NTRS: An Asset Servicing And Wealth Management Behemoth Active Worldwide

Image Source: Pixabay

Northern Trust Corp. (NTRS) provides wealth management, asset servicing, asset management, and banking solutions to corporations, institutions, families, and individuals. The company was formed in 1971 and has a global presence, including offices in 25 US states and 23 other locations across Canada, Europe, the Middle East, and Asia-Pacific.

NTRS organizes its services globally around its two principal business units: Asset Servicing (AS) and Wealth Management (WM). AS is a leading worldwide provider of asset servicing, asset management, and related services to corporate and public entity retirement funds, foundation and endowment clients, fund managers, insurance companies, and government funds.

As of Dec. 31, 2023, AS assets under custody/administration (AUC/A) were $15.4 trillion and assets under custody (AUC) were $11.9 billion. AS also offers a full range of commercial banking services through the bank, placing special emphasis on developing and supporting institutional relationships in two target markets: large- and mid-sized corporations and financial institutions (both US and non-US).

WM provides personal trust, investment management, custody, and philanthropic services; financial consulting; guardianship and estate administration; qualified retirement plans; brokerage services; and private and business banking.

WM focuses on high-net-worth individuals and families, business owners, executives, professionals, retirees, and established privately-held businesses in its target markets. WM is one of the largest providers of advisory services in the US, with AUM of $1.4 trillion with asset servicing at $1 trillion and wealth management at $403 billion.

Asset Management (AM) supports both the AS and WM reporting segments by providing a broad range of asset management and related services around the world. AM’s capabilities include active and passive equity; active and passive fixed income; cash management, multi-asset, and alternative assets; and multi-manager advisory services and products.

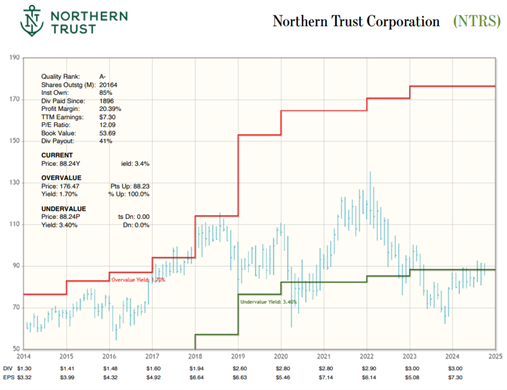

The ROIC, FCFY, and PVR is 9%, 4%, and 1.1 respectively. The Economic Book Value is $77.13 per share.

Recommended Action: Buy NTRS.

More By This Author:

MCD: A Great Example Of The Power Of Dividends And CompoundingBCYC: A Promising Play In The Biotech Sector

Coherent Corp: A Semiconductor Star Benefiting From Several Key Tech Trends

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more