Now Is The Time To Buy This AI Healthcare Company

There is perhaps no more exciting trend in technology today than the growing use of artificial intelligence (AI) in healthcare.

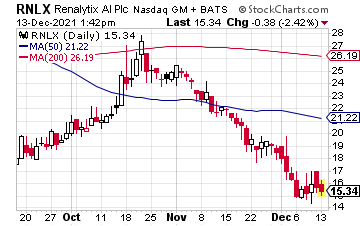

And what is especially exciting is the fact that my favorite stock in this sector has been beaten down by Wall Street from a high of over $35 a share to around $15 a share currently.

Renalytix AI PLC (RNLX) hails from the U.K., and its machine learning algorithm identifies patients that are at risk of developing chronic kidney diseases.

Let’s take a dive into exactly what is unique about the Renalytix’s technology—and why the company is sitting in the proverbial catbird seat, thanks to demographics.

Renalytix’s KidneyIntelX

Renalytix’s kidney diagnostic product, KidneyIntelX, uses a machine learning algorithm that checks blood markers and compares them against patient medical histories to provide a kidney health risk score. There are currently no other products on the market than can do this.

And here’s what caught my eye: peer-reviewed clinical studies found that KidneyIntelX is 72% more effective than the current standard of care in identifying early-stage patients at high risk for kidney disease progression and kidney failure.

This technology is needed immediately and here’s why…

Diabetes, a major cause of chronic kidney disease, is a large and growing problem, particularly here in the U.S. where Renalytix’s sales efforts are currently focused.

In the U.S., the CDC estimates that one in 10 people have diabetes and one in three have pre-diabetes. Among diabetes sufferers, 37% have chronic kidney disease (CKD). But only a quarter of those with moderate to severe CKD even know they have it!

This makes for a hugely expensive problem, as CKD becomes more expensive the longer it goes on undetected. And this makes CKD one of the largest cost drivers in the entire U.S. medical system. The reason is that, as well as the cost of drugs, late-stage CKD patients will likely eventually need weekly dialysis sessions.

That’s why catching patients that are at risk early and providing them with interventions to prevent CKD from worsening (or perhaps even from developing in the first place) is so important.

In other words, early detection (with KidneyIntelX) will save both lives and money.

KidneyIntelX Adoption

Both insurance companies and governments are catching on to the usefulness of Renalytix’s tech.

The company already has a 10-year government-wide contract with the U.S. General Services Administration (GSA) for KidneyIntelX at $950 per test. This applies to more than 140 government agencies, including a deal with the U.S. Veterans Association (VA), which provides healthcare services to 9 million veterans each year through 1,293 healthcare facilities. KidneyIntelX is also an accepted provider in 27 Medicaid state programs.

Private sector insurance firms are also jumping on board. Twenty private health insurance providers have agreed to cover KidneyIntelX, including HealthFirst, one of New York State’s largest not-for-profit health insurance companies with more than 1.5 million members.

However, despite all this good news, Renalytix is still at a pre-commercial stage in its development.

In its fiscal year through June 30, 2021, it generated just $1.5 million in revenue. Administrative expenses were $33.3 million, which contributed to losses for the period increasing to $31 million from $9.25 million.

The increase in administrative expenses was necessary and largely driven by the hiring of salespeople. This is a logical step in Renalytix’s development and the early signs are that it is paying off. The company this year has signed significant partnerships with hospitals.

For example, in September, the Mount Sinai Health Systems announced it would be targeting 300 KidneyIntelX tests per week and estimated 6,000 tests to be complete by the end of 2022. At $950 a test, this would generate $5.7 million of annual sales for Renalytix.

Deals have also been signed with Atrium Health, Wake Forest Baptist Health, and the University of Utah. All these hospital systems plan to run live testing starting this month and will allow KidneyIntelX to be provided at 37 hospitals.

Renalytix’s Buffett Moat?

I believe Renalytix has the potential to become a “Buffett moat” type of company.

As the first kidney diagnostic product to use machine learning, Renalytix has the opportunity to build a first-mover advantage since the quality of a machine learning algorithm is only as good as the volume and quality of the data that is fed into it. So, Renalytix collects more data, the product should continuously improve.

Over time, the data can be used to improve diabetes and kidney treatment. For instance, if a patient is tested every couple of years using KidneyIntelX, the doctors will be able to evaluate the quality of treatment by looking at how specific blood markers change in response to it.

And think about Renalytix’s potential market: it is estimated that chronic kidney disease affects 40 million people in the U.S. every year. If even half of those patients were to get KidneyIntelX tests every five years at the price of $950, that would generate almost $2 billion of sales for Renalytix.

And there is also the possibility too of the future commercialization of the medical data collected over time.

I expect Renalytix to turn profitable in 2024. Its current market cap of around $560 million could look minuscule if its full potential is realized. Any buy under $20 a share is a bargain.

Disclaimer: Information contained in this email and websites maintained by Investors Alley Corp. ("Investors Alley") are provided for educational purposes only and are neither an offer ...

more