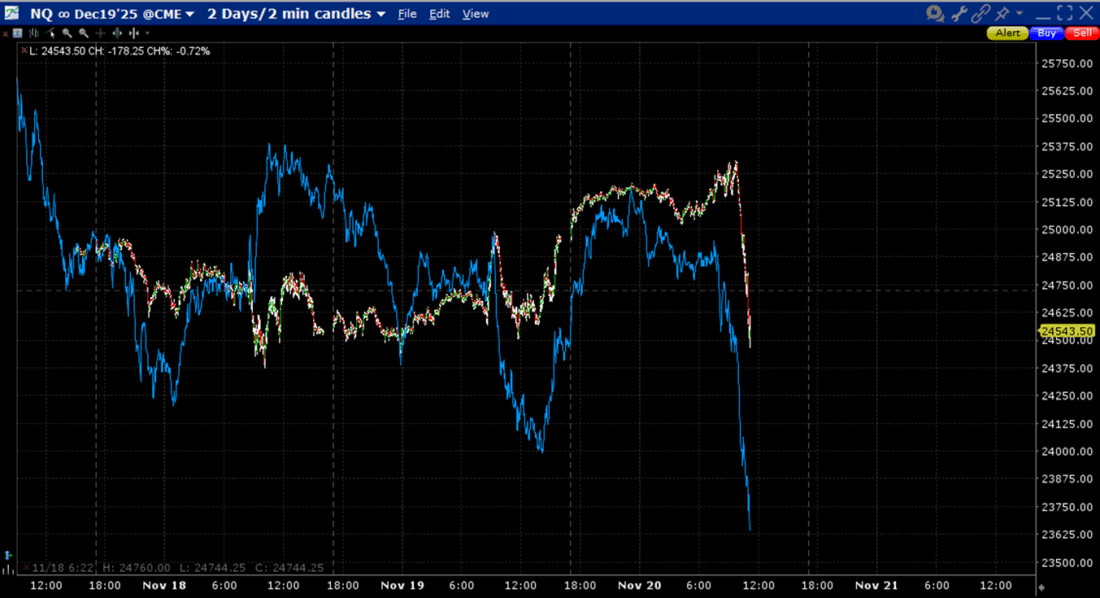

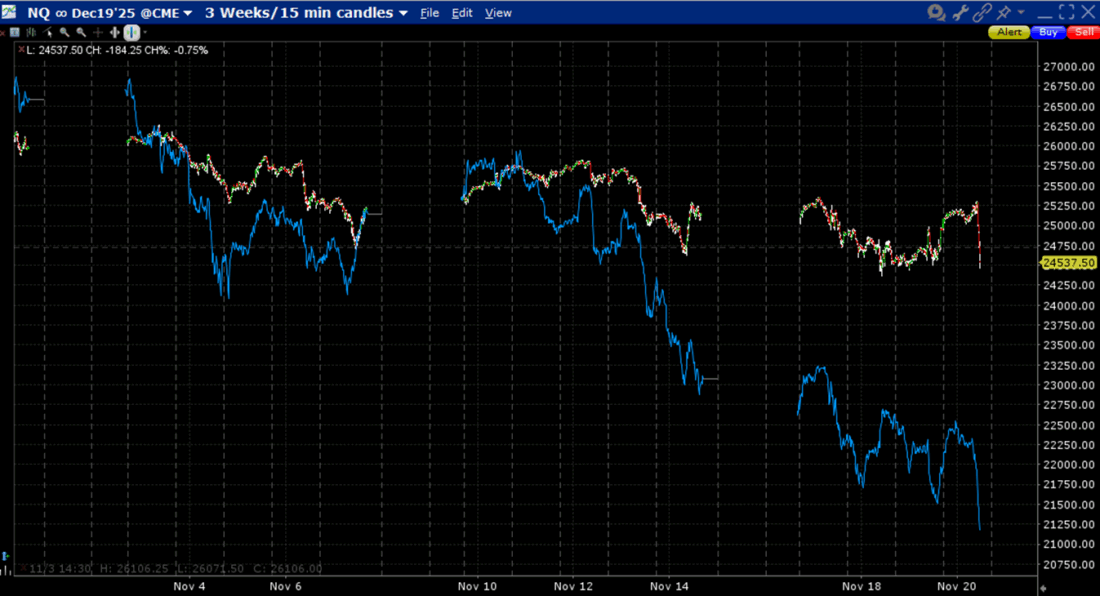

The most reliable short-term lead was typically the spread between SPX futures and the index level.If it moved to a premium or discount, the index would typically follow.But it is normal for other factors to influence market psychology in any given day, week, or month.Those can include bond yields of different tenors, currency pairs, or something completely different, and those have a way of changing from time to time.In recent days, bitcoin has become one of the most reliable leads. Note how the moves in bitcoin and futures on the Nasdaq 100 (NQ) line up almost perfectly over both the 2-day and 3-week periods.

While correlation is not causality, that can become the case if traders large and small are using that as a basis for their decision making.

2-Days, NQ December Futures (red/green candles), Bitcoin (blue line)

(Click on image to enlarge)

Source: Interactive Brokers

3-Weeks, NQ December Futures (red/green candles), Bitcoin (blue line)

(Click on image to enlarge)

Source: Interactive Brokers

This morning’s stunning reversal is a sign that market psychology has become quite brittle. If investors were truly enamored with NVDA’s results and the assurances about the lack of an AI bubble, then by no means would we have succumbed to an algorithmic quirk so quickly. We might have seen a bit of a blip lower but carried on nonetheless.Instead, we got a complete reversal and then some.Meanwhile, because the correlation is being led by NDX, WMT remains over 5% higher as I type this.Ironically, that could change. WMT announced that it will be moving from the NYSE to Nasdaq, which would then make it eligible for inclusion in NDX. But with a market cap of about 1/10 that of NVDA, the megacap techs will continue to dominate the key indices and investor psyche.

More By This Author:

Happy Nvidia Day (For Those Who Celebrate)Nvidia Earnings Test The S&P 500’s Top-Heavy Reality

Investors Bought The Rumor But Sold The News

Disclosure: The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the ...

more