Not So Crafty -- Budweiser Fumbles SuperBowl Commercial

Anheuser-Busch (BUD) is the leading global brewer and one of the world's top five consumer products companies. Their portfolio of well over 200 beer brands continues to forge strong connections with consumers. They invest the majority of their brand-building resources on their Focus Brands - those with the greatest growth potential such as global brands Budweiser, Stella Artois and Becks, alongside Leffe, Hoegaarden, Bud Light, Skol, Brahma, Antarctica, Quilmes, Michelob Ultra, Harbin, Sedrin, Klinskoye, Sibirskaya Korona, Chernigivske, Hasserder and Jupiler. In addition, the company owns a 50 percent equity interest in the operating subsidiary of Grupo Modelo, Mexico's leading brewer and owner of the global Corona brand.

AB-InBev, like so many macro brewers, has been unable to address the problem of falling market share and popularity amongst young and old drinkers alike. Once a mainstay of the US market, AB-InBev's Budweiser is under assault from upstart craft brewers, whose segment keeps growing by leaps and bounds. In fact, in 2013 sales of craft beer exceeded those of Budweiser.

In the past, BUD has responded by acquiring craft brewers and adding them to their stable of brands. However, this past weekend the company embarked on another path with its highly controversial Super Bowl commercial, "Brewed the Hard Way." The ad, replete with images of bearded, plaid-clad "hipster" craft-beer drinkers, essentially mocked both craft beer and craft- beer consumers.

Reaction so far has been negative, with many analysts noting that AB's commercial even attacked a style of beer manufactured by its most recent craft acquisition, Elysian Brewing. This is doubly problematic given the fact that many craft drinkers refuse to indulge in a craft brewery's offerings--no matter how good in the past--once it is acquired by a large macro concern. Elysian Co-Founder Dick Cantwell noted that "it doesn't make our job any easier, and it certainly doesn't make me feel any better about a deal I didn't even want to happen. It's made a difficult situation even more painful."

Judging from the SuperBowl ad, AB-InBev remains clueless as to how it should address the changing tastes and demographics of the US beer consumer. Making of fun of potential customers--as well as lost ones--has fallen flat, just like the sales of AB-InBevs flagship product.

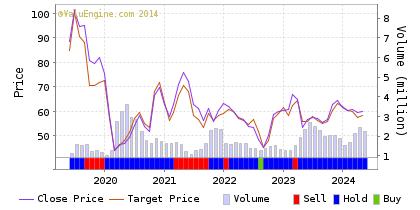

ValuEngine continues its HOLD recommendation on AB-InBev ADR for 2015-02-03. Based on the information we have gathered and our resulting research, we feel that AB-InBev has the probability to 'roughly match' the average market performance for the next year. The company exhibits 'Attractive' Company Size but 'Unattractive' Price Sales Ratio.

Below is today's data on BUD:

|

ValuEngine Forecast |

||

|

Target |

Expected |

|

|---|---|---|

|

1-Month |

125.87 | 0.26% |

|

3-Month |

125.95 | 0.32% |

|

6-Month |

126.50 | 0.75% |

|

1-Year |

129.42 | 3.08% |

|

2-Year |

143.52 | 14.31% |

|

3-Year |

97.05 | -22.70% |

|

Valuation & Rankings |

|||

|

Valuation |

4.46% overvalued |

Valuation Rank(?) |

|

|

1-M Forecast Return |

0.26% |

1-M Forecast Return Rank |

|

|

12-M Return |

33.12% |

Momentum Rank(?) |

|

|

Sharpe Ratio |

0.92 |

Sharpe Ratio Rank(?) |

|

|

5-Y Avg Annual Return |

17.94% |

5-Y Avg Annual Rtn Rank |

|

|

Volatility |

19.40% |

Volatility Rank(?) |

|

|

Expected EPS Growth |

6.85% |

EPS Growth Rank(?) |

|

|

Market Cap (billions) |

201.71 |

Size Rank |

|

|

Trailing P/E Ratio |

23.21 |

Trailing P/E Rank(?) |

|

|

Forward P/E Ratio |

21.72 |

Forward P/E Ratio Rank |

|

|

PEG Ratio |

3.39 |

PEG Ratio Rank |

|

|

Price/Sales |

4.31 |

Price/Sales Rank(?) |

|

|

Market/Book |

3.52 |

Market/Book Rank(?) |

|

|

Beta |

0.84 |

Beta Rank |

|

|

Alpha |

0.15 |

Alpha Rank |

|

Read our complete detailed valuation report on AB-InBev ADR here.

Disclosure: None