Nomura Nudges Out Deutsche To Become 'World's Most Hated Bank'

Deutsche Bank has some competition for the global bank that investors most love to hate.

Shares of Nomura have slumped 3% since Chief Executive Officer Koji Nagai unveiled a sweeping plan to overhaul its international business on April 4, as investors expressed skepticism with the bank's plans, and questioned whether the CEO would succeed in shearing $1 billion in costs, as he has pledged to do.

The drop coincides with Japan ceding the title of Asia's second-largest financial market to Hong Kong. But more importantly for the bank's long-suffering shareholders, Nomura shares extended their six-month drop to 27%, outpacing troubled European lenders SocGen and Deutsche Bank to become the world's most hated major bank.

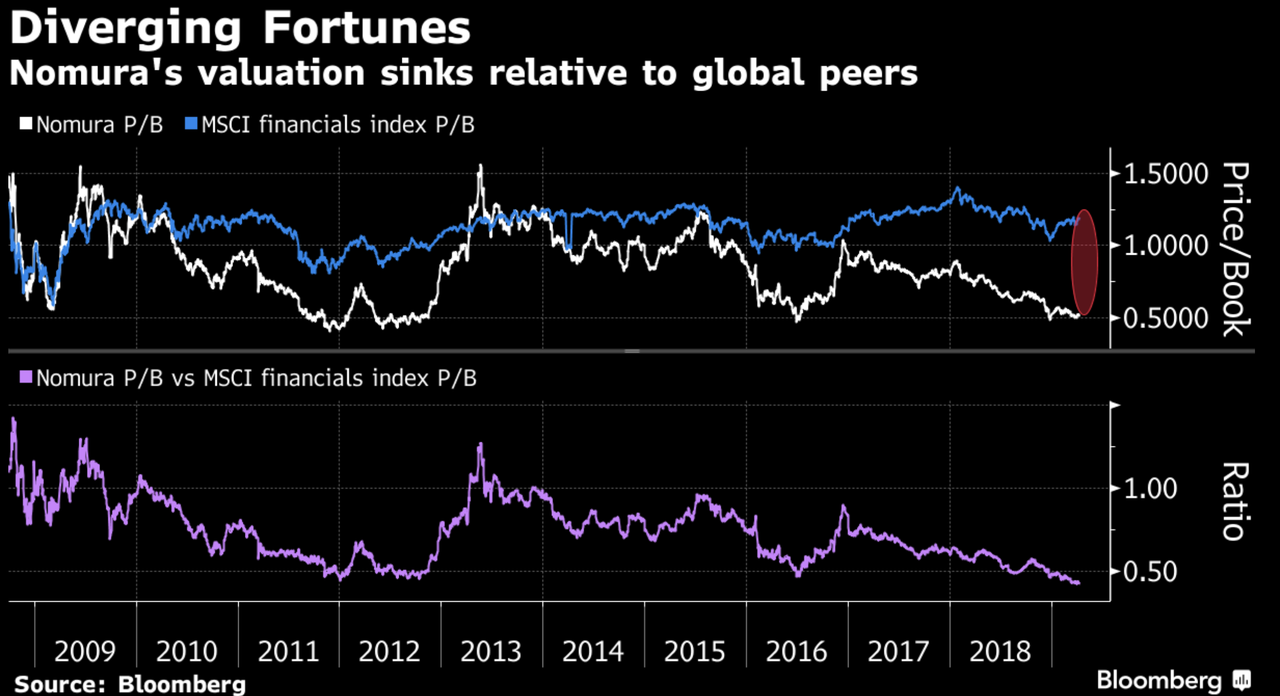

Going by price to book, Nomura is valued at just 58%, the lowest level since Bloomberg began tracking it in 1999. Meanwhile, its price-to-book value has fallen sharply compared with global peers.

The selloff underscores what analysts described as "entrenched skepticism" over Nagai's plans to revive the bank's international business after years of unsteady expansion, as well as increasing competition for retail traders in its domestic market. Nomura's slump has been a protracted one: Its shares have fallen 70% since it took over Lehman's European and Asian operations in 2008.

At 0.5 times net assets, valuations at these levels have preceded brief rebounds in 2009, 2012 and 2016.

But for now, at least, analysts believe there's little incentive to buy back in to Nomura until the company shows some material progress.

"The market seems to be saying 'If the recovery process takes longer, we do not need to rush back into this name,'" said Hideyasu Ban, senior research analyst at CLSA Ltd. in Tokyo.

An analyst at JPM said if the bank shows material progress in cutting costs, it could shift its underweight rating.

JPMorgan Chase & Co. analyst Wataru Otsuka points to questions surrounding Nagai’s pledge to slash $1 billion of costs, such as how quickly the cuts are likely to take effect and what they’ll mean for long-term profitability.

"If the effort is successful and profits recover to a sustainable level, we would reconsider our investment opinion, but the details on changes to the business structure are unclear, and we expect earnings to remain sluggish," Otsuka, who has an underweight rating on the stock, wrote in an April 5 report.

But with uncertainty surrounding the bank's profit outlook, that doesn't seem likely.

Yet given market conditions that Nomura’s CEO described as “increasingly uncertain” on April 4, many investors are likely to think twice before buying.

"Their structural overhaul is more about improving profit through cost cuts rather than through raising the top line,” said Kengo Sakaguchi, an analyst at Japan Credit Rating Agency. "Reducing costs may help its earnings improve temporarily, but unless its top line grows afterward, the outlook will remain murky."

We guess Nomura shareholders will need to pray for a miracle if they're unwilling to sell at a loss...or hope that the BOJ comes to their rescue.