Not Just Retail: Hedge Funds Go "All In" As Net Leverage Hits 99% Percentile

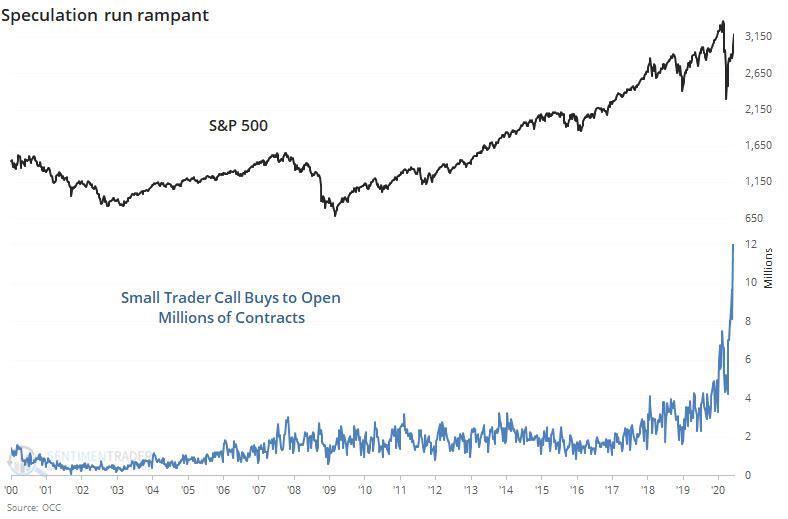

Two weeks ago, the retail day trading euphoria peaked manifesting itself in both a record surge in small trader call buying.

And the stock of bankrupt Hertz soared so much it prompted the company to try to and issue as much as $1 billion of worthless stock to Robinhood investors and a since-scuttled plan, we pointed out that it wasn't just retail investors flooding the market, and according to Goldman desk, after holding out for months hedge funds finally capitulated and were also flooding into stocks.

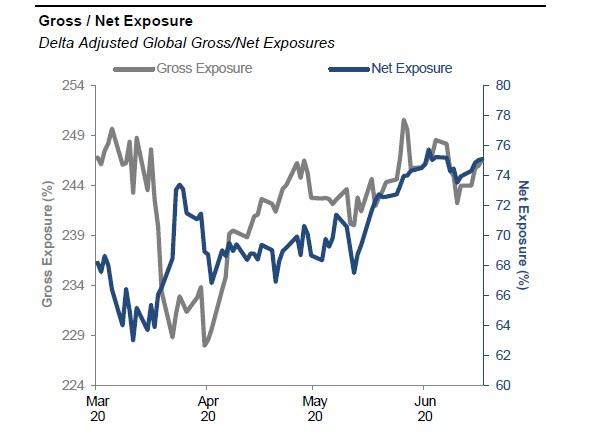

Fast forward to today when in its latest weekly exposure report, Goldman's prime desk notes that this panicked buying across hedge funds has continued and gross leverage of the overall book rose another +4.4% to 246.6% (93rd percentile one-year) while Net leverage rose further +1.6 pts to 75.1%, putting it in the 99th percentile, effectively the highest ever.

And another striking fact: according to Goldman Prime, the dollar amount of gross risk deployed during the past week is the largest over any five-day period since mid-March, with net buying seen on Fri/Mon/Tues followed by net selling on Wed/Thurs.

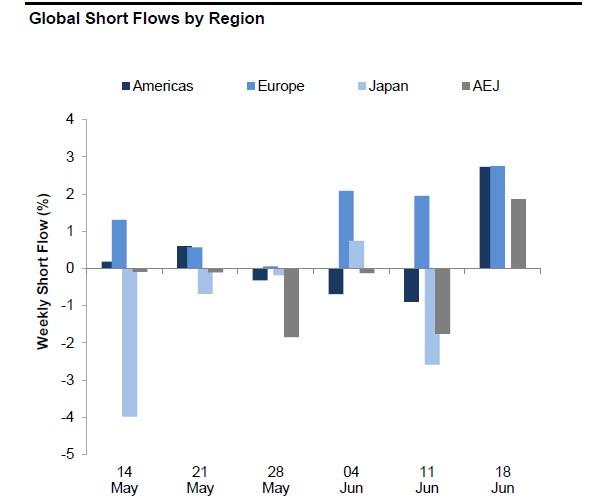

Digging into the flow data reveals that North America, Asia, and EM Asia were net bought. Europe was the only net sold region.

- North America’s net buying was driven by long buying slightly outweighing short selling.

- Europe was net sold for the second consecutive week led by short selling outweighing long buying in a 3:1 ratio. The region’s weight vs. the MXWD Index fell -0.2 pts to -4.7% U/W vs. the MSCI World – the lowest level of the year.

Perhaps not too surprising, the continued selling in Europe comes just as Goldman's own research team turned from Neutral to Overweight on Europe Stoxx 600, just as the continent experienced one of its biggest ever 3% month gains, likely capping gains for the foreseeable future.

