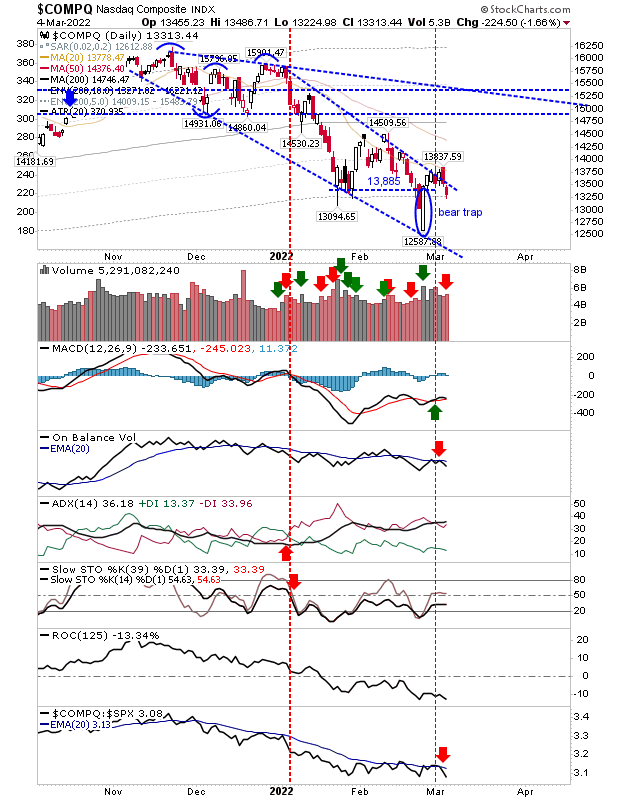

Now We Will See How Strong The Late February Reversal Is

After the big surge off the February lows on higher volume accumulation, we will now see how robust such demand is with markets edging back towards those February lows.

The Nasdaq is looking the most vulnerable, as it has already cut below support which defined the 'bear trap.' The breach was relatively minor from a price perspective, but it did come with a higher volume distribution and a 'sell' trigger in On-Balance-Volume. Relative performance took a sharp tick lower. Again, it's early days and the bullish reversal is not immediately at risk here.

Next up is the S&P 500. It closed Friday with a small bullish 'hammer' -- although the bullishness of this hammer is weakened by middling momentum -- it did occur above the support level defining the 'bear trap.'

There was also confirmed distribution which is feeding into a longer bearish trend in On-Balance-Volume. This index is holding to its MACD trigger 'buy,' and it is close to reasserting its leadership role relative to the Russell 2000.

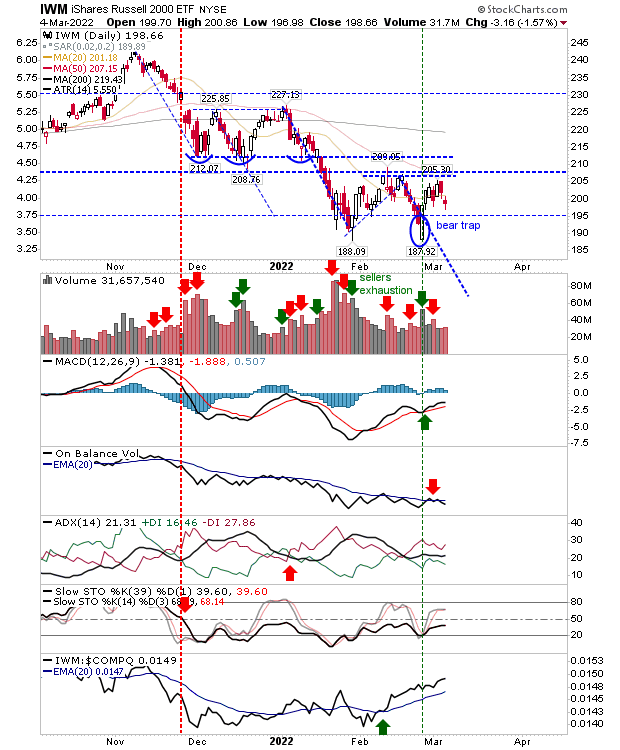

The Russell 2000 continues to put in solid leg work as Friday's doji kept the index well above 'bear trap' support and gave the index a little uptick in relative performance over the Nasdaq. The index hasn't quite stalled the bearish trend in On-Balance-Volume, and aside from the MACD trigger 'buy,' it still has bearish technicals, but bullish confidence is rising despite world events.

Obviously, there is a huge amount of global uncertainty and we still have a long way to go before there is a resolution -- or something worse. Markets have been remarkably resilient to these events.

Remember, when you look at historic price charts and see market lows, you forget the negativity which surrounds markets at these times, particularly given the 24-hour news cycle we live in. I do like the action in the Russell 2000, and as long as it can hold the 'bear trap,' it will be in good shape going forward.

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more