Not So Downbeat After A Downgrade

Image Source: Unsplash

If you slept late this morning, you missed most of it. Pre-market ES futures, which were down about -1.5% when I first checked this morning, seemed once again to wake up when US-based traders did the same.And now, about 90 minutes after the open, we’ve recouped almost all the early losses.Buy-the-dip strikes again.

The dip buying was not only seen in equities, but also in bonds. The latter part is more significant. The Moody’s downgrade, which removed the last AAA rating from US Treasuries after Friday’s close, directly addresses interest rate risks, not the stock market. That said, something that could negatively affect the creditworthiness of the USA has ramifications throughout the economy.If the “risk-free” rate is no longer quite as risk-free, that raises the cost of capital for everyone, which of course is a negative for all financial assets. Then late last night, the House budget bill, which has the potential to further expand the deficits that concerned Moody’s, passed through a committee vote that had previously failed.

Thus, a negative start for index futures. But the pattern of dip buying in stocks is quite well established at this point:

- Let pesky foreigners sell overnight

- Wake up and buy futures (optional: make coffee, brush teeth, shower)

- Watch for 8:30 economic news

- If positive, buy more

- If negative, wait for dip, then buy more

- Chase rallying markets after stock market opens

- Rinse, repeat

I’m of course being facetious, but it is not necessarily that far off from the now-routine behavior patterns we see.And the more a pattern works, the more it gets reinforced.

Yet we do have the aforementioned improvement in the bond market to thank for the sustainability of this morning’s bounce.Earlier today we saw yields higher across the curve, with notable steepening at the long end.At their worst, around 9:00 EDT, 10- and 30-year yields were about 10 basis points higher, while 2-years were up about 4bp. All three were breaching some key psychological levels — 2-yr > 4%, 10-yr > 4.5%, 30-yr > 5% — but they had all retreated below those points by about 10am. That justifiably bolstered the move in stocks.

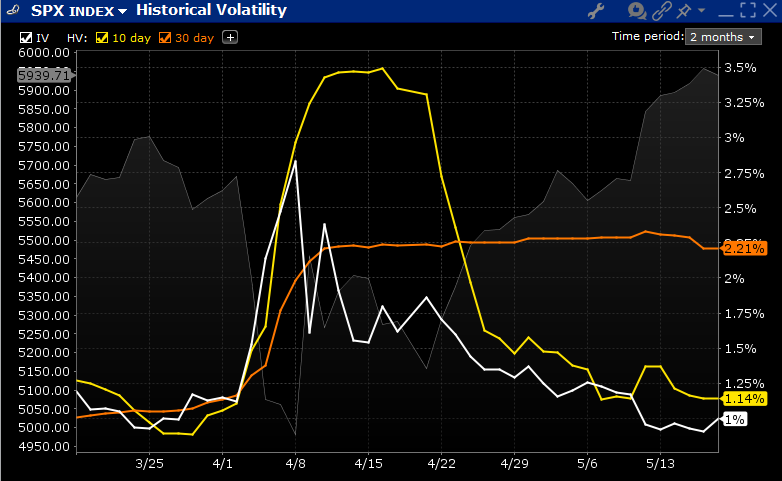

Despite the overnight jitters, VIX never cracked 20.Traders are pricing in a bit more volatility, but there is still not significant demand for hedges.Remember, despite the past volatility, VIX, which is a 30-day lookahead, has only moved from portraying relative complacency to very slight jitters.Traders are focused much more upon the recent plunge in short-term volatility than on the medium-term, as shown in the graph below:

SPX Volatility, Implied (white, right scale), 10-Day Historical (yellow, right), 30-Day Historical (orange, right); SPX Index (faint grey, left scale)

(Click on image to enlarge)

Source: Interactive Brokers

Traders are going to keep doing what works for them until it no longer does.And apparently, with bond traders’ help, a downgrade was not enough to seriously disturb the usual patterns.

More By This Author:

The Buyers Are Us

All Tariff News Is Now Good News

Prepping For A Big Week

Disclosure: The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the ...

more