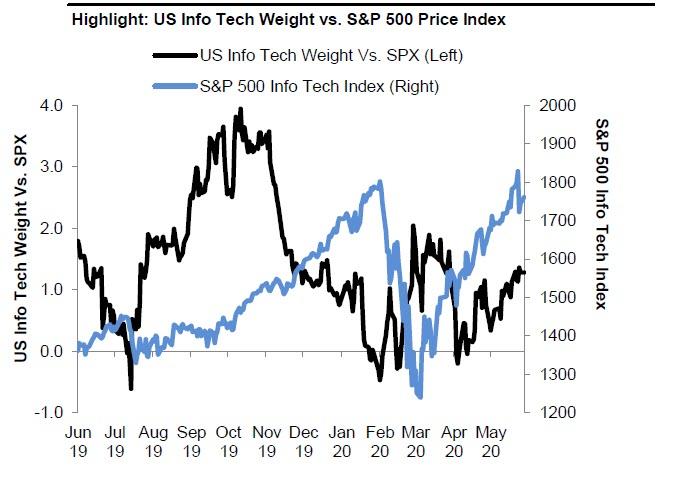

Also not surprising is that the Info Tech sector was the most net bought sector driven by “risk on” flows of long buying outweighing short selling in a 1:8:1 ratio. Within the sector, industry flows were split – Software and Semi & Semi Equip saw net buying, while IT Svcs and Communications Equip saw net selling. The sector’s weight vs. the S&P 500 rose 0.2 pts to +1.5% O/W (64th percentile one-year).

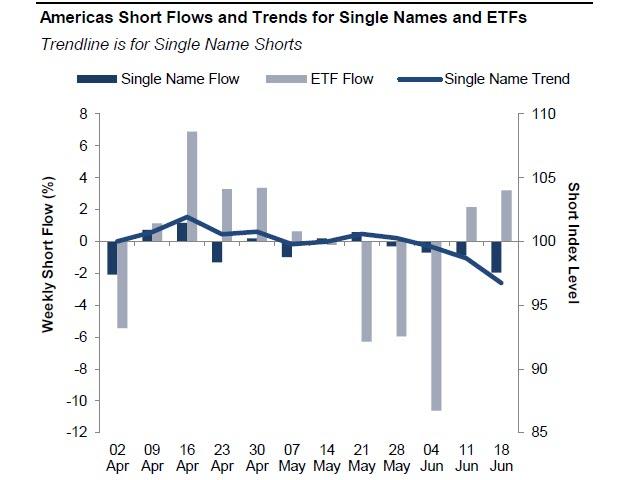

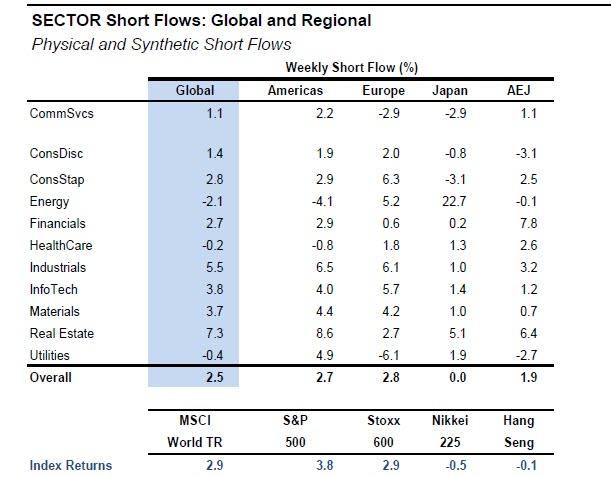

So what about the bears? Here, despite the overall continue surge in bullish sentiment, global single stock shorts increased +2.5%, with short inflows led by Europe, Americas and AEJ. Japan saw little to no net activity.

At the same time, single stock shorts in the US increased +2.7%.

Nine out of eleven sectors were shorted led by Real Estate and Industrials. Energy and Health Care were the only covered sectors.

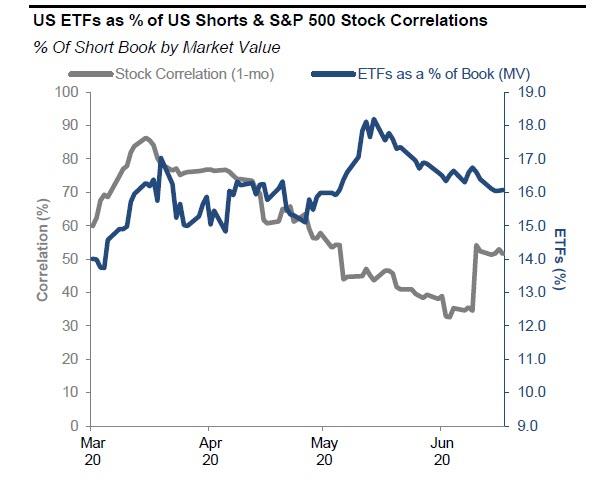

US ETF shorts increased +0.4% and currently make up 16.1% of the US Short Book (vs. 16.6% last week). ETF short outflows were driven by US Listed International ETFs.

Finally, at the single stock level, Goldman pointed out the following highlights:

Isn't that contradictory? Hedge Funds have low exposure and increased in shorts, how are they all in?