Nucor To Report Q1 Earnings: What's In The Cards?

Nucor Corporation (NUE - Free Report) is set to release first-quarter 2024 results after the closing bell on April 22.

The U.S. steel giant surpassed the Zacks Consensus Estimate in each of the trailing four quarters. It has a trailing four-quarter earnings surprise of 9.9%, on average. It posted an earnings surprise of 11.7% in the last reported quarter. Higher earnings in the steel mills segment on increased selling prices and volumes are likely to have supported its first-quarter results.

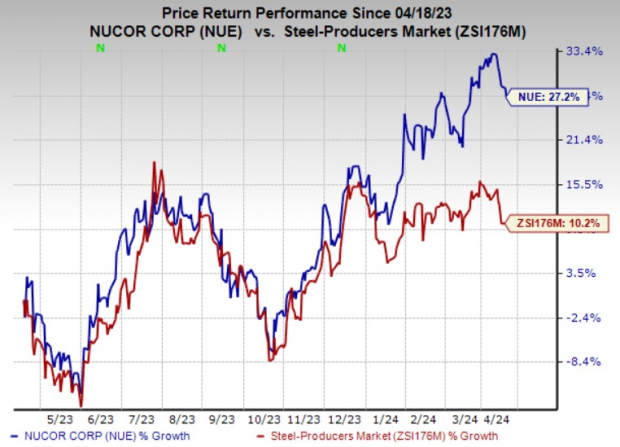

Nucor’s shares are up 27.2% over a year, compared with the industry’s 10.2% rise.

Image Source: Zacks Investment Research

Let’s see how things are shaping up for this announcement.

Zacks Model

Our proven model predicts an earnings beat for Nucor this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earning beat.

Earnings ESP: Earnings ESP for Nucor is +0.64%. The Zacks Consensus Estimate for the first quarter is currently pegged at $3.62. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Nucor currently carries a Zacks Rank #3.

What do the Estimates Say?

Nucor, last month, issued its earnings guidance for the first quarter. It anticipates first-quarter earnings in the range of $3.55-$3.65 per share.

The Zacks Consensus Estimate for first-quarter consolidated revenues for Nucor is currently pegged at $8,040.8 million, reflecting a year-over-year decline of 7.7%.

A Few Factors to Watch

Increased profitability in the steel mills segment is expected to have aided Nucor’s performance in the quarter to be reported. Nucor, in March, said that it expects an increase in the steel mills segment’s earnings, driven by higher average selling prices and volumes, particularly in sheet mills.

Our estimate for sales tons to outside customers for steel mills is pegged at 4,639,000 tons for the first quarter, suggesting a rise from 4,396,000 tons reported in the prior quarter.

However, NUE sees lower earnings in the steel products segment due to lower average selling prices and lower volumes. Earnings in the raw materials segment are projected to remain comparable to fourth-quarter 2023 levels, with improved performance in DRI facilities anticipated to be offset by lower margins in scrap processing operations.

Meanwhile, U.S. steel prices rebounded in late 2023 with the benchmark hot-rolled coil (HRC) prices breaking above $1,000 per short ton in December, driven by U.S. steel mills’ price hike actions, supply tightness and a recovery in demand. The recovery is also being supported by the resolution to the United Auto Workers (UAW) strike. Notably, the UAW reached a deal with the Detroit Big Three in November 2023, ending the roughly six-week strike that weighed on the U.S. steel industry due to a slowdown in automotive demand.

Despite the recent pullback in HRC prices partly due to easing mill lead times, NUE is expected to have benefited from higher selling prices in the to-be-reported quarter. Our estimate for first-quarter average sales price per ton for the company’s steel mills unit stands at $1,155, suggesting an 11.6% year-over-year increase a 13.8% sequential rise.

Nucor Corporation Price and EPS Surprise

Nucor Corporation price-eps-surprise | Nucor Corporation Quote

More By This Author:

3 Must-Buy Funds With Retail Sector Staging Solid Rebound4 Stocks To Buy From The Booming Water Supply Industry

Airline Stock Roundup: Delta's Q1 Earnings Beat, Spirit Gives Fleet Updates

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more